Modified Accelerated Cost Recovery System (MACRS) depreciation is a federal income tax convention that benefits companies by helping them plan for the decrease of the value of business assets over a set period.

More specifically, MACRS enables businesses to calculate the depreciation expense — the percentage of assets the business can write off — throughout its useful life.

Find out how to calculate the MACRS depreciation basis of your assets as well as the different MACRS methods of depreciation used to write off different depreciable assets. Additionally, discover how and when to take advantage of MACRS convention periods.

What Is MACRS Depreciation?

Very simply, the general MACRS depreciation formula is an accounting formula that allows for a larger tax deduction in the early years of an asset’s useful life and less as time goes by. This is in contrast to straight-line depreciation, which allows you to claim the same deduction year after year.

It’s important to note that the MACRS depreciation schedule is only used for business assets that a company bought after 1986. If you depreciate company property purchased before 1987, use the Accelerated Cost Recovery System (ACRS).

Steps for How to Calculate MACRS Depreciation

You’ll find that most asset accounting software programs include MACRS information for calculations. There are also free online MACRS Tax Depreciation calculators you can use.

However, if you’d like to learn how to calculate MACRS depreciation manually, you’ll need to follow these steps:

1. Determine the Basis

The basis is simply how much you pay for your purchase, including:

- Purchase price of the asset

- Sales tax

- Shipping and delivery costs

- Installation charges (if any)

- Example: The amount paid to install the equipment or furniture at your place of business.

- Other costs

- Example: If a technician had to come out and calibrate your new machine before you could use it, the amount paid to the technician is included in the cost basis of the machine.

2. Determine Your Property’s Class

The IRS groups depreciable assets into 9 classes in the general depreciation system (GDS), the most commonly used MACRS for calculating depreciation. Here’s a breakdown:

| GDS Property Classification | Asset Example |

| 3-year | Tractors for over-the-road use, qualified rent-to-own property |

| 5-year | Automobiles, qualified technological equipment, office machinery |

| 7-year | Office furniture, office fixture, used agricultural machinery and equipment |

| 10-year | Water transportation equipment (e.g., vessels, tugs), single-purpose agricultural structure |

| 15-year | Certain improvements made to land (e.g., fences, sidewalks) |

| 20-year | Farm buildings |

| 25-year | Municipal sewers |

| 27.5-year (Residential rental property) | Rental home, mobile home |

| 39-year (Nonresidential real property) | Office building, store, warehouse |

Classes are determined according to the usefulness, or recovery period, of the particular asset. Recovery periods under GDS are the same as the length of time indicated in the property class (e.g., office furniture is in the 7-year property class and has a recovery period of 7 years). The exception to this is residential rental property, which has a recovery period of 27.5 years, and nonresidential real property, which has a recovery period of 39 years.

The less commonly used alternative depreciation method (ADS), in contrast, is used only on property in special circumstances (e.g., tax-exempt use property, tax-exempt bond-financed property). Recovery periods under the ADS are typically longer than GSD recovery periods.

3. Determine Your Depreciation Method

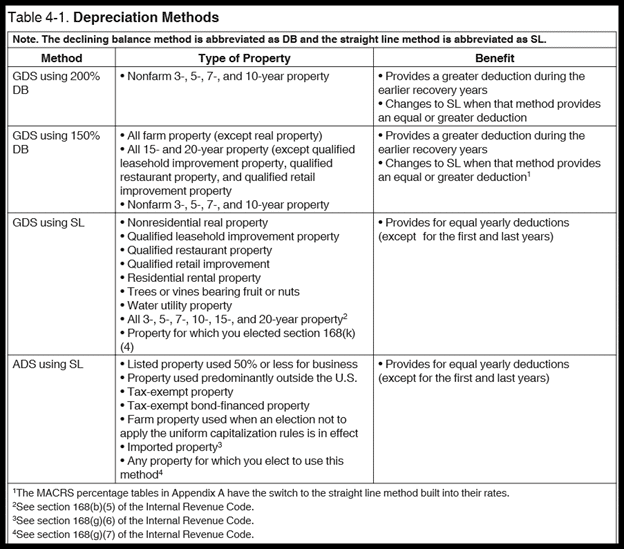

MACRS depreciation schedule gives you 3 methods under the GDS and 1 depreciation method under the ADS.

These MACRS depreciation methods include:

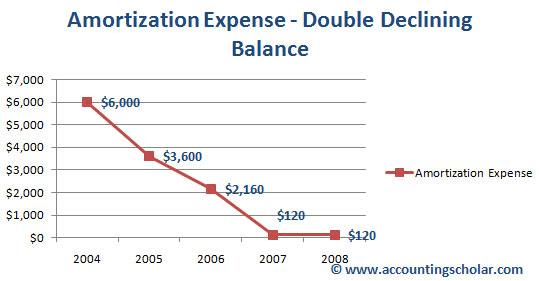

- GDS using 200% declining balance: This tax depreciation method gives you a significant tax deduction in the earliest years. The 200%, or double-declining depreciation, simply means that the depreciation rate is double the straight-line depreciation rate used for later property classes.

- GDS using 150% declining balance: This depreciation method gives you a higher depreciation rate – 150% more than the straight-line method.

- GDS using straight-line method: This tax depreciation method uses the straight-line formula under the GDS that calculates an even depreciation amount over the asset’s life, with the exception of the first and last year of service.

- ADS using straight-line method: This class is for listed property used less than 50% of the time for business. Property owners use the straight-line method over an ADS recovery period, giving your property a more extended recovery period, thus decreasing the annual deduction.

The current MACRS model allows you to choose the depreciation method that most benefits your business. Use the MACRS Depreciation Methods Table (in IRS Pub 946) to figure out the depreciation method of your asset.

Keep in mind, GSD uses the declining-balance method to depreciate assets.

-

Declining Balance Method

The declining balance, also known as the double-declining balance method, lets you write off more of an asset’s value right after you buy it and less as time goes on.

Who it’s for: Businesses that want to recover more of an asset’s value upfront. This is useful if you’ve just opened a shop and have a lot of expenses in your first year — any extra cash helps.

Straight-Line Method

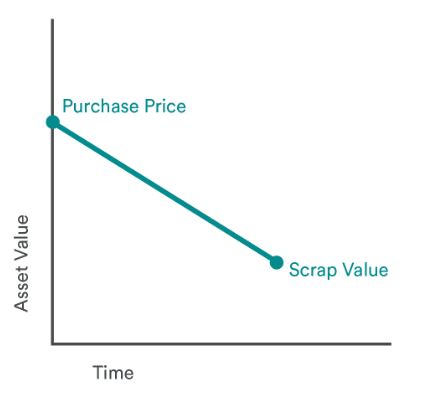

With straight-line depreciation, you write off the same amount of expense each year, so you’re evenly splitting off your asset’s value over multiple years.

Who it’s for: Small businesses expecting net losses. Thus, businesses cannot benefit from the accelerated depreciation method.

4. Choose Your MACRS Depreciation Convention

The MACRS convention establishes when the recovery period of an asset begins and ends. There are 3 types of conventions.

| Type | Description |

| Mid-Month | This convention only applies to residential rental property, nonresidential real property and railroad grading or tunnel bore. You get half-a-month’s worth of depreciation for the month the asset is placed in service or disposed of. A full month of depreciation is allowed for each additional month the asset is in service during the tax year. |

| Mid-Quarter | This convention gives you just slightly over 1-month’s worth of depreciation for the quarter in which you purchased the asset. The mid-quarter convention should only be used if more than 40% of your depreciable assets are purchased during the last 3 months of the tax year. |

| Half-Year | The MACRS half-year convention gives you half-a-year’s worth of depreciation regardless of how long you used that asset during the year. |

When choosing a MACRS depreciation convention, it’s a good idea to use the half-year option over the mid-quarter since the half-year convention helps you buy extra time and saves money. For instance, you could install a computer network in September and itemize 6-month’s worth of depreciation, resulting in more significant tax savings.

Most tax preparation software calculates which convention applies to your tax situation when you enter the date you purchased the property. Alternatively, you can use the tax tables in IRS Publication 946 to determine your convention and depreciation rates.

Reference the Appropriate MACRS Depreciation Table

MACRS gives you 3 tables to determine your depreciation rate. These are:

- MACRS Depreciation Methods Table

- MACRS Percentage Table Guide

- MACRS Depreciation Rate Tables

Each of these tables can be found in IRS Publication 946, Appendix B. Here are snapshots of each table:

MACRS Depreciation Methods Table

This table tells you which recovery class your asset is and which accounting method to use to calculate its depreciation.

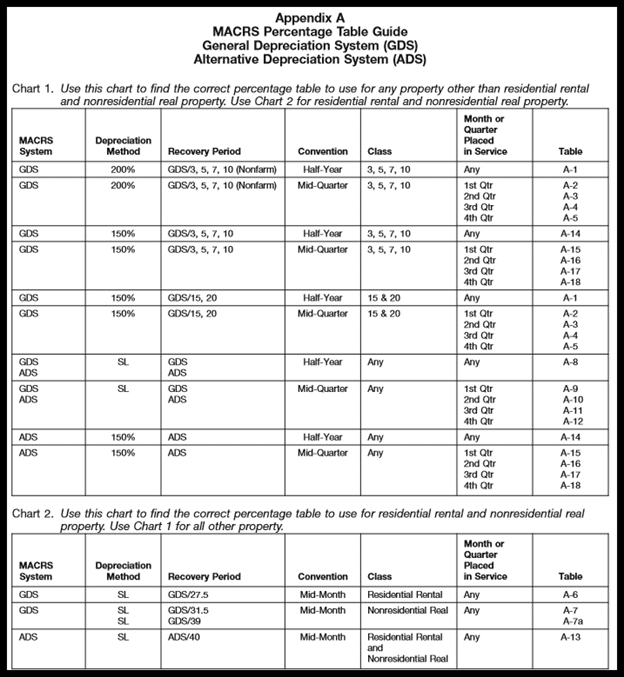

MACRS Percentage Table Guide

The following table refers to the MACRS chart for your particular asset’s useful life or recovery period. (There are about 18 such tables by the IRS). You’ll need to know your property class and convention. You’ll find the complete list of the tables in IRS Pub 946, Appendix A.

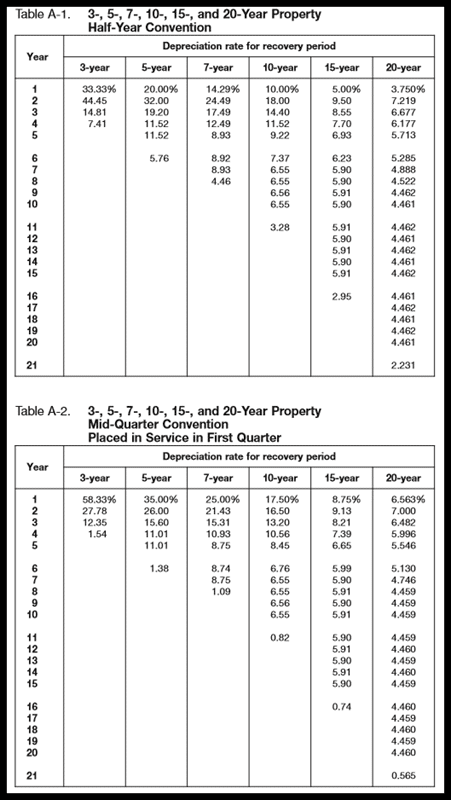

MACRS Depreciation Rates Table

This table charts your depreciation amount each year. Simply look up the table value and multiply the value by the asset’s basis.

5. Determine Your Percentage

The final MACRS Depreciation Rates Table tells you the tax percentage you can itemize for your asset. For example, say you have a computer that falls into the MACRS 5-year table category and you’ve used that computer for 4 years, the table tells you that you can deduct 11.52% tax from that property.

To illustrate:

| 3- and 5-Year Depreciation MACRS Table | ||

| Year | 3-year | 5-year |

| 1 | 33.33% | 20.00% |

| 2 | 44.45 | 32.00 |

| 3 | 14.81* | 19.20 |

| 4 | 7.41 | 11.52 |

| 5 | 11.52 | |

MACRS Depreciation Example Calculation

Putting it all together, you’ll want to have 3 pieces of information handy:

- Type of property you are depreciating: residential rental, nonresidential rental or all other property

- Depreciation method selected from the Depreciation Methods Table

- Month or quarter the asset was placed into service

Example 1: Calculating Tax for New Toyota

You bought a $40,000 Toyota for business use and want to claim a tax deduction on this asset. You consult the IRS MACRS Depreciation Tables:

- The first chart (the MACRS Depreciation Methods Table) tells you your Toyota is a non-farm 3-, 5-, 7- and 10-year property and that you use the GDS 200% method to calculate how much tax to deduct.

- The second chart (the Percentage Table Guide) asks for the convention – month or quarter – that you placed the Toyota in service. You select the Half-Year convention. You’re then referred to Depreciation Rate Table A-1 & A-2.

- This is your first year deducting tax on that vehicle, so the Depreciation Rate Table A-1 & A-2 tell you its depreciation value is 20% of the vehicle’s base rate.

Example 2: Calculating the Amount the Toyota Will Depreciate Over 6 Years

The MACRS table also tells you how much depreciation you get to take for your Toyota over, say, 6 years.

Using the MACRS 5-year column on the Depreciation Table, here’s the calculation, which multiplies the basis dollar amount by the appropriate depreciation percentage:

| Year | MACRS Calculation | Deduction Amount |

| 1 | 40,000 X 0.20 | $8,000 |

| 2 | 40,000 X 0.32 | $12,800 |

| 3 | 40,000 X 0.192 | $7,680 |

| 4 | 40,000 X 0.1152 | $4,608 |

| 5 | 40,000 X 0.1152 | $4,608 |

| 6 | 40,000 X 0.0576 | $2,304 |

Totaling the figures in the right column, you find that the total cost of MACRS depreciation for the vehicle is $40,000. This gives you your write-off for this asset.

Your final steps are to complete Form 4562 – with the optional MACRS Worksheet starting on page 37 of Pub 946 to help you calculate your deductions.

Putting MACRS Depreciation to Use for Your Business

If you’d rather not spend time calculating MACRS by hand, consider alternatives to still get the most out of this depreciation method. Evaluate accounting tools that can help you with your business taxes. Alternatively, think about reaching out to a reputable accountant for assistance calculating your business tax deductions.