Even when you’re keeping up with the details of your small business’s daily operations, you still have to be aware of the big financial picture. The best way to do that is by creating and monitoring a business budget.

Whether you’re just starting out or have been in business for years, we’ll simplify the process of creating a business budget and share tips and templates to make sure your small business budget is working for you.

What Is a Business Budget?

A business budget is an organizational tool that paints a picture of your company’s past, current and future financials. By taking into account revenue and expenses, businesses are able to create a financial plan to estimate spending and anticipate available capital.

5 Budgeting Process Steps

The most important part of creating a business budget is having the right data on hand. Your budget needs the correct background information to be effective. Follow this budget setting process step by step for the best results:

1. Review Financials

One of the first steps when creating a financial plan for your small business is to review your finances. If you’re an established business owner, this means looking over your financial statements. Your income and cash-flow statements as well as your balance sheet will give you the data you need to draw conclusions when forming and reviewing your small business budget.

If you’re a startup, you won’t have this information. However, in writing your business plan, you had to think about realistic expectations for potential income. Leverage relationships with others in your industry or past experiences working within it to gauge how you should create a business budget in your first year.

Once you have that information, you can apply it to create a business budget for the next year. Getting to your desired profit is as simple as calculating and subtracting expenses from your total revenue.

2. Assess Revenue

Another step of the budget planning process is to look at your revenue. If you’re a startup, this means making realistic expectations based on your industry. If your company is established, simply look back at your business’s income in past months, quarters and years. See if you notice any trends that could help you forecast when you could expect more or less income throughout the year.

3. Examine Expenses

The budgeting process in business also requires you to consider expenses. Your small business budgeting costs will vary depending on your business’s industry and size, but they can generally be broken down into these categories:

Fixed Expenses

Fixed expenses are costs that do not change over the course of a year, and they’re an essential component of a budget. These can include rent, equipment leases, vendor applications and insurance.

Variable Expenses

These are costs that constantly change depending on the current sales of your business and the needs those numbers present. Raw materials, inventory, shipping and commissions are examples of variable costs.

Semi-Variable Expenses

These are fixed costs that periodically change to coincide with the growth and decline within your business. For example, you may increase your business’s marketing and advertising budgets or decide to bring on new employees when business is booming.

One-Time Costs

It’s wise to leave room in the budget each month to put away money into an emergency fund. For instance, the last thing you want is to be blindsided when a piece of expensive equipment breaks down and you need to replace it.

4. Interpret the Data

When you’re working on business budget planning, having all of the information in front of you is great, but it means nothing if you can’t use it to make conclusions about how to create a business budget.

For revenue, it’s usually best to temper your expectations when you’re crafting your small business budget. For example, if you made $100,000 last year but less than $75,000 the 2 years prior, you might not want to expect the same type of success. This is especially true for startups. Even if you think you have a good idea of what similar businesses bring in, it can be more difficult for you to reach those numbers as you start out.

It’s important to consider all expenses that your business incurs. No payment is too small, so use your financial statements to track each and every expenditure.

Try to be conservative when projecting your business’s expenses. You can put in variances per month or year if you’re sure you’ll spend differently, but be careful not to expect too much. It might be tempting to say that you’ll spend less to improve your bottom line, but you may be over-tightening the business budget.

5. Turn Data Into Profit

After approximating the income and costs you may incur, it’s time to calculate profits. Follow this simple formula:

Revenue – Expenses = Profit

Once you have an idea of your company’s potential profits, you can begin to base decisions on them to create a small business budget. For example, if your calculation shows a net loss, you’ll want to figure out how to reduce costs or invest in revenue-generating initiatives, such as marketing and advertising, to boost sales.

-

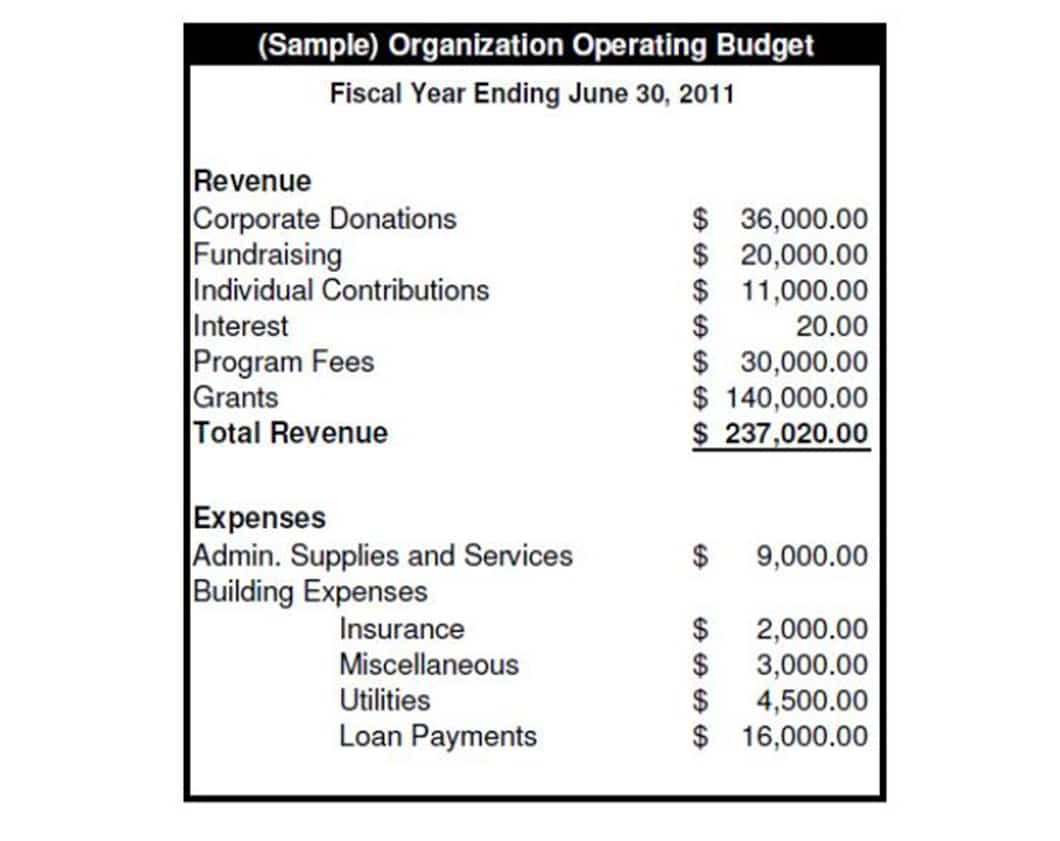

Operating Budget Example

While companies prepare many types of budgets (e.g., labor budget, capital budget, master budget), an operating budget is what is normally thought of when business budgets are mentioned. Here’s an example of an organizational operating budget.

Source: SampleTemplates.com

Online Business Budget Templates

Creating documents that are important to the success of your business has never been easier. If you don’t already have dedicated accounting software that offers it, you can still get intuitive templates and business budget examples to create your small business budget. Some templates are free, but other services come with a price.

Here are a few providers with budget business program templates:

Why Is Budgeting Important to a Business?

The main goal of your business is to turn a profit. By following a small business budget, you’re keeping a detailed plan of future revenue and expenses to effectively forecast and manage your business’s future.

For startups, researching and planning for your first year can be the difference between sinking or swimming as you dive into business ownership. Established businesses use budgets to take into account their past and learn what they can do as they grow.

Some of the main benefits of an effective small business budget include:

- Planning expenses to meet profit expectations

- Assisting in making realistic financial goals

- Identifying monthly or seasonal trends in revenue and expenses

- Adapting to these trends to scale your business

- Tracking cash on hand against future finances

- Catching future financial roadblocks before they become an issue

Keep in mind, about two-thirds of businesses with a budget in place usually stick to it, according to recent findings by market insights company Clutch.

Creating Your Small Business Budget

Once it’s time to put pen to paper (or finger to keyboard) to create your business budget, consider hiring an accountant to assist you.

After you create a yearly budget for your small business, it’s important to continually update it. Review your budget monthly. See if your performance justifies making some changes.

Are you spending more than you thought? Bringing in less? Any deviation from what you had predicted could make it necessary to adjust what you do going forward.