Once you’ve made a sale or provided a service, you want to get paid. You can ensure that happens if you create an invoice with everything your customers need to remit payment.

Here’s what you need to know about how to create an invoice. We’ll also share professional invoice examples, provide a downloadable invoice and recommend invoicing software that will work for your small business.

What Is a Professional Invoice?

A professional invoice is a bill your business submits to customers for goods and/or services delivered. This document is key for your business’s general bookkeeping and tax records. Your invoice layout will vary depending on your business and what’s being billed, but in general, it should contain the following information:

- Your business’s name, address and other contact details

- Itemized list of goods and/or services rendered

- Amount owed

- How payments are accepted

Business Invoice Format

Your professional invoice should be straightforward. Include the following elements when you create an invoice:

1. Your Information

Your invoice should have the basic information someone would need to remit payment to you or inquire with questions. Your business’s name, address, phone number and email should be listed. If you prefer customers to contact specific people or offices for questions, include that information as well. For example, include the phone number of the person who handles accounts receivable in your business.

2. Your Customer’s Information

List complete information, including name, address, phone number and contact name for the customer. If it’s a business, make sure to use the company’s legal name.

3. Invoice Number

Include an invoice number that’s unique to each customer and each bill. This makes it easier to find the transaction record if there are questions, or when it’s time to match payments with invoices. If an invoice goes unpaid, you can also refer to the invoice number in follow-up attempts to collect or in statements.

4. Products or Services Rendered

List the specific product(s) or service(s) rendered and the date of purchase or completion. Be sure to separate costs and any other expenses, such as tax or shipping.

5. Total Cost

Add the cost for each product and/or service your invoice covers. Remember to include any taxes in the total bill.

6. Payment Terms

It’s important that you list your expected payment terms. This includes the due date and whether you add late fees if the payment is received after the due date. What terms you list are up to you, but make sure they comply with any previous customer agreements or contracts.

Invoice Payment Terms Example

Here are some of the more common payment terms that companies use:

- Due immediately upon receipt

- Net 7 (Due 7 days after invoice date)

- Net 10 (Due 10 days after invoice date)

- Net 30 (Due 30 days after invoice date)

- Net 60 (Due 60 days after invoice date)

7. Methods of Payment

Make it clear what methods of payment you accept. If you accept credit cards, online payments, PayPal, Venmo or other online payment services, list it on the invoice. Note any preferred payment methods.

Business Invoice Examples

Always use a professional-looking template when you create an invoice. Keep your language professional as well. You can add a personal note but keep the message clear.

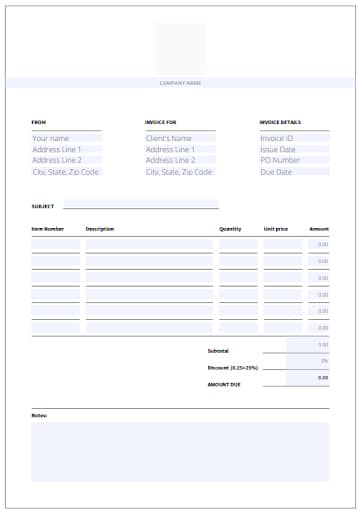

Example Invoice Template

Here’s a general invoice layout example that provides everything you need to request payment for products or flat-fee services.

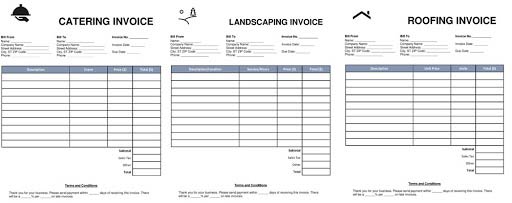

Service Invoice Example

Fill out the basic information — list the services you provided and the date and the amount you’re charging. Include any additional charges, such as tax or delivery, and total it.

Here are a few service invoice examples from eForms:

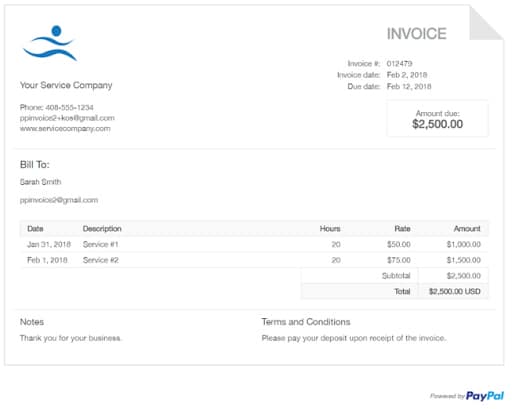

Consulting Invoice Example

When you create a consultant invoice, detail the services you’re providing and whether it’s a flat fee or hourly billing. If you are charging by the hour, list the number of hours you worked, the hourly rate and the total. For example, if you worked 20 hours and charge $50 an hour, list that information along with the $1,000 total for that line.

Here’s a consulting invoice example:

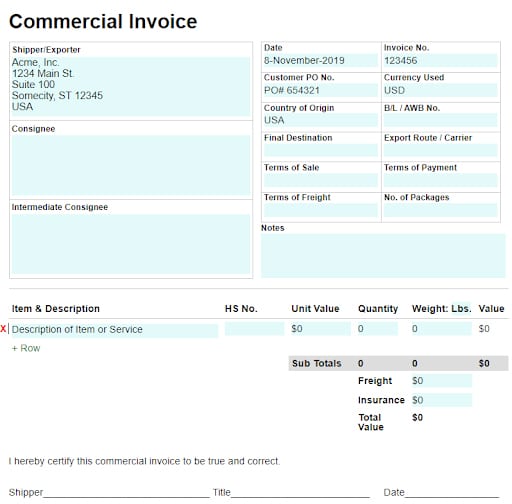

Commercial Invoice Example

A commercial invoice is used for international shipping. Customs uses them to determine whether duty fees are owed. It requires additional information such as country of origin, final destination, export route and carrier and terms of freight.

Here’s a commercial invoice example:

-

You can use any of these examples as inspiration to create your own invoice. However, you can also download and customize this free small business invoice template from Fast Capital 360.

Small Business Invoice Software Options

If you’re using accounting software, such as QuickBooks, you can create invoices easily. You can automate invoice generation, set up tracking, schedule recurring invoices and apply payments using the software.

Square dashboard functions include small business invoicing. You can complete and send invoices from the website or mobile app, which adds convenience if your business doesn’t have a central office (or if you often work outside of it). However, at least 1 review notes that the invoicing is better for businesses that produce goods rather than service-based companies.

Zoho boasts free invoicing software that can be customized to include your company’s branding and your signature. Users can also craft recurring invoices and accept payments in multiple currencies.

FreshBooks small business invoicing and billing software also offers accounting features, helping you streamline your bookkeeping. You can customize your invoices and accept multiple payment methods, including credit cards and payment apps (such as Apple Pay).