Your stock is an asset, and its value affects your cost of goods sold (COGS), prime costs and gross profit. Inventory costing methods improve accuracy and may have tax benefits.

Therefore, the Internal Revenue Service (IRS) requires companies to use one system consistently. Learn how to pick the best method for your small business.

What They Are and Why They Matter

Inventory costing methods, also called inventory accounting methods, assign values to products and the supplies used to create goods.

The valuation helps companies determine COGS and track crucial key performance indicators (KPIs), such as the cost of carrying inventory.

Moreover, inventory is counted as assets and part of your taxable income. Small business owners report their inventory for the beginning and end of the year on the IRS form 1125-A: Cost of Goods Sold.

According to IRS Publication 538, “The rules for valuing inventory aren’t the same for all businesses.” However, the process must adhere to generally accepted accounting principles (GAAP) “for similar businesses and must clearly reflect income.”

In addition, the method “must be consistent from year to year.” If you change how you value inventory, the IRS requires business owners to complete IRS Form 3115: Application for Change in Accounting Method.

Kinds of Inventory Costing Methods

Business owners use various methods for identifying the cost of inventory items.

The IRS Publication 538 lists three stock costing methods:

- Specific identification: The cost reflects the exact price of the individual item.

- First-in, first-out (FIFO): This method assumes you sell the oldest items first.

- Last-in, first-out (LIFO): The LIFO technique implies you sell the newest items first.

Some business owners may also use the weighted average cost (WAC) method, which provides an average cost of goods sold.

Different Types of Inventory Valuation Methods

Companies use inventory accounting methods and must list their inventory valuation method in Part III of the Schedule C tax form.

The IRS has specific rules and use cases for inventory valuation techniques. In most cases, it’s best to speak with an accounting professional to decide which system is appropriate for your business and industry.

IRS Publication 538 lists the following inventory valuation methods:

- Cost

- Lower of cost or market

- Retail

- Perpetual or book inventory

How It Works: An Inventory Valuation Example

Every product or raw material has a price associated with it. However, the price paid per unit varies throughout the year.

For example, your store may keep a big bin of pool noodles during the summer season and order a shipment 3 months in a row. Each month, you refill the container, and new pool noodles get mixed in with the old.

The price per unit may increase or decrease for every order. At the end of the year, how do you know the cost of the remaining stock?

Your choice of inventory valuation techniques gives the answer.

4 Inventory Costing Methods

Learn about the most common inventory methods before making a decision.

Below, we break down the definition, use cases, advantages and disadvantages of the 4 primary inventory costing methods.

1. Specific Identification Method

The specific identification method of inventory costing tracks every individual item and its exact cost from the day it’s stock to the day it’s sold.

Typically, companies selling larger items with serial numbers use the specific identification method.

But it can be used for various products, as long as there’s a radio-frequency identification (RFID) tag, serial number, or stamped receipt date tied to each item.

Specific Identification Method: Pros and Cons

The specific identification method formula is straightforward and highly accurate.

If your business sells rare or high-value items, such as cars or one-of-a-kind artwork, it makes sense to show your exact cost for actual revenue results.

Yet, it isn’t a good fit for retailers selling hundreds of identical small-dollar items. It would be time prohibitive to individually track hundreds of pool noodles or bins of flip flops.

Therefore, the specific identification method isn’t a good fit for all small business owners.

2. FIFO Method

The first-in, first-out method, known as FIFO, is the most common inventory costing method. It assumes the business owner sells the oldest products first.

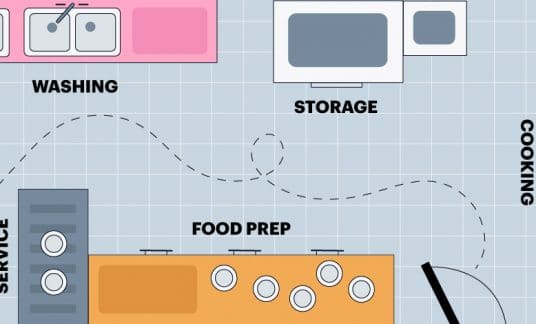

Restaurants and grocers selling perishable items often use this method.

If a bakery buys 25 units of flour per quarter and has 23 units remaining at the end of the year, the inventory valuation equals the per-unit cost from the fourth-quarter shipment.

FIFO Method: Pros and Cons

The FIFO method is easy to use and understand because it often matches the regular physical flow of goods and inventory management process.

Additionally, accountants may prefer this system because there’s less chance of income manipulation.

The first in, first out method also comes closest to the current market value, as your end-of-year valuation looks at the most recent numbers.

However, it fails to account for a rapid increase in product or supply prices, meaning it’s less beneficial during times of high inflation. It also can increase your overall profit resulting in a higher tax burden.

3. LIFO Method

The last-in, first-out method of identification, or LIFO, says the last stock purchased was the first sold. It’s more of an inventory accounting tactic to save on taxes than a physical model for counting inventory.

Companies may decide to switch to the LIFO method to circumvent the effects of rising inflation or other price increases.

For instance, some major pool supply distributors may have switched to LIFO after learning about the BioLab explosion affecting chlorine prices, possibly until late 2022.

Other businesses, such as landscaping, may use LIFO because they sell mulch or gravel from piles, where the top of the stack represents the most recent shipment, therefore gets sold first.

Switching to the last in, first out method lets distributors claim higher costs and fewer profits on their tax forms when prices rapidly increase.

LIFO: Pros and Cons

For practical purposes, LIFO matches current revenue to current costs, which may make more sense financially. It can lead to lower income taxes, especially during times of high inflation.

But it doesn’t follow the physical flow of goods, and inventory valuation may not reflect the current replacement costs.

A large company may get a huge discount on hammers and purchase 100 of them at $1 a piece right before the year ends. The following year, the price skyrockets, and the company buys another 100 at $2 each.

Now, every hammer purchased takes $2 off the value of inventory instead of $1. This may lead to an inventory undervaluation on the balance sheet.

Although any inventory valuation or costing method should be reviewed by an accountant, last in, first out is more complex. Moreover, companies must apply to use it via IRS Form 970 “Application to Use LIFO Inventory Method.”

4. WAC Method

The weighted average cost (WAC) method, referred to as the rolling average method, averages the costs over a specific timeframe.

For instance, a gas station mixes new gasoline shipments with gas already in the holding tank. Using a rolling average per gallon of gas makes more sense than using a different inventory costing method.

Business owners use the following formula for inventory valuation:

Total Cost of Goods in Inventory / Total Units in Inventory = Weighted Average Cost Per Unit

The formula is better for figuring out the cost of goods sold when it’s difficult or impossible to track individual costs of supplies.

Rolling Average: Pros and Cons

The weighted average cost is relatively easy to track, especially when using inventory management software.

Plus, it doesn’t affect your balance sheet as much when prices decrease or increase, as it’s all averaged together.

But it may not be as accurate as FIFO or provide the tax benefits of LIFO.

The Impact of Inventory Costing Methods

Let’s look at the results of using the various stock costing methods.

A retailer decides to start selling packages of batteries. They buy 10 units for $10 apiece in January. Throughout the year, they buy shipments of 10 units at different price points:

- March: 10 units for $10.50

- July: 10 units for $12.50

- September: 10 units for $12.75

- November: 10 units for $14.00

In total, the company purchased 50 units for the year, costing $597.50. At the end of the year, they have 8 units remaining.

How Inventory Methods Affect Your Balance Sheet

Here’s how those numbers combined with inventory costing methods affect your end of year asset totals:

- Specific identification method: In this case, owners track units using RFID tags. At the end of the year, regardless of when the items are sold, they know the exact unit cost.

- FIFO method: Owners assume the oldest items sold first, leaving 8 units at $14 left at the end of the year valued at $112.

- LIFO method: Owners assume the newest items sold first, leaving 8 units at $10 each valued at $80.

- WAC method: The inventory cost is averaged, so the total price for inventory purchased is $597.50 divided by 50 units equals $11.95 per unit. The 8 remaining units are valued at $95.60.

When moving a high volume of inventory, these slight price differences can add up. On the one hand, some methods increase your tax burden. Others make your business appear more profitable on paper.

Understanding how each method affects your bottom line helps you make decisions about inventory optimization, retail prices and taxes.

Inventory Costing Methods: How to Pick the Right Technique

Inventory valuation and costing methods vary by industry and business size. Therefore, what works for one company may not be fitting for another.

For starters, talk to a financial professional to see what’s standard for your sector and discuss each method’s pros and cons.

While it’s possible to switch methods, the process is complicated. Moreover, if your company needs to show financial statements to secure a loan, because you may need to go back and apply the new accounting method to previous statements.

For the accounting principle of consistency, picking — and sticking with — one method is best for many small businesses.

Considerations for selecting a method include:

- Businesses selling perishable items, such as restaurants, benefit from accurate and close to real-time inventory costs found with the FIFO method.

- Growing companies ordering a lot of inventory or facing inflated prices may use the LIFO method to reduce their income for tax purposes.

- Retailers wanting to expand their business and acquire funding may prefer the specific identification or FIFO method as they reflect your historical costs more accurately.

- The rolling averages method keeps things simple and works well when prices don’t dramatically increase or decrease throughout the year.

Choose a Suitable Inventory Method for Your Small Business

In short, inventory costing methods affect your balance and income sheets. Furthermore, a consistent approach is necessary for accurate financial records, analyzing KPIs and abiding by IRS rules.

Select the method that makes sense for your industry and business goals.