Without getting too deep in the weeds, contactless payments have been the preferred form of transaction nowadays — and not just for obvious reasons.

There are benefits that contactless transactions bring to the table as long as customers and merchants know how to use them properly.

To this end, let’s take a deeper look into this payment system, its pros and cons, the mobile wallets you can use to help you transition into contactless payments, and more.

What Is Contactless Payment and How Does It Work?

Contactless payments are also referred to as “tap and go” or “tap” by some banks and retailers.

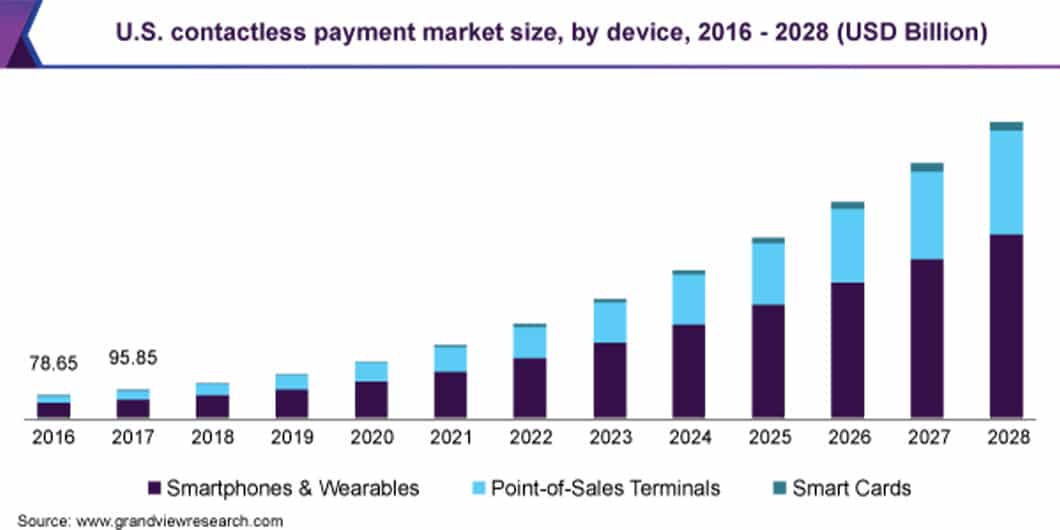

According to Grand View Research, the market size of contactless payment was valued at $1.34 trillion in 2020. Thanks to the increasing adoption of businesses towards this form of payment, the same report expects this market to expand at a 20.3% compound annual growth rate (CAGR) within seven years starting in 2021.

So, how does contactless payment work? Unlike some credit or debit cards, this form of payment uses radio-frequency identification (RFID) or Near Field Communication (NFC) technology. You tap a contactless payment card near a point-of-sale terminal instead of swiping, entering a PIN, and signing for transactions.

Merchants that accept contactless payment have a special symbol similar to the Wi-Fi logo turned onto its side. When the merchant’s system prompts the customer to pay, they bring the card close to the payment symbol on the terminal.

Chips and Tokens

The card’s NFC chip is transmitted to a payment terminal electronically using a unique one-time token. This token doesn’t contain any of your card details, so that token can’t be used again if payment is compromised.

Both use radio waves to identify the payment automatically for both debit and credit transactions, depending on how the bank has the contactless payment setup on their card. A contactless card has a chip embedded in it that sends information to a contactless reader.

Aside from cards, people can use a mobile wallet app to conduct contactless payments. They need to open the app from their smartphone and tap the symbol with it for the transaction to take place.

The beauty of mobile wallets, and you’ll find more about them later on, is you can connect all your cards with the app. In doing so, you no longer have to bring your cards whenever you go out — you can just use the app to conduct all your payments and transactions.

Benefits of Contactless Payments

Security

The contactless transactions go through a secure cryptogram to protect your payment information against fraud.

The technology in contactless cards transmits data using a 13.56Mhz radio frequency equivalent to roughly 4 centimeters at best according to defense and aerospace company Thales. Therefore, for hackers to steal your information, they must be centimeters close to your card for that to happen.

Even then, thanks to tokenization, they still wouldn’t be able to swipe your card data.

Faster and Effortless Checkout Process

As mentioned, customers don’t have to swipe a card through a POS terminal or insert it into a terminal to authorize contactless transactions. As a result, they tend to be faster than non-contactless ones.

Even better, you can use your mobile app to make transactions with retailers and merchants whether you’re in the store or not.

Loyalty Benefits

Many stores offer it as an option in their loyalty program to encourage customers to adapt to contactless payments. The frequency of discounts and loyalty points is determined by the tap-to-pay smartphone used for payment. Contactless credit offers cashback incentives from banks based on your transactions using this feature as well.

Disadvantages of Contactless Payment

Limited Acceptance and Availability

Retailers are facilitating contactless payments at a rapid rate, but not without their own set of difficulties. For one thing, the coverage is spotty among independent retailers. There’s been an uptick over the last couple of years or so.

Even if you have a mobile device that works internationally and gets accepted abroad (likely for additional fees), it still doesn’t guarantee your purchase will go through. Some mobile wallets used for contactless payment don’t get recognized outside U.S. borders.

Low Transaction Limit

Contactless payments are heavily moderated all worldwide in terms of transaction limits.

For example, the Reserve Bank of India has ruled that contactless payments will carry a capping limit at 5000 Indian rupees per transaction, up from 2,000 rupees. While the goal of the increase is to help boost e-payments moving forward, the low limitations could impede customers’ ability to shop for high-priced items and hinder their overall shopping experience.

For large transactions, users are required to enter their PIN for security measures. While this is a necessary step against fraud protection, entering one’s PIN defeats the purpose of contactless transactions.

Increase in Fraud

Just because contactless payments are relatively safe, this won’t stop hackers from coming up with ways to bypass fraud protection. For example, researchers Leigh-Anne Galloway and Tim Yunusov from Cyber R&D Lab showed a way to bypass the multistep authentication guard against tap-and-go fraud using different hacks.

The point of their research was to show that, as secure as this form of payment is, it’s not safe from fraud at all times. Action Fraud reported that the reported contactless fraud in 2018 amounted to £1.18 million (about $1.65 million), which was £711,000 more than a year earlier.

As contactless payments will continue to see a rise in the future, expect more fraud cases to emerge from this payment form.

The Best Contactless Payments Software

Google Pay

Google Pay is a secure way to make payments without showing your credit card number. Instead, you’ll be given an encrypted code that will get sent right over to the store. You also can send money as well by just using someone’s email address or phone number with Google Pay without the need for cash.

Apple Pay

Apple Pay has been designed to make it easier and faster for consumers to pay. By storing credit card information on their smartphone, users no longer have to go through filling out forms. The same goes for inputting numbers when trying to buy something online. Apple will store the data securely in its device. All you must do now is hit the “pay” button at checkout. The system also allows purchases within apps without having access to your bank account number.

Samsung Pay

Samsung Pay is a contactless payment that can be made on the go. You can register all your cards — credit, debit, gift, membership — so you no longer have to bring them with you. This virtual payment system also can be linked to your bank account to transfer funds to friends and family.

Venmo

Venmo is a contactless payment app where you can send payments to friends and family quickly, securely, and privately. The app makes it simple to pick a contact. Simply enter an amount for the transaction, then pay. There’s no need to exchange bank account details like contactless cards.

Venmo leans toward the fun side compared to other mobile wallets. That’s because it shows a wide variety of emojis when your contacts receive your payment.

Facebook Pay

Facebook first announced its contactless payment app in June 2017. Since then, it’s expanded to cover more than just peer-to-peer payments. You can now use the app to make contactless purchases on websites and apps, order delivery, or even buy tickets.

Facebook Pay also allows for in-store payments using Apple Watch, so you can just wave your watch over contactless terminals, and it’ll make contactless transactions.

Contactless Payment Is Here to Stay

The sudden rise of contactless payments in the U.S, may have been due to the pandemic. However, even when coronavirus eventually subsides, this form of payment is expected to continue soaring.

According to the National Retail Federation and Forrester, there has been a 40% increase since 2019 in retailers that accept contactless cards. And among those that enabled contactless payments, 94% believe that more businesses will adapt to this form of payment.

More importantly, 20% of customers have engaged in contactless transactions for the first time in 2020.

These figures go to show that people are willing to adapt to the changes in technology. And while there are still hurdles that contactless payments need to overcome, it seems like it’s here to stay.

However, contactless transactions are just one of the many options customers can use to pay for goods and services. Having the choice to pay via contactless, credit, or debit card gives consumers and retailers multiple ways to transact.