As a small business owner, there will be occasions when you’ll need financing to keep up your operations. Kabbage and Fundbox are both well-known, credible lenders. And if you have a growing business, you can turn to either one to get funding almost immediately.

However, which one is best suited for your business? What advantages does one have over the other?

Let’s dive a little deeper and see what Kabbage and Fundbox have to offer.

Kabbage Overview

Kabbage is an online lender for small to mid-sized businesses (SMB). You can secure up to a $250,000 line of credit through this platform.

The processing of applications can be as fast as 10 minutes with 6-, 12- or 18-month terms.

Trustpilot gives Kabbage a rating of 4.8 out of 5.

Kabbage Funding

Kabbage currently offers a single product, and that’s a short-term line of credit. To qualify for Kabbage funding, your business needs to be in operation for at least a year.

There’s a revenue requirement; you should make at least $50,000 annually or generate $4,200 a month (over the last 3 months).

However, you don’t need to have a minimum FICO credit score to qualify. Any U.S.-based business can apply as long as it’s not in the marijuana or CBD niche. Some firearms businesses can be granted credit access, but not those that manufacture or sell assault-style weapons/rifles, or a company that sells ammunition or weapons to individuals younger than 21. Kabbage also doesn’t entertain applications from financial institutions, lending and non-profit organizations.

You can apply for a loan online or through the Kabbage app (iOS or Android).

Kabbage Lines of Credit

It’s important to note that not all businesses can get any term length. The term length and the amount granted will depend on Kabbage’s assessment of your business.

For 6- and 12-month loans, you would have to pay a monthly fee. That’s on top of the loan principal you have to give back monthly. Expect to pay higher rates in the first few months.

That’s not the case for 18-month loans. In this case, the loan fees accrue in full. This means you’re paying the same number every month, regardless of the amount deducted from your balance.

Kabbage Business Loans

When you apply, you’re asked for basic information about you and your business. Kabbage will suggest that you connect your banking information with their network so they can process your application faster.

If you use accounting software like QuickBooks or payment services like PayPal, you can connect those as well.

Note: You have better chances of getting approved if you connect more business services.

Kabbage will then use your business checking account and the other services you connected to determine if you qualify. It will analyze your average monthly revenue, seller rating, time in business and transaction volume, to name a few factors.

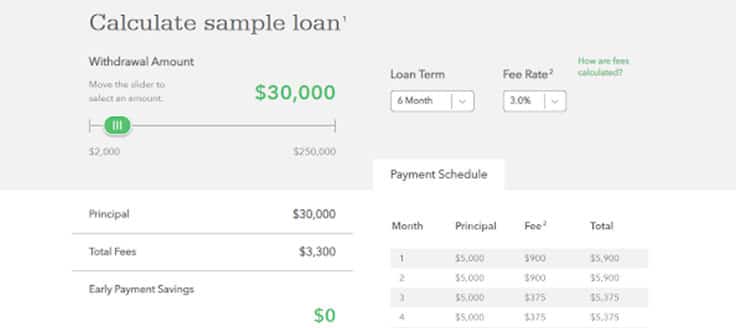

Kabbage Interest Rates

Kabbage interest rates range anywhere between 1.5% and 10%. Right now, the only way to determine what your fee would be is by applying.

The company does have a loan calculator so you can get a sense of how much you’ll pay based on how much you borrow, how long the term is and the fee rate.

As stated in the footnotes section of the Loan Rates and Terms page, Kabbage’s third-party partners can charge up to an additional 1.5% each month.

Kabbage does not have a prepayment fee. But because you’re paying more for the first few months (for 6- to 12-month terms), there’s little incentive to pay earlier.

Fundbox Overview

Fundbox is also an online lender that offers up to $100,000 in invoice financing or a line of credit. The company claims to shorten the application time to minutes. Funds are then transferred to your business checking account the next business day.

Trustpilot also gives Fundbox a rating of 4.8 out of 5.

Fundbox Funding

Fundbox offers 2 types of services. You have your usual line of credit as well as a service for merchants who want to offer access to net terms.

The line of credit is ideal for businesses that need working capital to keep things moving. Your business needs to be in operation for at least 2 to 3 months to qualify. Fundbox also requires a credit score of 500. Only U.S. businesses can apply and they need to have a minimum annual revenue of $25,000.

The other program allows customers to get goods and services now and pay them at a later date. You, as the merchant, get paid right away through Fundbox (as soon as next business day) while it takes care of the collection.

Fundbox gets a 1% to 3.3% merchant fee for net terms ranging from 15 to 90 days.

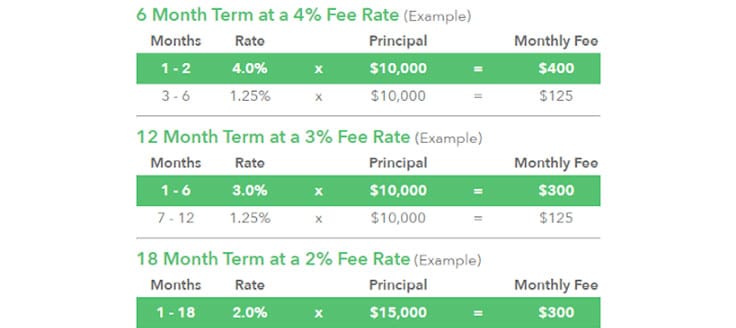

Fundbox Lines of Credit

To get a line of credit, you should have a business checking account. That account should have at least 3 months’ worth of transactions. In the absence of that, you should have at least 2 months’ worth of activity in your accounting software.

Fundbox offers a line of credit up to $100,000. Its online calculator shows how much you’ll have to pay on a weekly basis, although fees may vary for each customer.

Fundbox can adjust credit limits and fee rates over time. Fundbox regularly updates the rates based on the business information you provided. The company will inform you if you become eligible.

Fundbox Business Loans

Fundbox will ask you to provide basic details about your business if you want to apply for a line of credit.

Like Kabbage, you’re asked to provide data from your accounting software and business checking account. However, you’ll also need to provide your credit report. Any inquiry Fundbox makes about your credit report will not affect your credit score.

If you qualify for a line of credit, Fundbox will let you know right away.

The requirements for both line of credit applications and the net term are the same.

Fundbox Interest Rates

With Fundbox, you can repay your outstanding balance in advance. If you do, the company will waive all remaining fees.

But what do the fees look like?

Rates start at 4.66% for a 12-week repayment plan, but this can change over time. The rate changes from one applicant to another. This is where early repayment becomes advantageous; it allows you to save yourself from fees you might incur.

You can also get discounts through coupons and CashBack programs. When Fundbox sends out coupons, the rewards are automatically applied to your remaining balance. With CashBack, a percentage of the fee paid goes to your account after you make a weekly payment.

Kabbage and Fundbox Reviews

While both Kabbage and Fundbox offer lines of credit for business owners, they both have their own set of pros and cons.

Fundbox is a good choice for you if you can pay off your debt early. Otherwise, you may end up getting caught in all the fees associated with your loan. And because of the $100,000 limit, you’d have to search elsewhere if you need more than that amount. But Fundbox becomes a great option if you’re interested in net term options.

Regarding what customers think of Fundbox, the online lending website has 92% Excellent rating on Trustpilot out of more than 1,600 reviews. However, while Fundbox has an A+ Better Business Bureau rating, on the BBB website it has only four customer reviews, all of which are negative.

With Kabbage, you don’t need to provide a credit score to qualify. However, because of how it structures its payment rates (charging you more upfront early on), there’s no real incentive to pay earlier. Kabbage does offer up to $250,000, so if you do need more than what Fundbox can give, Kabbage is the lender for you.

Across over 6,000 reviews on Trustpilot, Kabbage has an 8.4 Excellent rating, which is lower than Fundbox’s. However, on top of having an A+ BBB Rating, Kabbage has a 4.5 star-out-of-5 rating from 146 customer reviews.

Conclusion

There’s no clear winner here — in the end, it’s about what your needs are as a business. If you can afford to pay early and won’t need more than $100,000, then Fundbox is the better choice. Kabbage will work for those who don’t have a good credit rating at the moment.