If there’s a word to describe what is finance automation, it’s “future.”

There’s a limit to how much you can grow your business and that limit is between $10 million to $15 million, said David Mustin, vice president of strategic consulting at Marcum Technology, as cited in a NetSuite Brainyard article. Once a business reaches that threshold, it needs to put systems and policies in place that will help the company reach up to $50 million in profit.

While your business may not be at this stage yet, the point is that you will eventually have to scale your company sooner than later to unlock its growth potential. And the best way to do this is by bringing the future now via finance automation.

What Is Finance Automation?

Finance automation is the process of putting specific finance tasks on autopilot with the help of artificial intelligence (AI) tools.

Here are some technologies used for financial automation:

- Chatbots – Also known as conversational agents, they are computer programs that allow users and customers to communicate with your team without having someone physically around to manage the conversation. What the bot does is pull information using conditional logic and deliver it to customers.

- Document automation – This technology processes documents by collecting information from various sources and reviewing the validity of data from each. It also can create documents such as contracts and invoices by extracting data from the previous stages.

- Machine learning – This technology enables you to develop rules and conditions that the software must follow to execute specific actions. Over time, machine learning can detect patterns from previous transactions and decisions to help identify irregularities in the data.

- Process mining – Using this technology, banks can analyze their processes and determine which workflows are inefficient and require improvements.

- Robotic Process Automation (RPA) – These bots can execute the tasks using rules established in machine learning. It enables bankers and lenders to free up more time for themselves to perform other essential tasks. It’s even been reported that RPA can save the finance department about 25,000 hours of work yearly, according to information technology research and advisory company Gartner.

Benefits from Shifting to Finance Automation

Adopting finance automation is easier said than done, especially for legacy organizations that built their business using tested manual processes. But the benefits your organization will reap after automating your finance processes are worth the effort.

Here are some of the most vital advantages of finance automation:

Analyze Your Finances More Efficiency

Before automation, you would need to follow a paper trail over a period to record your finances and organize them for your reports and statements. Depending on the data you’re looking for and the period coverage, gathering the information for the reports could take some time.

With a finance automation tool, all you must do is check the information readily available to you in a few clicks. There’s no need for your team to collate data from different spreadsheets and files as the software already has done the hard work for you.

All you have to do now is to study your profitability index, earnings per shares (EPS), and other metrics pertinent to your organization. This way, you can take action on them sooner than later.

Get Rid of Manual Errors

In manual processes, human error is inevitable. No matter how foolproof your workflows are, the risk of somebody making a mistake for whatever reason will always loom.

To eliminate this issue, use machine learning and RPA to help create and enforce rules and conditions in executing tasks. Your team can tweak the conditional logic of your finance automation to ensure that the data it produces is accurate.

Save Time

By implementing finance automation to perform manual data entry and processing documents, you get to free up your team to do equally essential tasks.

Not only will business and finance teams be grateful for automation, but 73% of industry experts, according to a study conducted by Dun & Bradstreet.

Finance Tasks You Can Automate

Here are some of the most common tasks that you can automate:

Accounts Payable

Paying your invoices can be a straightforward process for most organizations. But it could get complicated real quick, primarily if someone from your team records the information from the invoices after processing the payment.

Instead of recording them manually, automation lets you scan your invoices to capture information and include them in your database. Doing so removes a few steps from your process and decreases the risks of human error.

More importantly, going the paperless route with your accounts payable reduces your invoicing costs by 82%, according to Ardent Partners.

Bookkeeping

This time-consuming process requires you to record every item as a separate entry of expenditure. While spreadsheet tools have made bookkeeping more convenient, manual intervention still requires you to list the items correctly.

Accounting software allows you to do bookkeeping automatically. For instance, it can extract bank and credit card data and categorize them according to cash balance and cash flow. From here, your team can focus on analyzing the results to improve the processes and develop financial projects.

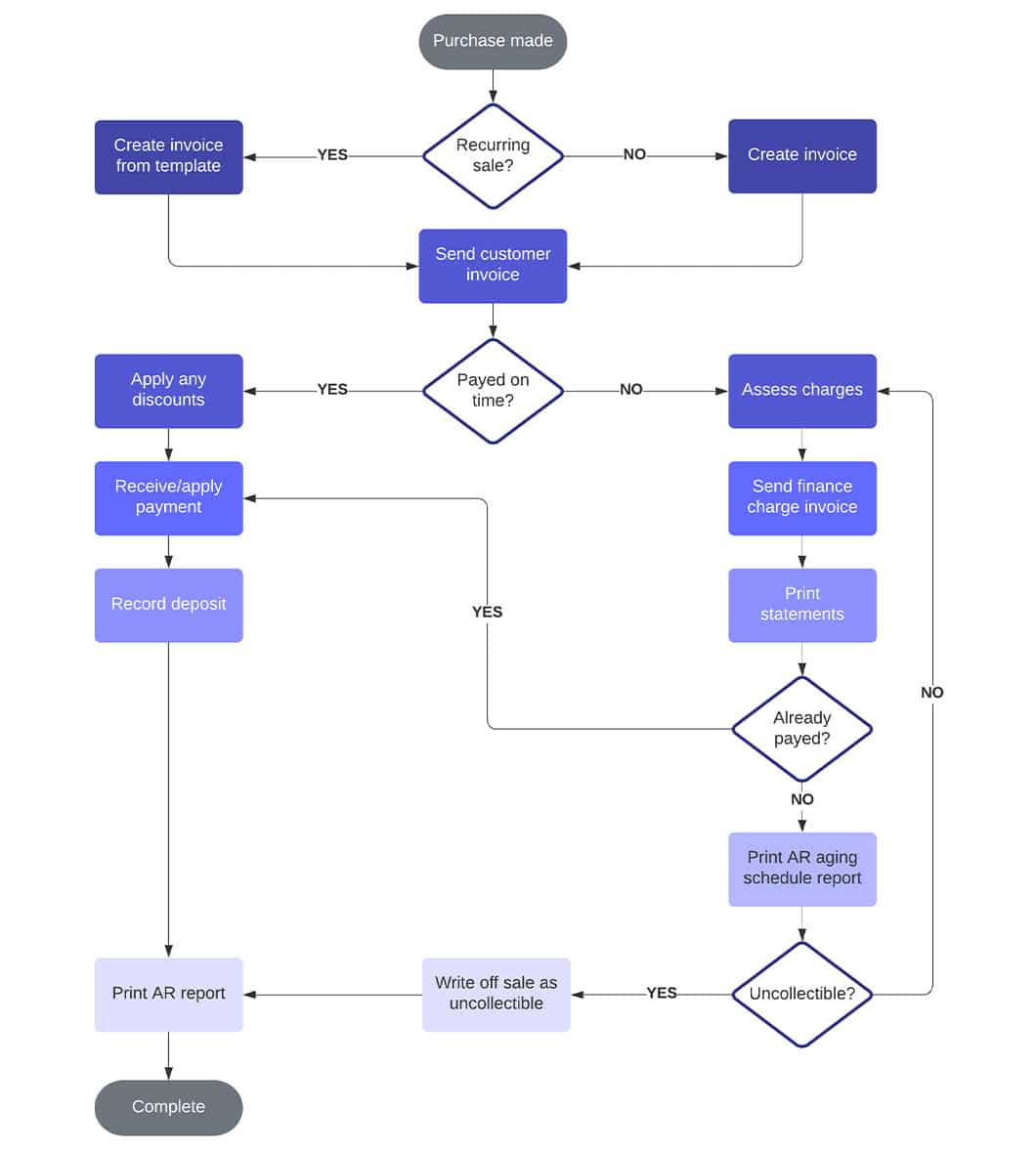

Invoice and Accounts Receivable

As with accounts payable, accounts receivable is an even more complex process involving different factors, some of which are beyond your control.

First, you must get different teams to work together and collect accurate invoice information. Note one possible downside is getting too many people involved could lead to more human errors.

Also, you have to factor in the time when customers send the payment. If they take longer to pay you, it creates extra and unnecessary steps in your workflows that take time away from your team to do other tasks.

Automating this process not only reduces the steps involved and the risk of human error but allows you to receive the payment faster. You can achieve this through automated invoicing — a common feature in automation software.

You also can set the tool to send reminders to customers automatically if they haven’t sent their payments yet.

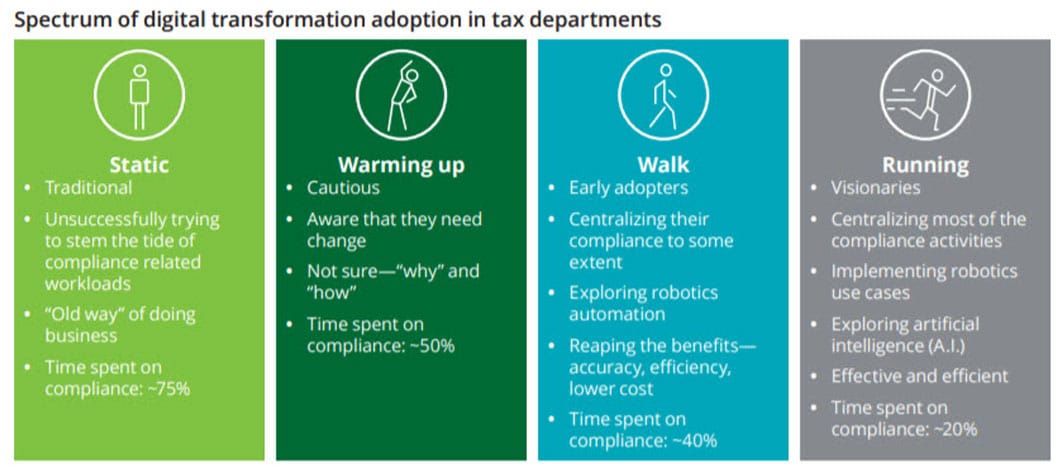

Tax Compliance and Reporting

It is your responsibility to be aware of and observe the tax laws that apply to your business. On top of knowing your tax obligations, you have to calculate them and file them before the deadline to avoid fines.

Yes, you can hire an accountant who will do all these things for you. However, paying for their expertise could get expensive quickly since this task is very dense and intensive.

So, if you want to cut down on costs and speed up the process, you can assign your team to handle your company taxes using automation software. The tool will compute the tax requirements for each item line in your expenses.

By letting automation simplify how you deal with your taxes, you can focus on growing your business and keep taxing authorities at bay.

Payroll

Ensuring that all your employees receive their exact regular salary down by the dollar and on time is arguably the most challenging task you must deal with in your organization.

It is easy to make mistakes in computing when it comes to the payroll. Aside from the different salary levels, you have to factor in fringe benefits, holiday entitlements, etc.

With help from finance automation, you can accurately compute the salaries of employees in minutes. This enables you to get the payment on time instead of worrying about the exact amount each receives.

What Are the Main Challenges?

Putting your business on autopilot is the best way to help improve productivity and decrease human error. But despite how much value finance automation brings to your organization, there are still roadblocks it has to overcome for everybody to be fully on board with it.

Setting Up Your Automation Platform

Finance automation isn’t a “silver bullet.” To make it work for your business, you need to set it up properly first. As mentioned, setting up your machine learning and conditional logic in your automation software is vital to get it to execute the tasks you want it to complete.

Initially, configuring the rules and conditions is a lot of work. But once you have it set up correctly, it should be smooth sailing from here on out. If you’re still getting the hang of the software, start automating small tasks before moving to more complex ones.

Hiring Dedicated People to Implement Finance Automation

Setting up automation for your business isn’t a one-time activity. Because company goals and objectives change over time, you must learn how to customize the automation software accordingly.

To help you with this, you’ll need dedicated people who know your finance automation tool from the inside out. They will implement the automation and integrate them into your process seamlessly. At the same time, they can monitor any changes happening in your automation and change them for the better.

Continued Developments in the Industry

Since finance automation continues to evolve as a business practice, more trends will emerge to help simply finance processes. What a business knows now in automation can change at a moment’s notice.

As a result, the lack of knowledge about finance automation could cost a business more in the long run.

Assigning someone in the company who will follow the latest updates in finance automation allows them to stay on top with its best practices. The business can then take fuller advantage of automation to simplify their finance tasks.