Loan payments, in general, primarily consist of principal and interest.

Business loan principal is the amount of money entrepreneurs or companies borrow to cover a business expense. Interest, often a percentage of the principal balance, is the cost of borrowing the capital. Interest is how lenders make money from loans.

We’ll dive into how the loan principal affects what you pay in interest and how you can lower the principal amount with targeted principal payments.

What Is Loan Principal and Current Principal Balance?

Loan principal is the total amount of money paid out to a borrower in a lending transaction. Your current principal balance refers to the amount of money you still owe on the original loan amount, not including interest or finance charges.

For example, if you took out a $100,000 loan to purchase commercial real estate, that total is considered the original loan principal. After you’ve paid off half of that total, the remaining $50,000 — aside from any accrued interest — is considered your outstanding principal balance or unpaid principal balance.

-

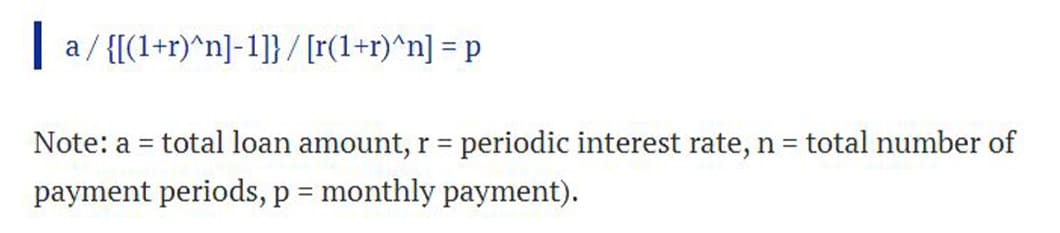

Loan Principal Payment Formula

While you can use a principal payment calculator to figure out your loan installments (e.g., Calculator.net), the loan principal payment formula is as follows:

Source: GoCardless

Calculating Interest From Principal

Your business loan’s interest rate will be higher or lower based on your business and personal credit scores as well as other risk factors.

The percentage rate you get based on your creditworthiness determines what number to use to calculate your interest payments. These calculations are then applied to your principal balance to add to your monthly installment.

Simple Interest

If you were financing a car for your business for $25,000 at an interest rate of 5% over 5 years, this is what you would pay in interest.

Principal x Interest Rate x Loan Term = Total Simple Interest

$25,000 x 5% x 5 years = $6,250

Over the life of the car loan, you’d pay $6,250 to the lender on top of the $25,000 purchase price, or $31,250.

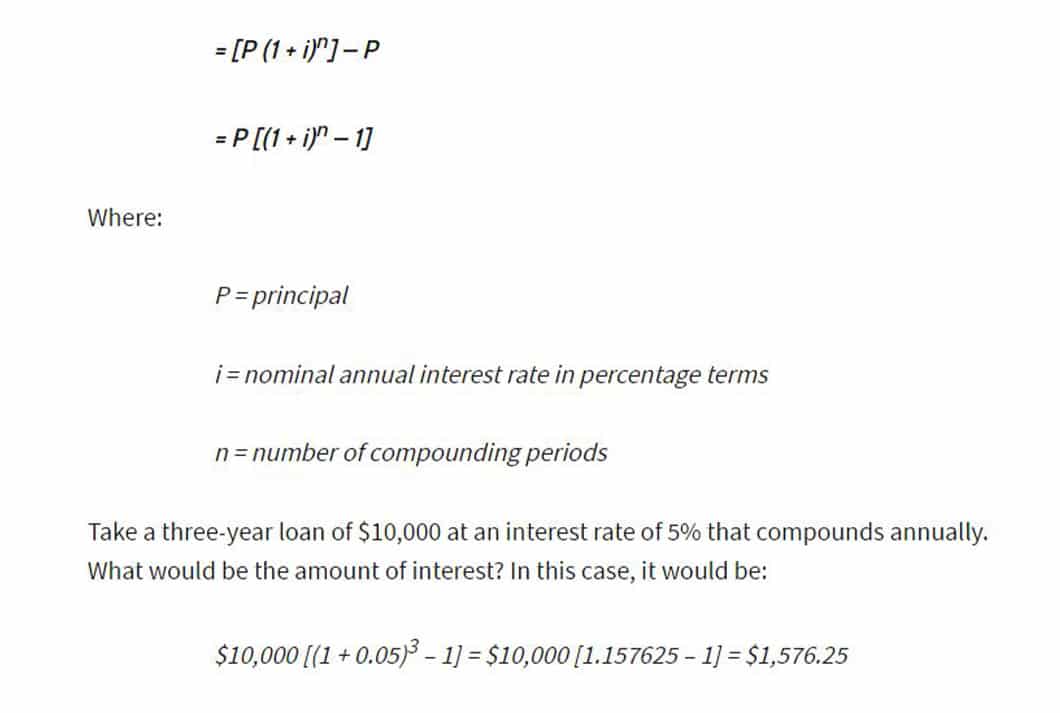

Compound Interest

When it comes to loans, compound interest is interest that’s charged on both the loan principal and the interest that has accumulated thus far. This causes the amount the borrower owes to grow at a much faster rate when compared with a simple-interest loan.

The formula for calculating compound interest is as follows:

-

How Does a Business Loan Affect Taxes?

While your loan principal balance can’t be deducted from your small business taxes, interest is another story.

As with home and student loans, the Internal Revenue Service will take into account what you pay in business loan interest and will consider it on your taxes.

Related Link: How to Benefit From Business Interest Deductions

Calculating Factor Charges from Principal

Factor rates are commonly used in alternative small business financing. Factor rates express the total cost of borrowing a specific amount and are calculated once at the beginning of the lending period.

This means they’re set in stone at signing and will have to be repaid no matter what. Whether you pay off the balance in 3 or 6 months, the amount you pay in interest won’t change.

Factor rates are easy to calculate. For example, let’s apply the formula to a $10,000 merchant cash advance used to finance day-to-day operations.

Principal x Factor Rate = Repayment Amount

$10,000 x 1.2 Factor Rate = $12,000

Repayment Amount – Principal = Total Cost of Borrowing

$12,000 – $10,000 = $2,000

When signing for this type of funding, you agree to pay back .2 times the loan principal amount, or 20% in finance fees.

How Loan Principal Is Paid

There are multiple approaches to paying the principal of a loan, and the principal payment formula will be different depending on the type of financing you’re seeking and who the lender is. Additionally, what you’re using the funding for and your creditworthiness affect the type of repayment structure you’re given. Understanding those factors and how you can manipulate your principal loan balance can help you pay less and put more money back into your small business.

Amortized Payments

Common in vehicle and real estate loans, amortized payments are based on an amortization schedule. With these agreements, you have an equal payment each month that consists of both principal and interest, which is calculated off your current balance.

This payment structure is interest front-loaded, meaning the majority of your payment goes toward interest at the beginning of the term. As the interest portion of an amortized loan decreases, the loan principal portion of the payment increases.

As an example, let’s consider the repayment term, principal and interest rate of ABC Industries’ loan.

- The company borrows $50,000 at a 6% annual percentage rate with repayment terms extending 10 years.

- The company makes monthly payment installments.

Using a loan principal calculator, we can determine how the principal amount of the loan would decrease with each payment. Specifically, the following table briefly shows what happens to the principal paid over time and how the unpaid principal balance goes down with each monthly installment.

While this table only shows the breakdown of the first 5 payments, a loan principal calculator could provide the amortization schedule for the entire loan term, whatever your terms may be.

| Payment | Beginning Balance | Interest Payment | Principal Payment | Outstanding Principal Balance |

| 1- $555.10 | $50,000.00 | $250.00 | $305.10 | $49,694.90 |

| 2- $555.10 | $49,694.90 | $248.47 | $306.63 | $49,388.27 |

| 3- $555.10 | $49,388.27 | $246.94 | $308.16 | $49,080.11 |

| 4- $555.10 | $49,080.11 | $245.40 | $309.70 | $48,770.41 |

| 5- $555.10 | $48,770.41 | $243.85 | $311.25 | $48,459.16 |

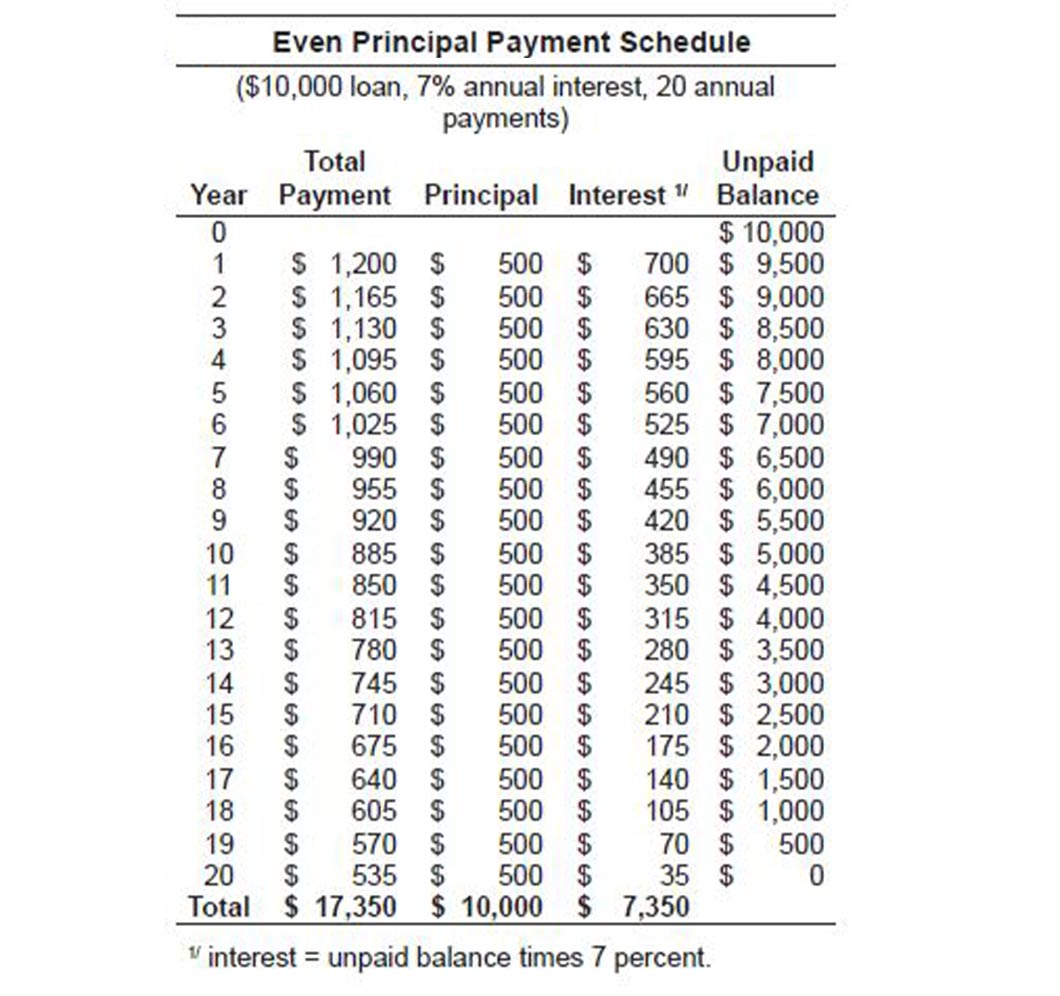

Even-Principal Payments

With a fixed principal loan, your remittance payment will be higher at the beginning of your term and lower as your loan matures. Your principal payment is fixed, but your interest charge changes.

For example, let’s say you take out a $10,000 loan over a 10-year term, your principal payments would be $1,000 each year throughout the term, with your amount of interest decreasing with each payment.

Like their amortized counterparts, even-principal payments have you paying more interest in the beginning of your repayment schedule than you will as the loan matures.

Interest-Only Loans

Certain bridge loans can have the repayment structure consist of interest-only payments. Bridge loans are very short-term — usually about 6 months — and are for small business owners who need money fast.

With interest-only loans, the entire principal loan balance — a large sum referred to as a balloon payment — is due at the end of the term.

You’ll have to either cough up the money or, more commonly, refinance into a more palatable loan. You can get an idea of what an interest-only loan would cost you per month by using an interest-only payment calculator.

Paying Down Your Principal Faster

Unless your lender uses factor rates, you could considerably cut down your repayment costs by lowering your principal on a loan. Because interest is calculated off your current balance, paying more than is required (or paying more often) allows less money to accrue. There are a couple of ways to do this, but either way will save you money in the long run.

When it comes to principal payment vs. regular payment, you can add extra money to your regular payments earmarked for the original principal loan balance. Doing this consistently could save you thousands of dollars in interest and help you pay off your loan sooner.

You also can make targeted, principal-only payments throughout the loan. Some borrowers will use a portion of their tax return to pay down their loan balance, for example. Spending a little extra now in a loan principal payment could save you a significant amount of money and time in the long run.