Many people launching their own company begin their journey with high hopes, but about 20% of small businesses fail within the first year, according to the Small Business Administration (SBA).

Many new businesses fail as a direct result of financial difficulties. Running a break-even point formula ahead of time and frequently throughout the operation of a business can help prevent failure.

What Is the Break-Even Point?

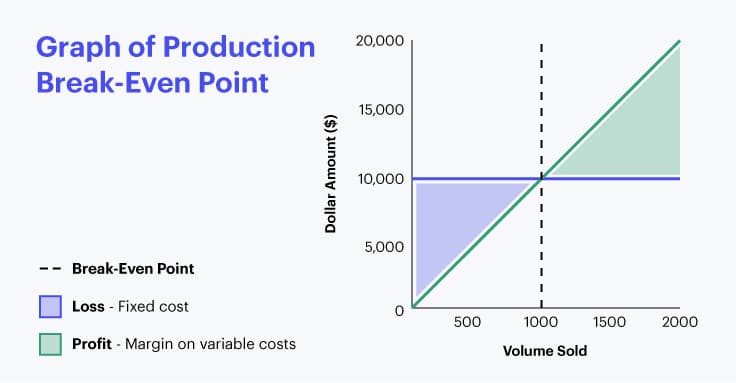

The break-even point is the juncture in which a company’s revenue from production and sales equals its fixed and variable expenses. It represents the number of units you need to sell to cover all costs associated with producing your product and running your business.

Before reaching break-even, money coming into the business is going toward covering expenses. Only after you reach that break-even point will your business turn a profit.

How to Calculate the Break-Even Point

Determining your company’s break-even point using a formula isn’t difficult, but it does require several steps. To perform a break-even analysis, you’ll need to take a look at not only your current business operations but the potential costs of products or service offerings that you’re likely to undertake in the future.

Step 1: Determine Your Company’s Fixed Costs

Fixed costs are any expenses that keep your business open and operating on a day-to-day basis. You would continue to pay these costs even if you never produce or sell a single product. This also means that these costs don’t include any product production, research or other fees associated with creating, marketing or selling a product.

Fixed costs include:

- Rent or mortgage payments

- Utilities for your building (this doesn’t include utility costs associated with machinery or equipment used to produce products)

- Insurance

- Salaries of employees who don’t work in production

- Office equipment such as computers, telephones and internet devices required to operate your business.

Step 2: Determine Your Variable Unit Costs

Once you’ve determined your fixed costs, it’s time to determine variable costs that are directly associated with producing or obtaining products.

To determine your variable costs, you’ll need to consider every element of the production process. This includes the cost of market research, design research and initial testing. You’ll also need to include every cost that comes with actually producing your product, including the equipment you need, the employees who produce your products and the shipping cost of getting your materials.

-

No Products to Sell?

If you don’t produce your own products to sell, that doesn’t mean you don’t have variable costs.

Rather than production costs, your variables would instead be the wholesale price you pay, as well as any warehouse storage costs, shipping, packaging or other fees that you incur to obtain your products, transport them and store them.

As with most businesses, you likely have more than one product to offer. This can make setting your variable cost a bit of a challenge. Averaging your variable costs will help account for this.

For instance, if your business sold 3 products, 1 with a variable cost of $10, 1 with a variable cost of $15 and 1 with a variable cost of $20, your average variable cost would be:

($10 + $15 + $20) ÷ 3 = $15

Step 3: Set Your Unit Selling Price

While you may be utilizing a break-even point formula to help you figure out how much you need to sell your products to turn a profit, you will first need to set a placeholder-unit price.

This will be used as a part of the formula, so you should try to set a realistic price that you might sell your product for.

Of course, if you are already selling products, you’ll want to list the actual price before tax.

Step 4: Calculate the Break-Even Point

Now that you have your fixed costs, variable costs and unit selling price in hand, it’s time to determine your break-even point.

The break-even point formula is:

Break-even point (units you need to sell) = fixed costs ÷ (revenue per unit-variable cost of each unit)

-

Break-Even Point Formula Example

Let’s run through an example of the break-even point formula.

Let’s say you run a bookstore that has $10,000 in fixed costs. You purchase books from a wholesaler. Including shipping, storage and other expenses, each book costs you $10. You’ve decided to list your books at $20 each.

To figure out how many books you would need to sell to break even, your formula would look like this:

$10,000 ÷ ($20 – $10) = 1,000 books

Why It’s Crucial to Find Your Break-Even Point

For new and growing small businesses, determining the break-even point early on might seem like an unnecessary step. But, it’s actually an important tool for a number of reasons, even if your business is still a long way away from turning a profit.

- For starters, knowing the amount of money your business needs to make to recoup its startup and operational costs will allow you to better create your business plan.

- It may help you determine what kind of additional financing you’ll need to keep your business operating until you are able to turn a profit.

- Your calculated break-even point can also be used when you are making your case to lenders as a part of your business plan.

- It can help you plan for launching new products. You might find that you’ll need to wait to start creating new products until you are able to find additional funding, or your business picks up.

- It may help you price your products to cover their associated costs.

The Problem With Only Utilizing Break-Even

Calculating break-even can help give you a better idea of how to price your products, show lenders your potential profit and give you an idea of how much money you need to make to stay out of debt. However, it certainly isn’t the only metric that will define the success of your business.

Fixed costs can change when rent or utilities increase. Materials may become unavailable or production costs may vary, leading to a change in your variable costs. Knowing how many units you need to sell to break even is no guarantee that you’ll meet this projection. If you set your sights too high and fail to make enough sales, you’ll never break even.

It’s always important to look at all risks associated with a business decision before you commit to a new idea.

-

How Relying on Break-Even Can Be Problematic

Consider this break-even point example:

Let’s say you run a midsize manufacturing plant that produces ball bearings. You have 200 employees and fixed costs of $10,000 a month. Say it costs you $2 to make each bearing and you sell them for $10 each.According to your break-even calculations, you’ve determined that you need to produce and sell 1,250 bearings each month to break even.

Let’s say you fail to watch the prices on your materials closely and you discover that your cost of raw materials has added an extra $2 a bearing. Then, without warning, 30% of your employees quit to work at a new plant opening across town.

This certainly helps your labor cost, but suddenly you can only produce half as many bearings as you were before.

In this case, your break-even point calculations would have gone out the window. The formula shows that you need to produce 30% more ball bearings each month, but the mass departure of employees may have cut your production capacity below your break-even point.

Conclusion

The break-even point is a useful metric to know regardless of whether you’re just starting out, thinking about expanding or would like to know more about your business’s finances.

It isn’t the only thing that will determine your business’s profitability, but it’s certainly worth calculating to gain insight and understand the impact of decisions you face each day.