Understanding the asset-liability-equity formula, known as the balance sheet equation can help you see what your company owns and owes. When used alongside other financial statements, it provides insight into the health of your business and can help you make more informed decisions. Let’s break it down.

The Balance Sheet Equation

The balance sheet equation is as follows:

Assets = Liabilities + Equity

The balance sheet shows how an asset was earned through liabilities (loans) or equity (money in the bank or investments). The two sides of the formula always equal.

For example, if you take out a loan (liability) to buy a new piece of equipment for your business, the value of the equipment is recorded as an asset. The loan is recorded as a liability. The two sides equal.

Conversely, if your business turns a profit, the value is recorded as a cash injection on both sides of the equation: As a cash asset and as earned equity.

Note: You can substitute the word capital for equity and call it the asset-liabilities-capital equation. Others use the terms accounting equation or equity equation. Every transaction gets added or subtracted to both sides of the formula — which is why it should always balance.

Let’s explore how these 3 elements interact in the balance sheet equation.

Asset Definition

Assets are the sum of short-term (current) and long-term (noncurrent) resources owned by your business. Assets include your inventory, the money customers owe you (accounts receivable) and investments. They also include fixed assets and intangible assets:

- Fixed assets include buildings, furniture, office equipment and machinery.

- Intangible assets include patents, trademarks and customer lists.

In the balance sheet equation, your company’s total assets equal the sum of your liabilities and equity.

Current Assets vs. Noncurrent Assets

You can further break down your list of assets by determining which are current and which are noncurrent. This is important to know because your current assets can be sold or liquidated to pay off short-term debt as well as serve as collateral for loans. This could be a short-term investment such as a certificate of deposit (CD) coming due or inventory that’ll get used or sold within a year.

On the other hand, noncurrent assets, also called long-term assets, are those that you’ll hold onto for a year or longer. It’s difficult or impossible to liquidate these resources in less than a year. Examples of noncurrent assets include office furniture, long-term investments such as bonds and intangible assets.

Liability Definition

Liabilities are something most business owners are familiar with: debt. If you use a loan or credit card to pay for a product or service, you’re responsible for paying off the debt.

Examples of liability include money owed to vendors from your accounts payable list along with debts to creditors, such as credit cards and bank loans. Depending on your business or situation, liabilities may consist of debts to the Internal Revenue Service (IRS), prepaid services for customers or outstanding obligations such as gift cards.

Current vs. Noncurrent Liabilities

Similar to long- and short-term assets, liabilities fall into 2 categories. Any debt that you expect to pay off this year is called a current liability. Along with short-term debts or obligations coming due within a year, current liabilities may include:

- Accounts payable to suppliers

- Short-term debts (e.g. bank loans)

- Quarterly taxes

Noncurrent or long-term liabilities include loans that’ll take you more than a year to pay off. These liabilities can consist of long-term loans, deferred tax liabilities or pension obligations. For businesses that offer product warranties, such a guarantee is considered a noncurrent liability.

Equity Definition

Equity is the sum of your total assets, including any income earned or saved in your accounts, minus the total of your debts. The equity definition can vary, whether it’s owner equity or shareholder equity. However, in the business world, equity is your net worth or your working capital.

To figure out your equity, you add your debts and the total value of your assets. Then subtract the two numbers to find the difference. That’s what your company is worth. It also gives banks an idea of your financial condition and might benefit you if you choose equity financing for your business.

The Importance of the Balance Sheet

Your balance sheet gives you a snapshot of your financial strength and ability to meet financial obligations. This isn’t only for your benefit: Stakeholders, investors and financial institutions look at the balance sheet to determine your financial credibility. It’s also essential for double-entry accounting, which is a type of checks-and-balances system where every transaction is recorded in 2 separate accounts.

Your balance sheet lists every asset and liability, broken down by current and noncurrent categories. Each type of account, such as inventory or investments, has its own line on the balance sheet. Not only can you glance at the final number to see where you stand, but you can see how that breaks down by section.

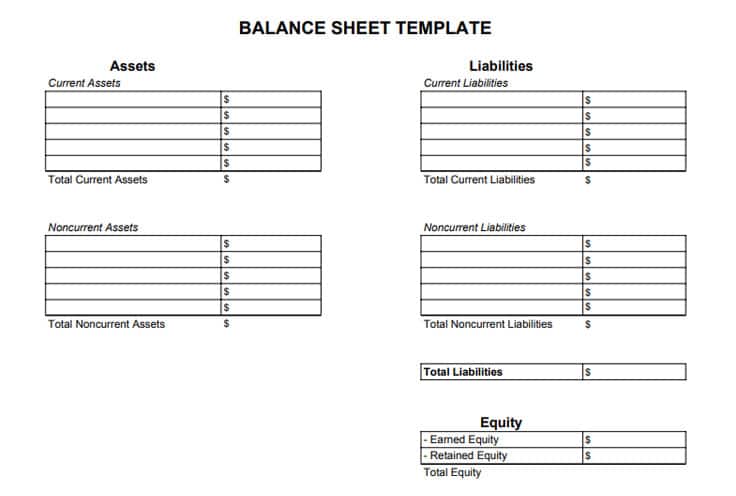

Balance Sheet Template

On the left side of your balance sheet, list all of your company’s assets, categorized by current and noncurrent holdings. Input totals for each section, and end with a grand total of all of your assets.

On the right side, list your liabilities. Again, separate these according to current and noncurrent liabilities. Tally the numbers up and move on to your equity. Combine your company’s earned and retained income to determine your total capital.

Next, you’ll use your assets-liabilities-equity equation. Add together your total debts and your equity. Insert this number at the bottom. When you’ve accurately tracked your transactions, these 2 final numbers will be equal.