Looking to develop new goods, expand an existing product line or enter a new market? If you’re seeking to scale your company, the Ansoff Matrix (or Ansoff growth matrix) can be an ideal tool to help you assess, strategize and mitigate the risks involved.

What Is the Ansoff Matrix?

The Ansoff Matrix is a strategic planning tool developed and presented by mathematician Igor Ansoff in 1957.

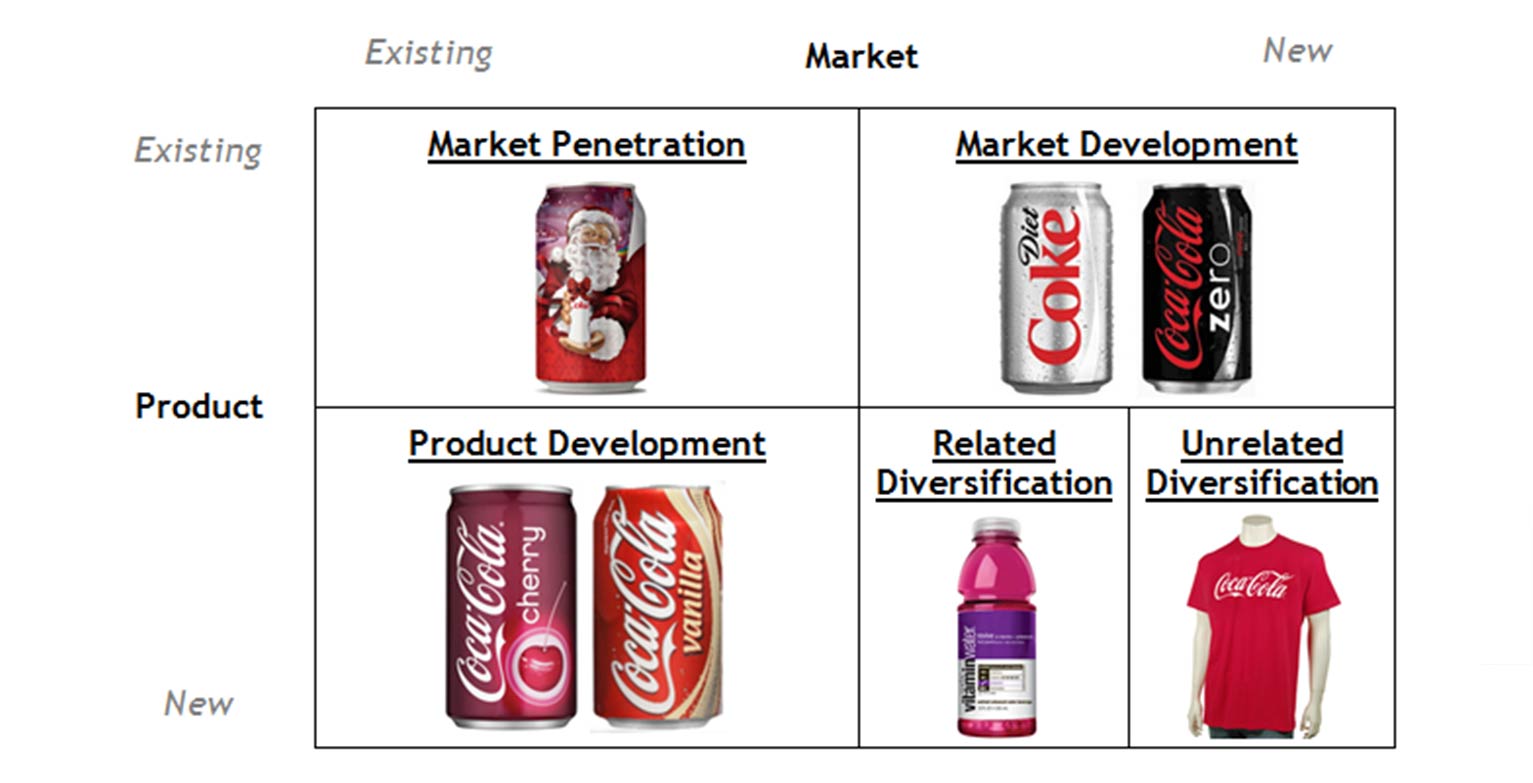

Ansoff said there are 2 core aspects to business: products and markets, either new or existing. The interrelationship between new and existing products and markets results in 4 strategies, each shown as a quadrant in the Ansoff growth strategy matrix:

- Market penetration

- Market development

- Diversification

- Product development

See how all the components work together with this sample Ansoff Matrix inspired by the Professional Academy:

Market Penetration

Market penetration refers to increasing sales within your existing market. With this strategy, you promote and sell current products or services to an established customer base.

Consider this strategy if your company has created a demand for your product and narrowed down the necessary market to target customers. The key benefit of this marketing strategy is that you’ve already laid the groundwork for the products you already have. This makes the strategy the lowest risk of the 4, by leveraging your existing data, resources and market share.

Businesses can implement a market penetration strategy in many ways, which could include increasing promotions, offering loyalty programs, lowering prices, making minor product enhancements or buying out a competitor.

Here’s an Ansoff Matrix example for marketing penetration: A chain of coffee shops introduces a loyalty program, offers special promotions and doubles its Facebook advertising spending. By taking advantage of their existing product selection, they’re able to improve their market share, bring in new leads and retain customer loyalty.

Market penetration is ideal for companies with a strong competitive advantage to tap into their existing customer base and maximize their ROI.

Market Development

Another quadrant of the Ansoff Matrix contains a strategy based on expanding your existing products and services into new markets. This could entail enticing new customers and bringing in fresh leads or dipping your toes into different geographical locations.

With a market development strategy, you also can take advantage of online channels to acquire new leads and convert customers. For example, a brick-and-mortar store could benefit from a company website, social media, email marketing campaigns and an ecommerce store.

This strategy offers a lot of growth potential for companies that want a low- to mid-risk strategy.

It’s important to note that a market development strategy may not be ideal for you if:

- There’s no demand for your product outside of your existing target market

- You don’t have the data to successfully localize your products worldwide

- Your company can’t support this strategy with existing resources

Product Development

Companies implement a product development growth strategy by shifting their focus to targeting existing markets with new products. Approaching your existing customer base with new products or services can be done by repackaging products, offering new services or developing related products.

Crunching the data and reviewing customer feedback is essential to product development. Understanding customers based on demographics and psychographics can distinguish why a customer prefers red over blue or chocolate over vanilla.

While some of the risk involved in implementing this strategy is mitigated by targeting your existing customer base. It’s important to note that developing new products can be a costly endeavor.

Companies should expect upfront costs while factoring in losses that may occur from delays in production and unforeseen expenses. That said, the potential for growth is supported by the possibility to offer products with a higher ROI than your existing range.

Diversification

Diversifying into new markets with new products is the riskiest strategy in the Ansoff Matrix. However, don’t be put off by the thought of delving into uncharted territory. Diversification presents the perfect opportunity for companies that want to vary their revenue by entering untapped markets and supplying the demand for new products.

Consider vertical integration, which can synergize your business by acquiring businesses involved in your supply chain to catalyze your company’s growth. For example, by owning the companies that produce and distribute your product, you’re able to help your company decrease manufacturing costs and logistic expenses. Furthermore, synergizing with your transportation company will help reduce the turnaround times to create and distribute your products.

If you aren’t ready to take on the risk of starting an entirely new venture, then horizontal diversification may be an option. This entails offering a product or service that is similar to one you already have. You have the processes in place and knowledge of the field that you can put to use.

Not only can you reach a new group of customers, you also can target your existing customer base. This part of the diversification strategy is aimed at customers loyal to your brand and often increases your company’s dependence on the market segment.

As business owners often know, competition can be fierce. Horizontal diversification enables companies to improve their competitive position with a broad product offering.

How to Apply Ansoff Matrix

The Ansoff Matrix offers perspective on business growth. As such, companies can use this tool to compare different types of opportunities they’re considering.

While each of the 4 strategies provides a business with an opportunity, each has its own level of risk. For example, market penetration is seen as least risky, while diversification has the most risk involved.

To use the Ansoff Matrix, first analyze the 4 options. Determine what actions you’d take to execute each strategy. After you’ve laid out your plan of attack, consider the specific risks involved with each strategy. After careful analysis of the information you’ve compiled, choose the option that makes the most sense for your business. A good rule of thumb is to focus on 1 strategy (2 at the most).

The Ansoff Matrix is often used in conjunction with other helpful business analysis techniques, such as:

- SWOT analysis: What are the strengths, weaknesses, opportunities and threats associated with each strategy?

- PESTLE analysis: Political, economic, sociocultural, legal and environmental analysis

- What’s going on politically and how can it affect your strategy? (e.g., tax policies)

- What are the economic conditions? (e.g., fluctuating inflation rate)

- What’s the sociocultural climate like? (e.g., demographics, cultural trends)

- What technological factors could impact your business? (e.g., research and development)

- Are there any legal or legislative issues that could impact your business? (e.g., safety standards, consumer laws)

- 5 C’s Checklist: Competition, context, cost, competencies and commitment

- Who is your competition?

- What is the context or environment?

- How much will it cost you to pursue your strategy?

- Do you have the competencies and skills to be effective?

- Do you have commitment from those you need it from in order to be successful?

Ansoff Matrix Examples

Now that you understand the what and how, let’s look at a few examples.

The Marketing Agenda posted this Ansoff Matrix sample visual with Coke as the focus.

Here’s another sample Ansoff Matrix, offered by Vizzlo.com and sourced from a Starbucks news release in 2016.

Ansoff Matrix Disadvantages and Limitations

As with most things, the Ansoff strategic opportunity matrix has pros as well as cons. While it can be a helpful tool to establish a focused approach to growth, it does have certain drawbacks.

Some limitations of the Ansoff Matrix include:

- Lack of depth: By only focusing on products and markets, the model has been criticized for being too simplistic and unrealistic.

- Critical components overlooked: Critical factors beyond product and markets are overlooked (e.g., competition). Additionally, there is no cost-benefit analysis of the different strategies.

- Hard to predict the impact: The Ansoff Matrix isn’t surefire and the level of risk associated with each strategy can’t be guaranteed. After all, it’s difficult to know how your products will take off and how the market will respond.

- Outdated: Because it was developed in the 1950s, the Ansoff Matrix is sometimes viewed as out of touch with today’s business strategies.

Factoring Risk Using Ansoff’s Strategic Opportunity Matrix

Perhaps you’ve heard the saying, “With great risk comes great reward.” How risky is your new endeavor?

The Ansoff Matrix can shed some light. It can also help your company strategize potential growth opportunities, whether tapping into new markets or producing new products.