The terms “W-2” and “1099” refer to U.S. tax forms specific to a certain type of worker. W-2 employees, for instance, are those workers who earn a regular wage, are eligible for employment benefits and must meet expectations dictated by their employer (e.g., work schedules, standards of conduct, etc.).

In contrast, 1099 workers are typically self-employed professionals or freelancers who aren’t eligible for benefits, are responsible for using their own equipment and are required to withhold their own income taxes, among other things.

There are other significant differences between W-2 and 1099 workers, including how you classify and treat them. Knowing these distinctions is crucial to avoiding fines, tax penalties and other legal issues.

Here’s what you need to know, including the advantages of each type of worker and when you might opt for one over the other.

What Is a W-2 Employee?

W-2 employees are workers who are on your permanent payroll and work on a regular, ongoing basis with your company. A W-2 employee is someone who might work in your office, using a desk and computer you provide and be assigned to a specific shift.

The litmus test the IRS uses to classify someone as an employee is when the business controls what jobs the worker will do and how they’ll do them. Even if you give employees broad discretion in how to do their work, you have the right to control the details of how the service is performed.

If you’re an employer of W-2 workers, you’re required, per Internal Revenue Service (IRS) rules, to withhold income taxes, Social Security and Medicare taxes, pay unemployment insurance and pay workers compensation on wages paid to the employee. You’ll also need to provide W-2 statements to employees by Jan. 31 of the following calendar year and report their wages to the IRS.

What Is a 1099 Employee?

To be clear, there is no such thing as a “1099 employee,” though someone may function as a 1099 worker, or independent contractor. Interestingly, 14% of workers indicated they were independent contractors, according to Forbes.

Companies that hire 1099 workers can’t control how these independent contractors do their work or when they choose to work.

For example, you may hire a 1099 worker who’s a freelance graphic designer. This designer could work when your employees are sleeping, complete tasks while on vacation and use programs you may have never heard of before, all in the name of getting the job done. Workers might be hired on a 1099 basis for short-term projects or part-time consulting work.

As independent contractors, 1099 workers essentially operate as independent businesses. They aren’t subject to minimum wage and overtime and typically are not covered by workers compensation and unemployment insurance. That said, some states require workers compensation for all employees and contractors or for contractors in certain industries, such as construction workers at job sites. You should check with your state’s department of labor on the rules and regulations.

Additionally, companies that contract with independent contractors generally aren’t required to withhold taxes. Instead, the contractor is responsible for paying any taxes, such as the self-employment tax. Employers need to provide these workers with a 1099 form by Jan. 31 of the following calendar year, which they will use to report their income.

W-2 vs. 1099 Rules for Employers

In determining whether someone is an employee or independent contractor, the IRS will consider the work relationship in terms of the following categories:

- Behavioral: Does the business have control over how, when and where the worker does their job?

- Financial: Does the business control how a worker is paid, reimbursement of work-related expenses and the tools needed to do the job?

- Relationship: Is the work performed key to the business? Is the working relationship permanent? Are there contracts or benefits consistent with being an employee (e.g., paid time off, retirement)?

If you’re uncertain whether someone qualifies as an employee or an independent contractor, you can ask the IRS for clarification by submitting form SS-8.

Initial Tax Forms Needed When Hiring 1099 Workers vs. W-2 Employees

When employees start a job, they fill out a W4 form. However, an independent contractor will provide you with a W9 form that includes the contractor’s tax ID or social security number. You can pay independent contractors in any method you choose. In most situations, you would not withhold taxes.

It’s a good idea to have a 1099 workers contract that spells out the details of both compensation and scope of work. If the job involves intellectual property or may have liability concerns in the future, a contract is critical.

Benefits of 1099 vs. W-2 Workers for Employers

When you’re trying to determine which option is the better fit for your business, consider the advantages of each type of worker (as well as the drawbacks).

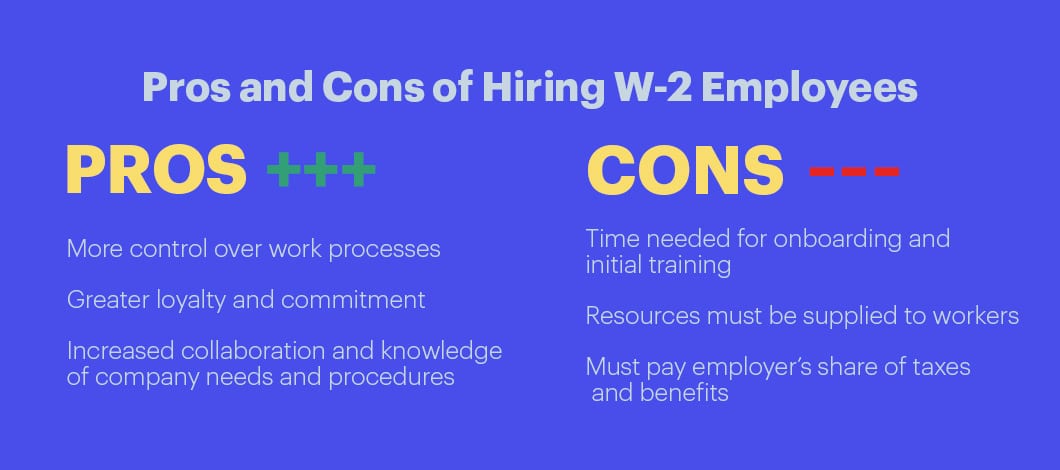

Advantages of W-2 Employees

W-2 employees work for you. They do what you need in the manner you want it done. They are more committed to your company and offer more continuity. With independent contractors, you aren’t their sole focus as they are free to work with other clients.

Additionally, you can shift employees to other jobs and tasks as business dictates. In contrast, independent contractors are typically hired for specific purposes.

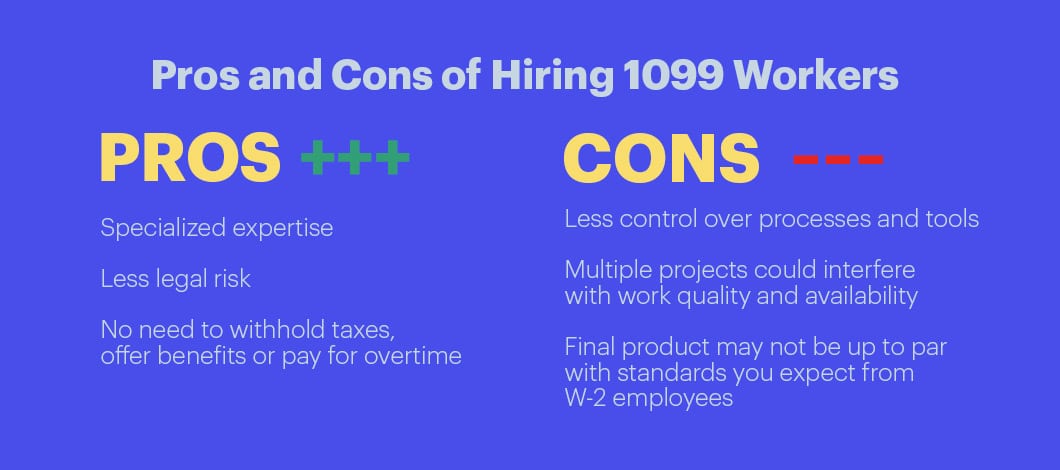

Advantages of Independent Contractors

Independent contractors offer greater flexibility. You can hire them for specific projects or when you have extra funds in your budget. Once they complete their work according to the terms of your contract, you’re under no obligation to continue engaging (or paying) them. W-2 employees, however, are members of your permanent staff whom you continue to pay for their work until they are terminated or resign.

Additionally, independent contractors can provide expertise your employees may not possess. You also may be able to lower your business costs because you don’t have to provide benefits or overtime. It’s been noted hiring independent contractors vs. employees could save a business 15%-30%.

There’s also less paperwork since you don’t have to withhold taxes as well as less legal risk, such as the potential for wrongful termination claims.

1099 vs. W-2: Which Is Better for Employers?

According to the previously mentioned Forbes article, popular industries for sole proprietors, many of whom function as independent contractors and are given 1099 tax forms, include these:

- Professional services

- Personal services

- Repair services

- Construction

- Administrative services

- Transportation services

- Retail

- Farming

If you need services in one of these sectors, you might consider a 1099 worker vs. a W-2 employee. Additionally, an IRS study shows that use of independent contractors has grown the most among small firms, those with 4 or fewer employees.

Still not sure if a 1099 worker or a W-2 employee is the best fit for your company? Here are a few reasons why you might hire one over another:

When to Consider Hiring a W-2 vs. 1099 Worker

| Use Case | W-2 Employee | 1099 Worker |

| You have a temporary, one-off project | X | |

| You value consistency and consistent adherence to a strict standard of quality | X | |

| You need expert advice for a specific short-term project | X | |

| You’re looking to build a permanent team | X | |

| You don’t have a human resources department | X | |

| You don’t want to be responsible for benefits, taxes or withholdings | X |

Ready to Hire?

Deciding which type of worker to hire and how to correctly classify a worker shouldn’t be taken lightly. While one option could be better than another for your business or a specific job you need completed, miscategorizing workers as independent contractors when the IRS would consider them employees could result in fines, back payment of taxes and legal consequences.

If you don’t have a human resources department to guide you, consider contacting an employment attorney for assistance in making the best decision for your situation. Another option is to reach out to a temporary staffing agency to fill a short-term vacancy and handle payroll processing and tax payments for a new hire.

Alternatively, some companies make use of professional employer organizations, which handle human resource functions.