The North American Industry Classification System (NAICS) is a coding standard created to classify companies operating in the U.S., Canada and Mexico based on the industry they operate in.

The primary purpose of creating NAICS, according to the U.S. Census Bureau, is to classify businesses “for the purpose of collecting, analyzing and publishing statistical data related to the U.S. business economy.”

Who uses NAICS codes? Insurance companies, banks and other such institutions review these codes to assess risk—and that can affect financing terms for small businesses.

What Is an NAICS Code?

An NAICS code is a 5- or 6-digit number used to identify what type of business a company does and the sector it operates in. These NAICS codes are used by lenders and insurers to determine risk levels and can impact everything from loan underwriting to workers’ compensation premiums.

A few examples include:

- 336111 identifies automakers

- 337124 identifies makers of metal household furniture

- 423420 identifies a wholesaler of office equipment

NAICS Code Meaning

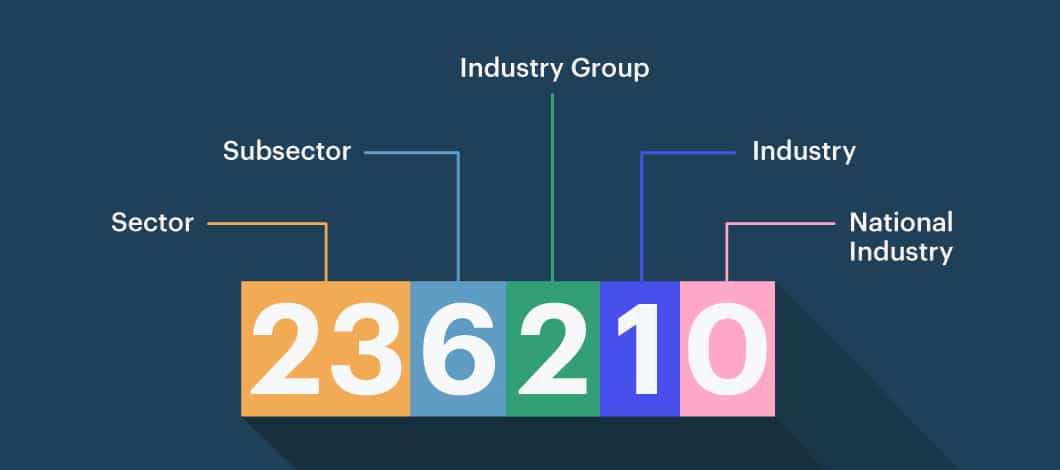

Each number in an NAICS code has a different meaning. The numbering system works as follows:

- The first and second numbers designate the economic sector a company operates in

- The third number designates the sub-sector of the company

- The fourth indicates the industry group the company belongs to

- The fifth identifies the specific industry of the company

- The sixth number identifies the national industry the company belongs to

In this way, every NAICS code relates to an individual business and shows what it does.

-

Here, we see the classification process for resort businesses operating in Canada:

- 72 designates a business operating in “Accommodation and Food Services”

- 721 specifies the business as an “Accommodation Service”

- 7211 further specifies the service as “Traveler’s Accommodation Services”

- 72111 filters down to hotel and motel companies not related to casinos

- 721113, finally, identifies the business as a resort

How to Get an NAICS Code

Businesses aren’t given an NAICS code by the government where they operate. Rather, it’s up to the business owners to determine which NAICS codes most accurately and honestly represent the services their companies provide.

Additionally, for businesses that perform multiple functions or services, owners should choose the NAICS code that identifies where the majority of the company’s revenue comes from.

Conglomerates made up of multiple companies will need to assign an NAICS code for each business within the corporation.

How NAICS Codes Can Affect Commercial Lending Decisions

While the intended purpose of NAICS codes is to track economic activity throughout North America, these codes often are used by institutions that provide services to other businesses.

For example, your NAICS code can directly affect your ability to secure small business loans from financial institutions and other such investors.

When deciding whether to provide a loan to a given company, lenders will often refer to the company’s NAICS to determine the level of risk involved in providing a loan.

However, lenders also will rely on several other metrics besides a company’s NAICS code.

Some examples of the factors lending companies consider:

- The risks (to employees, equipment and consumers) involved in the actual service provided by a company

- The past, current and projected future state of the industry in question

- The business model(s) typically used by companies in a specific industry

NAICS and High-Risk Industries

When reviewing NAICS codes, many lenders and insurers will consider some classes of code inherently riskier than others. These codes are typically associated with businesses that operate in certain sectors or subsectors of their economy.

Below are 3 of the highest-risk industries that often stand out to lenders and insurers because of their NAICS codes.

If you’re trying to apply for a loan or buy insurance, it can be helpful to avoid classifying your business in one of the industries below. If possible, classifying your business using a low-risk NAICS code can improve your odds of approval and lower your rates.

Transportation and Warehousing

Transportation services—be they public or private, people- or goods-focused—inherently have a high risk of damages or losses.

If a truck transporting produce breaks down mid-transit, the food may spoil—and the trucking company will be held liable for the loss. To add to the cost of that spoilage, the trucking company will need to cover the cost of any repairs.

Another issue with the transportation industry is the low barrier of exit for sole proprietors wanting to move on from their business venture. When disasters, such as the one mentioned above, strike, it isn’t exactly uncommon for sole proprietors to cut their losses and walk away from the business entirely.

These factors—among many others—culminate in a sector-wide default rate of nearly 50%. This represents a gamble for lenders—which is why many transportation businesses may see their loan applications denied.

Wholesale and Retail Trade

Retail companies live and die by the level of demand their customers have for their products.

If demand falls, retail companies aren’t going to be pulling in as much revenue as when demand was steady. On the other hand, if demand rises sharply—and a retailer can’t keep up with the spike—consumers will likely defect to a competing brand to get the products they need.

Another area of concern, depending on the types of products being sold, is the low-profit margin of many retailers. This margin leaves little room for such companies to comfortably repay their loans while still being able to keep business going (let alone growing). If even the slightest thing goes wrong, there’s a good chance it will cause issues for the retailer and impact the ability to repay business loans.

Administrative Support and Waste Management

Within the administrative support and waste management industry, administration-focused services are typically seen as the riskiest. This includes staffing agencies, temp agencies and travel or tour-guide services.

Businesses in these sectors often have low profit margins. Temp agencies, for example, collect payments from their clients—but then need to use most of this income to pay their temp employees for their services.

Because of their low margins, these companies often rely on business loans to get a command over their cash flow. With little wiggle room left after paying off major business expenses, these companies may find it difficult to find the cash on hand to pay back their loans in full and on time.

SBA Loans and NAICS Codes

One of the biggest reasons that business owners need to worry about their NAICS code is if they’re thinking of applying for a Small Business Administration (SBA) loan.

The SBA and lenders that issue SBA loans know that failure rates vary among NAICS codes. This means that if your business is classified in a higher-risk industry, it can be more difficult to qualify for an SBA loan. Lenders may require higher down payments or additional underwriting to review the risks associated with an individual business.

Lending Alternatives for High-Risk Industries

If your business happens to be one that’s often considered high-risk for lenders, you do have other options for securing funding.

Here are 3 of the most common—and least-risky—paths you can choose when looking to secure a business loan.

Invoice Financing

Invoice financing is a type of financing that lets businesses borrow against outstanding invoices owed by the company’s customers or clients. For a fee equal to an agreed-upon percentage of the overall loan, your business can immediately collect cash that would otherwise be collected from customers over time.

-

Let’s say your company completes a $10,000 project for a client, and you agree to collect $1,000 from them each month for the next 10 months.

You can then work with an invoice financing lender to receive a percentage of the entire $10,000 upfront, then pay the lender back as your client pays off their balance to your company.

In turn, you can then reinvest the $10,000 into your business right away—which, ultimately, will be much more effective than investing $1,000 at a time.

Crowdfunding

Crowdfunding has become an increasingly popular—and effective—means for businesses to raise funding with relatively little risk.

With crowdfunding, a business solicits small monetary investments from large groups of people through an online platform. Typically, those who donate funds will be those who either:

- Have an interest in, or need for, the products or services the business is developing

- See the potential value of the product or service, even if it doesn’t directly apply to them

Often, those who invest in crowdsourced projects will receive some kind of reward that relates to the overall business. For example, the company may give investors early access to a new service or a personalized item of some kind.

The Risk-Lending Correlation and How to Overcome It

The hard truth is lenders consider some business ventures riskier than others.

For entrepreneurs looking to break into these more risky industries, this can mean facing an uphill battle in terms of securing business financing.

But that doesn’t mean such companies can’t receive funds to bolster their operations. It just means they need to be extra diligent and strategic when approaching investors or lenders to win their confidence and financial support.