If you’re applying for a Small Business Administration (SBA) 7(a) loan, including one of the agency’s Express programs, you’ll need to complete SBA Form 1919.

We’ll walk you through the process of completing this SBA 7(a) borrower information form and provide you with examples of how to complete the SBA Form 1919.

What Is an SBA Form 1919?

An SBA 1919 form asks borrowers to answer a series of questions and supply personal information.

Examples of details you’ll need to include are the following:

- Citizenship status

- Existing debts

- Details regarding previous government financing

- Job creation goals

- Loan purpose and amount requested

The form also provides for background checks and is a requirement to assess if the applicant qualifies for financial assistance.

The SBA 1919 is in PDF format and available for download from the agency’s website.

Who Has to Complete an SBA Form 1919?

Generally, a business owner must complete Form 1919 for SBA Express as well as standard SBA 7(a) loans.

However, specific requirements for who completes the SBA 1919 form will depend on the structure of the business, as noted below:

- Individuals: If you’re the sole proprietor, you’ll need to complete Form 1919.

- Partnerships: All general partners or any limited partners who own 20% or more equity in your business must also complete the 1919 form.

- Corporations: If the company is a corporation, anyone owning 20% or more equity in the corporation must complete the form.

- Limited liability company (LLC): If the business is an LLC, all members who own 20% or more of the company and every director, managing member and officer have to complete SBA Form 1919.

- Employees: If you hire someone to manage the day-to-day aspects of your business, that person also has to complete Form 1919.

How to Fill Out SBA Form 1919: Instructions

Below is our step-by-step guide to completing SBA Form 1919 with corresponding images of the new SBA Form 1919 for 2022-2023.

It’s important to note that each section of SBA Form 1919 requires the signature of the applicant, which represents, acknowledges and authorizes the application and certifies the accuracy of the information provided.

In addition to verifying that you have read all relevant statements related to applying for an SBA loan, your signature is also confirming that, where possible, you’ll use U.S.-made equipment, comply with any limitations listed in the SBA Form 1919 and only use the loan for the reasons you’ve stated.

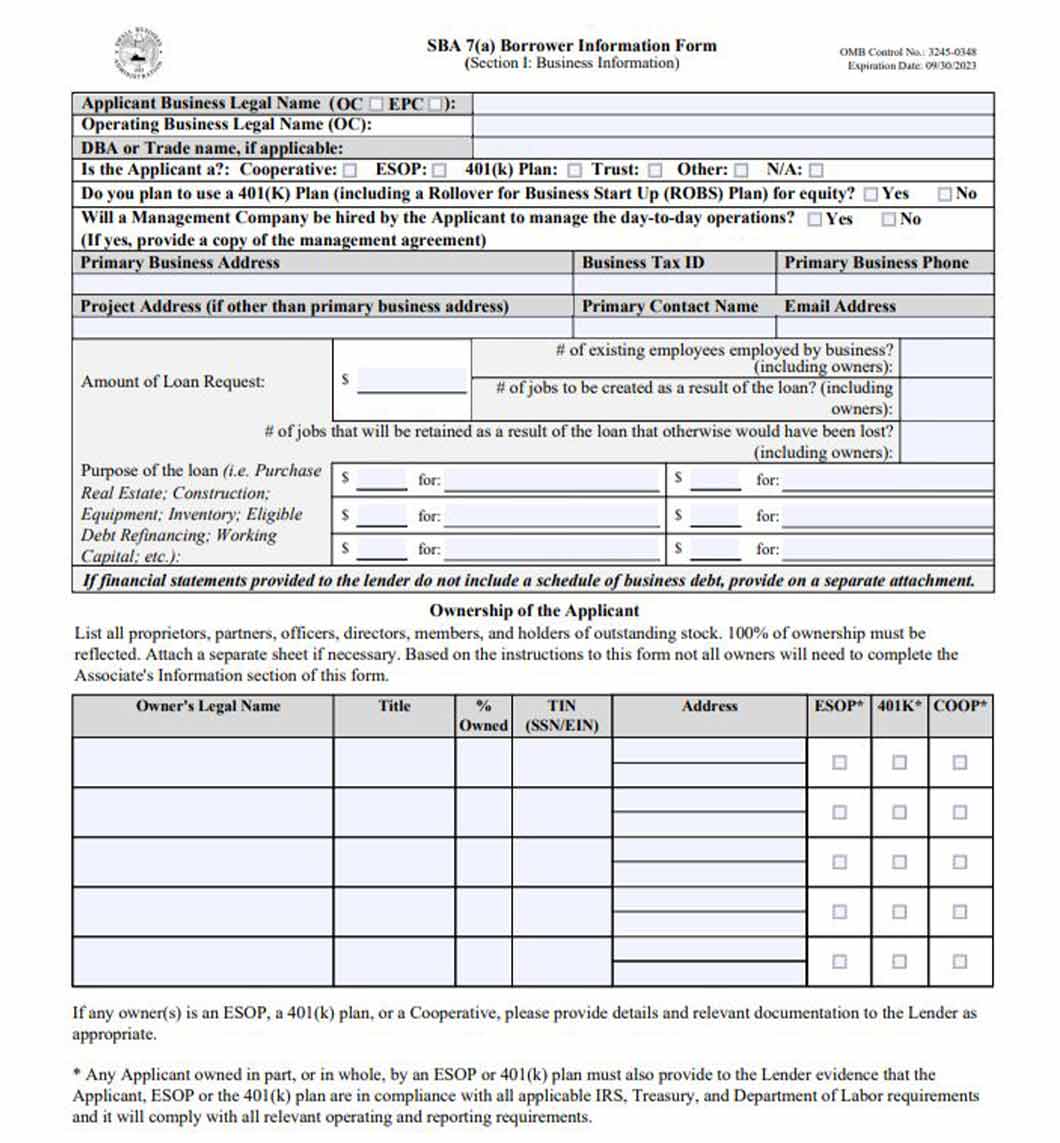

Step 1: Provide Business Information

The first part of Section 1 relates to the small business applicant’s information. Each co-applicant must complete this section. Required details include:

Applicant Business Legal Name

This has to be the same as the name listed on your company documentation and federal tax returns. You’ll also have to state if your business is an operating company (OC) or an eligible passive company (EPC).

An operating company actively conducts business operations. In contrast, eligible passive companies do not engage in business activities on a regular and continual basis. Instead, they lease real or personal property to operating companies.

If you run an operating company, you’ll need to provide the legal name of the operating business.

Doing Business As (DBA) or Trade Name

If you operate under a trade name or have a different “doing business as” name, you have to list it in this section of SBA Form 1919.

Additional Information

Additionally, you’ll need to indicate whether you are applying as a cooperative, employee stock ownership (ESOP), 401(K) plan, trust or something else.

You’ll also need to note if you plan to use a 401(K) plan for equity and note if a management company will be hired to manage daily operations.

Also, whoever is authorized to complete SBA Form 1919 must provide the following information:

- Primary business address

- Project address (If you have premises that need financing at different addresses, you must state where these are.)

- Business tax identification

- Primary contact’s name (i.e., the authorized representative of your company)

- Business phone number

- Email address of primary contact

- Amount of money you want to borrow

- Purpose of the loan (e.g., refinance existing debt, buy a property, purchase other fixed assets, etc.)

- Number of existing employees

- Number of existing jobs to be created and retained

- Small business applicant ownership (i.e., names, addresses and percentage ownership of any directors, owners, proprietors and stockholders)

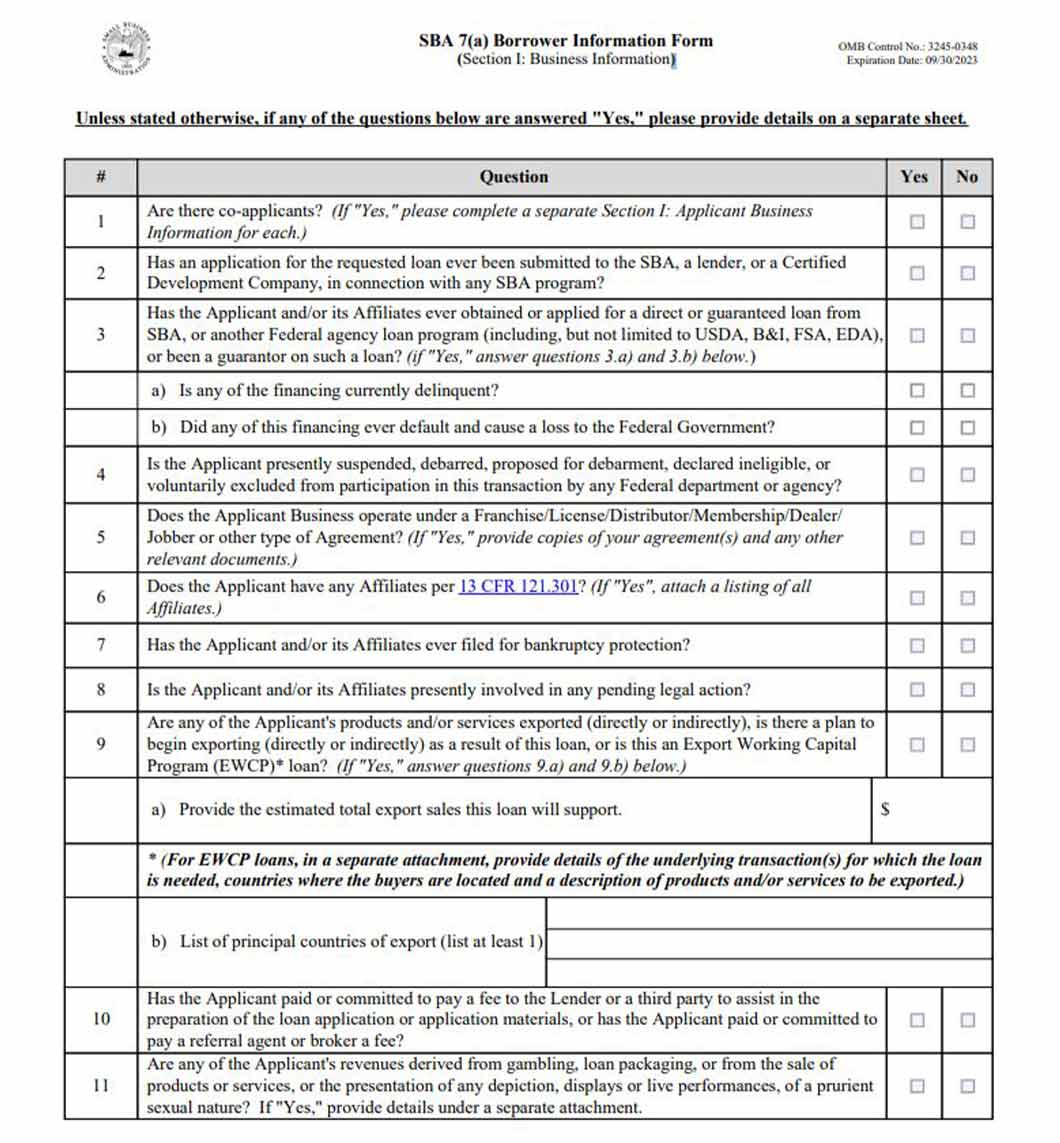

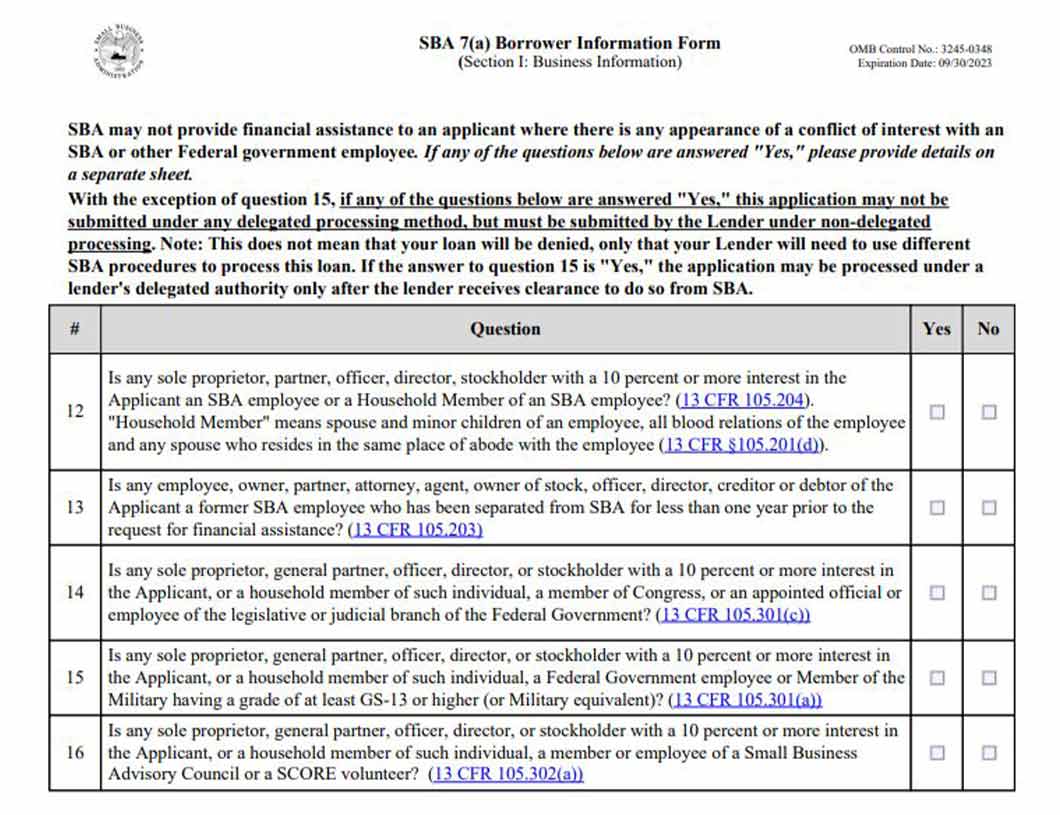

Then, the next set of questions will require you to mark either “yes” or “no.” These questions relate to the person applying for the SBA loan as well as the person also completing the SBA Form 1919. There are also questions to ensure there are no conflicts of interest between anyone in your company, the SBA or another government agency.

Once step 1 is complete, an authorized applicant has to sign and date the form.

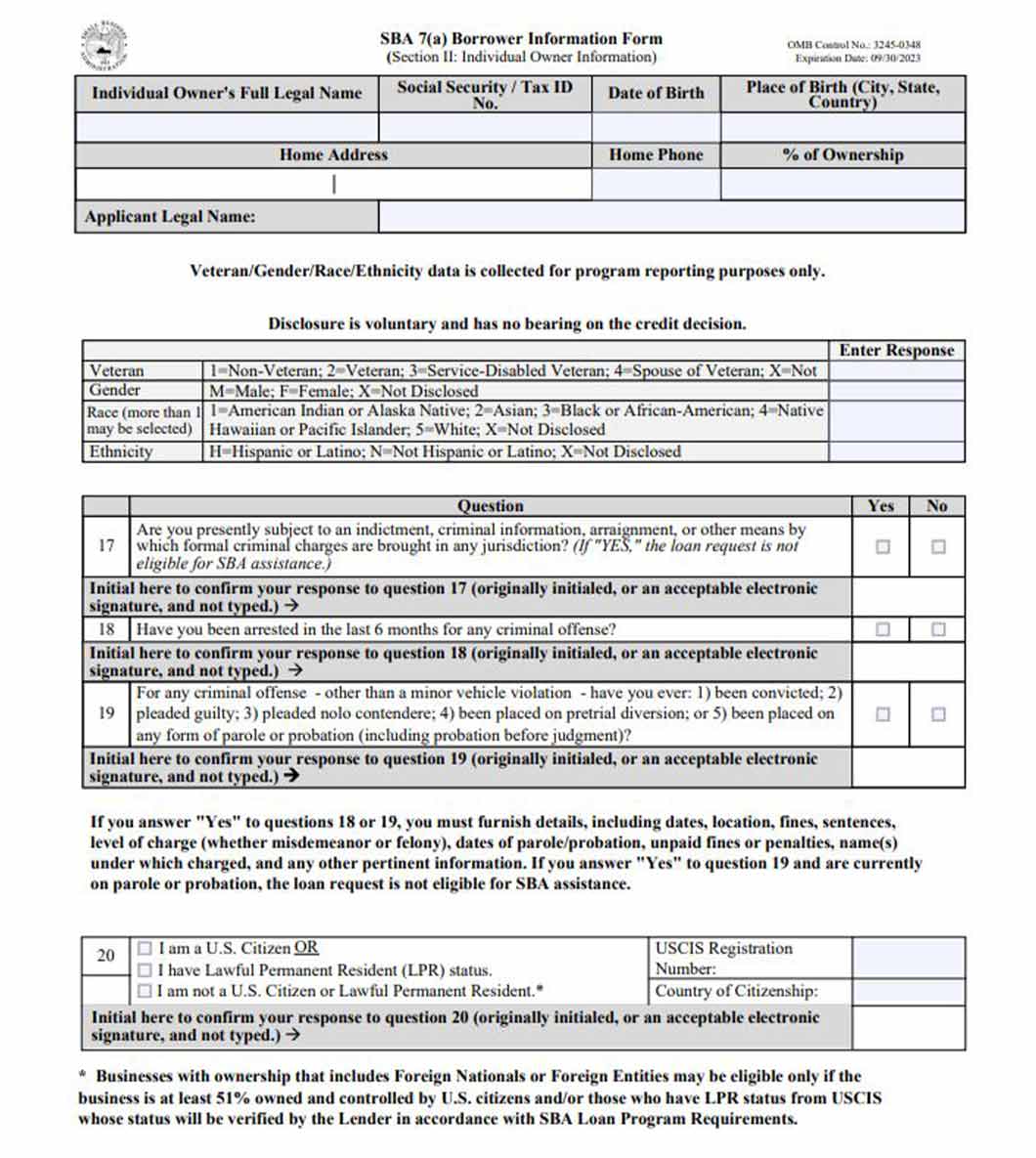

Step 2: Supply Individual Owner Details

Moving on to section 2, information such as the applicant’s Social Security number, date of birth, place of birth, home address and percentage of ownership in the business is required. This is also the place to indicate military veteran status and disclose gender, ethnicity and race.

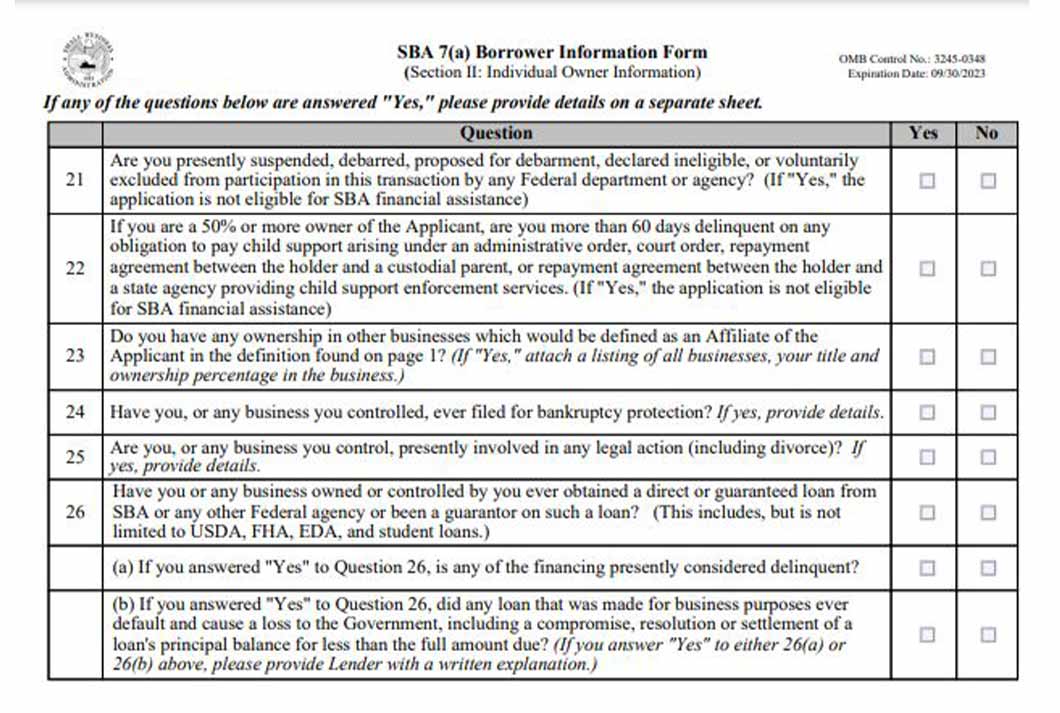

There are then several questions requiring “yes” or “no” responses. These include whether you’ve ever filed for bankruptcy protection or if you’re facing pending legal actions (including divorce proceedings, child-support payments, etc.). You’ll also be asked about past government financing, including veteran or student loans, disaster loans and Federal Housing Administration home loans. Naturally, there are also questions on whether you defaulted on any of these.

Step 3: Provide Entity Owner Information

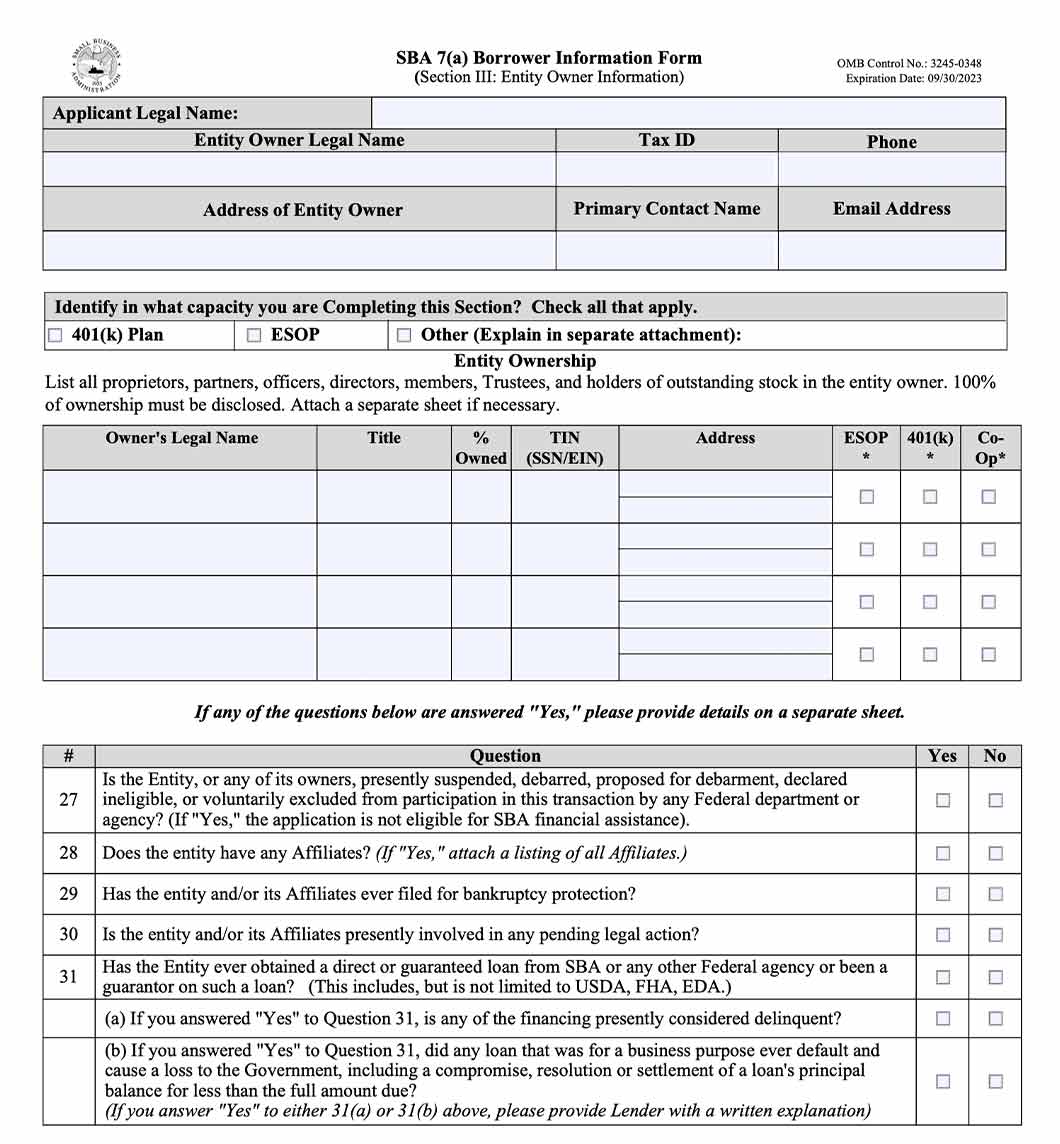

In this section, you’ll need to provide information for each entity that owns an equity interest. This will include the entity owner’s legal name, tax identification and contact details. All proprietors, partners, officers, directors, etc., must be listed here along with their specific details. You’ll also need to complete a few yes or no questions about the entity, such as whether the entity has any affiliates, among others.

Ready to Tackle the SBA Form 1919?

You should now have a better idea of who needs to fill out the SBA Form 1919 and how to go about doing that. Remember, the 3 main steps to completing this form are:

- Provide business information

- Supply individual owner details

- Provide entity owner information

Keep in mind that before applying for an SBA 7(a) loan, you should calculate how much funding you’ll need and what the total cost of borrowing is likely to be. This includes an estimated interest rate and loan repayment terms.

The SBA produces weekly lending reports, which should give you an idea of average loan application success rates. These are certainly worth looking at if you’re interested in conducting research before applying for financing and completing the SBA 1919 application form.