The pandemic altered how, where, and when we work and shop. As a result, small business owners adjusted on the fly.

Now, it’s time to decide how to move forward. Use this blueprint to define your next steps.

Create a Framework to Assess Your Small Business

After global disruption, you can’t click a switch and magically jump back to the way things were in 2019. Doing so leaves your business vulnerable.

There are many important lessons learned from COVID-19. Indeed, learning from a crisis is critical to future resilience.

The key areas every company should assess and adjust include:

- Customers

- Cash flow

- Workforce

- Technology

- Workplace

Collect data to see what worked and didn’t work, the impact your actions had and decide whether to keep, update or roll back your pandemic measures.

Start by pulling out your mission statement, value proposition and business goals.

For each category, compare your actions and outcomes to your objectives. Doing so helps you eliminate any ideas that contradict your purpose and focus on those that support it.

Customers: Behavior and Expectations

Consumers changed their shopping habits, brands and payment methods during the pandemic.

According to the Qualtrics Experience Management (XM) Institute report “2021 Global Consumer Trends,” 16% of U.S. consumers “shopped online for the first time in 2020.”

Post-pandemic, the top 3 activities they’re most likely to continue to include contacting customer service online, streaming a movie or television show and online shopping.

The financial services company FIS estimates that digital wallets will “account for 51.7% of ecommerce payment volumes” and the digital market share for buy now, pay later (BNPL) to double by 2024.

To learn how your customers’ changed and what they expect post-pandemic, collect data from:

- Point-of-sale (POS) systems

- Customer satisfaction scores

- Website analytics

- Social media reports

- Email marketing data

- Customer service complaints

- Usage data from loyalty programs

- Customer surveys and polls

- Customer relationship management (CRM) programs

Develop Insights From Customer Data

Think about specific actions you took to accommodate your clients during COVID-19, such as offering curbside delivery or virtual consultations.

Do your customers expect these options to be available post-pandemic? If the data isn’t clear, conduct a poll or survey to gauge their expectations and behavior.

Depending on your industry and business model, consider the following questions:

- Did demand increase or decrease for specific products or services? If so, why?

- What are your customers’ communication preferences?

- Is there still demand for buy online, pickup in-store (BOPIS) and curbside delivery?

- Do your customers want contactless, mobile, or POS financing options?

- What digital channels does your audience use?

- Do improved safety and hygiene protocols improve their experience?

Cash Flow: Financial Health and Sustainability

Many small businesses took a financial hit in 2020. Along with being shut down, you likely spent money on new safety measures and tech tools.

Some companies also adjusted their business hours, shifted to remote work, increased prices or added service fees.

Assess the costs and benefits of your efforts and decide if your actions are sustainable in the future.

Start with a cost-benefit analysis (CBA). A CBA shows you if the benefits of a change outweigh the expenses.

Create a list of any costs associated with the change. If you reduced your store hours, the expenses might reflect lost revenue.

Likewise, accepting different payment methods or using new software for virtual meetings comes with monthly subscription fees.

Next, calculate potential tangible and intangible benefits, including increased online sales or customer satisfaction improvements.

Follow this method for each business change because of COVID-19 to see how it pans out financially.

Decide Which Changes Make Fiscal Sense

Once you understand your total costs and benefits, it’s time to look to the future.

If a change ends up costing you more money without noticeable benefits, you may be tempted to switch back to your old method.

For instance, perhaps you added a new ecommerce channel, but the sales weren’t enough to cover the costs.

In this case, you could look at customer and competitor data to see if there’s demand. If so, the failure could be in your approach to marketing and channel awareness.

Consider extending the change for 6 months and strengthening your strategy to make it profitable.

Workforce: Status, Support and Skills

You may be ready to return to normal but are your employees?

CBS News reports nearly 3 million U.S. women left the workforce over the past year. Many still face challenges.

In addition, a U.S. Gallup poll found 23% of workers “want to maintain their remote work arrangement.”

Supportive and flexible work options may improve the employee experience and reduce turnover while attracting new talent.

Evaluate Employee Experiences and Expectations

Work with your human resources (HR) and information technology (IT) teams to identify how changes to your business affected your staff.

Usage data can show which technologies and benefits your employees use the most. It also pinpoints which team members need extra support.

Keep these factors in mind when reviewing workforce changes:

- Support and benefits: Providing enhanced sick leave, scheduling flexibility and telehealth benefits can help you retain and attract employees.

- Skills: Moving from a role-based to a skill-based workforce allows employees to get work done to the best of their ability without constraining them to a job title.

- Training: 64% of respondents to a PwC U.S. Remote Work survey say they’re investing in training supervisors on how to “manage a virtual workforce.”

- Resources: Providing the right tech tools and knowledge databases empowers employees to be the best at their job.

Technology: Pull Back or Move Forward

Companies without a solid online presence had to pivot quickly to digital tools.

While it was necessary then, you may wonder if it’s worth the monthly subscription cost now. Should you stick with the same platforms, or do you need the service at all?

Part of this decision depends on how you work and communicate with customers, vendors and employees.

According to PwC, 72% of U.S. executives plan new investments in “tools for virtual collaboration,” and 70% will invest in “IT infrastructure to secure virtual connectivity.”

If you’re back to in-person work, your team may not need an online attendance system or time tracking tool.

Yet, employees may appreciate the features of digital collaboration tools and want to incorporate them into their in-office workflow.

Examine Your Tech Stack

First, take inventory of your digital applications (software type, provider and cost) and categorize them according to department use.

Some tools, like a password manager, may be used company-wide.

You’ll have a hefty list that includes video conferencing, cybersecurity, accounting and payroll, collaboration, project management, and more.

Follow these steps to decide which tools to keep:

- Identify all tools added since the start of the pandemic

- Ask staff to label the software category in order of priority

- Survey employees about their likes and dislikes for each application

- Work with IT to find tools with overlapping features

- Complete a cost-benefit analysis on the software you want to keep

- Look for options for those you want to change, such as QuickBooks alternatives

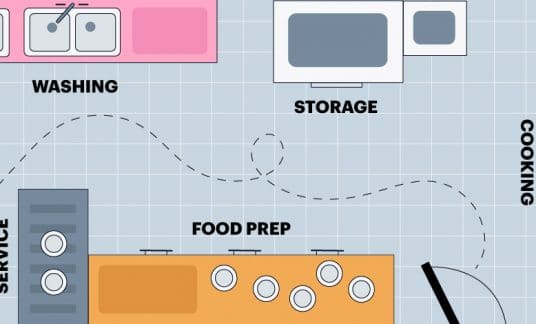

Workplace: Size and Updates

What is the future of office space? Can you reduce your physical footprint without sacrificing your business culture?

Part of this depends on what physical space fits your operating model and business needs.

According to PwC, 57% of U.S. executives plan to upgrade “conference rooms with enhanced virtual connectivity,” and 48% want to improve “communal space in the office.”

As with other parts of the framework, a cost-benefit analysis is essential, as is surveying those affected by the decision.

Ultimately, if your business model and virtual workspaces support downsizing, go for it. But have a plan for analyzing the impact.

Balance Virtual and Physical Spaces

Assess changes you’ve made during the pandemic and how your workplace could adapt to support them.

Consider various challenges and questions, such as:

- Where and how does your team collaborate and innovate?

- Do your teams face geographic barriers?

- Can on-site and remote staff connect effectively?

- Could a smaller, better-equipped space serve your team better?

Lessons Learned: Creating a Better, More-Resilient Future

Implementing organizational change after a year of disruption is difficult. But it’s worth your time to dig into the data showing the risks and opportunities.

Build on your pandemic changes and turn these trying moments into insights that drive sustainable success.