There are two types of leases for fixed assets: capital and operating. With one method, the lessee takes ownership of the asset and the responsibilities that come with it. With the other, the lessor retains ownership. Both methods can have an impact on a company’s income statement and the amount of taxes owed.

Which type of lease is best for your business? Let’s examine the pros and cons of each type.

Recent Changes to Accounting Standards for Leases

On Feb. 25, 2016, the Financial Accounting Standards Board (FASB) issued new regulations for the reporting of capital and operating leases. These new guidelines took effect for public companies beginning Dec. 15, 2018, and will become effective for all other businesses using Generally Accepted Accounting Principles (GAAP) after Dec. 15, 2019.

This means that small business owners need to pay attention to the new standards and understand the effects these changes will have on their financial statements and their ability to obtain financing. The following discussion explains the differences between capital and operating leases and considers the effects of the new accounting regulations.

What Is a Capital Lease?

With a capital lease, the lessee assumes all the risks and benefits of asset ownership. The legal owner is still the lessor during the term of the contract.

A lease that meets any one of the following 4 conditions qualifies as a capital lease:

- Ownership of the asset transfers to the lessee at the end of the contract, usually at a bargain price.

- The lessee has the option to purchase the asset at a discounted price at the end of the agreement.

- The lease has a term greater than the “major part” of the useful life of the asset.

- The present value of the lease payment is “substantially equal” to the asset’s fair market value.

Capital leases are used to lease assets with long-term useful lives, usually 5 years or longer.

With a capital lease, the lessee is responsible for all maintenance and repairs.

The liability for the lease is recorded on the company’s balance sheet as the market value of the leased asset. Lease payments are recorded on the income statement as a combination of principal and interest expenses.

A capital lease is treated as debt and entered on the balance sheet by recording the asset value and the liability of the lease. Lease payments include both principal and interest expenses.

Advantages of a Capital Lease

A capital lease is best for businesses that ultimately want to own the leased asset. A capital lease benefits the lessee by being able to use depreciation and interest deductions to offset income and have an attractive purchase price at the end of the agreement.

Capital leases are suitable for equipment with long useful lives such as dies, tools and machines, but not like computer equipment and other electronics, which can quickly become obsolete in just a few years.

The end-of-term bargain purchase price gives the lessee alternatives for monthly payments. A $1 buyout may be desirable for businesses that can make higher monthly payments and don’t want to come up with a large balloon payment at the end of the lease agreement.

On the other hand, a business that prefers to make lower monthly payments may opt for a 10% buyout option, even if it requires a higher payment at the end. For lessees that aren’t entirely certain they want to purchase the asset, the 10% alternative gives them the option to walk away from the deal and not have to make a large balloon payment at the end.

A lessee can claim depreciation deductions on the income statement, reducing taxable income. Interest expense deductions also reduce taxable income.

What Is an Example of a Capital Lease?

Suppose you are leasing a forklift that costs $42,000 and will be used for moving materials in your warehouse. The asset has a useful life of 8 years. The lease requires payments of $600/month for 6 years.

With 6 years of payments, the lease has terms that are greater than the “major portion” of the useful life of the asset: 75% (6-year term of lease divided by 8 years of useful life).

In addition, the present value of $600/month payments at 4% over 6 years is $38,350, which is 91% of the market value of the forklift ($38,350 divided by $42,000). The present value for this lease could be considered “substantially equal” to the market value of the asset.

Therefore, after satisfying two conditions for a capital lease, this lease for a forklift would be considered as such.

What Is an Operating Lease?

With an operating lease, the lessee doesn’t intend to purchase the asset when the contract ends. The lessor owns the leased asset, and the lessee rents the asset for typically 1 to 5 years. The life of the lease is substantially less than the useful life of the asset.

Operating leases are like renting and do not transfer ownership of the asset at the end of the contract. Unlike a capital lease, the lessee does not have an option to purchase the asset at the end of the agreement at a bargain price. The asset could only be purchased at its fair market value.

Operating leases are better suited for situations where the assets are only needed for a short time or when the item may be quickly outdated due to changing technologies.

Operating leases have lower monthly payments because you’re not financing the total cost of the asset.

Advantages of an Operating Lease

Operating leases are popular for the following reasons:

- Operating leases are used to finance equipment that is only needed for a short term or has a history of rapid technological changes and becoming obsolete.

- Businesses with operating leases don’t want to keep the asset over the long term.

- Lessees with operating leases have the flexibility to swap for newer equipment more often to keep up with the latest changes.

- Operating leases have lower monthly payments since the lessee isn’t paying for the total cost of the asset.

- Companies have more flexibility to replace and update their equipment with less risk of ending up with obsolete assets.

- Lease payments are treated as expenses and are deductions on the income statement.

What Is an Example of an Operating Lease?

An example of an operating lease would be the renting of office space. Suppose a business leased 2,000 square feet of space for 3 years in a building that had a total of 50,000 square feet available and a useful life of 20 years.

The lessee is only renting a small portion of the building for a period substantially less than the useful life of the asset. Also, the lease does not contain a purchase option at a bargain price.

This is an operating lease and will be recorded on the company’s balance sheet.

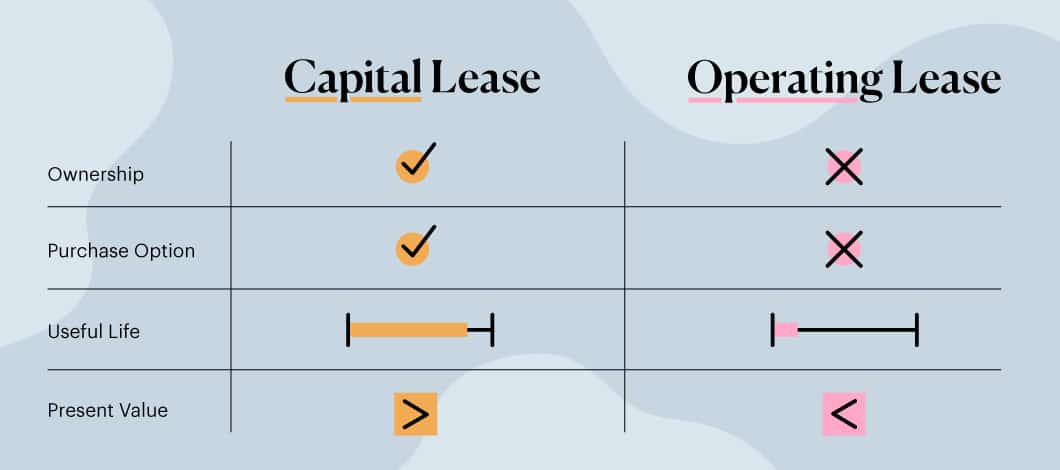

Differences Between a Capital Lease and an Operating Lease

The differences between the two types of leases are as follows:

- Ownership – If you own the asset at the end of the contract, it’s a capital lease. With an operating lease, the lessee does not take possession of the asset.

- Purchase option – Is there an option to purchase? If you can buy the leased items at the end of the term for less than the current market value of the item, it’s a capital lease. If there’s no purchase option, it’s an operating lease.

- Useful life – If the term of the lease lasts for the major part of the asset’s useful life, then it’s a capital lease. If it’s significantly less than the useful life, it’s an operating lease.

- Present value- If the present value of the lease payments is substantially less than the asset’s fair market value, it’s an operating lease. If the present value is considerably more than the fair market value, it’s a capital lease.

Effects of FASB Accounting Changes

Previous to the recent accounting changes, capital leases were recorded on the lessee’s balance sheet as the initial value of the asset and the present value of the total lease payments. However, operating leases were not recorded on the company’s balance sheet but were, instead, included in the footnotes to the financial statements. This was known as ‘off-balance-sheet financing.’

Now, according to FASB rule ASC842, operating leases with terms of 1 year or longer must be recorded on the lessee’s balance sheet. This change will have the effect of adding more debt to the company’s liabilities.

The increase in reported debt could affect various debt financial ratios and possibly impact the company’s ability to qualify for more business loan options.

A small business owner who is considering a lease should discuss the situation with a professional accountant to determine the impact on the company’s financial condition.

Which Type of Lease Is Better?

As with many decisions in business, the answer is, “It depends.”

A capital lease lets you use an asset for an extended period, and then gives you the option to buy the item for less than its current market value at a bargain price. This feature is appealing because you get to try it out before committing to buy. If you aren’t satisfied with the leased asset, you can walk away at the end of the lease and avoid the hassle of selling the asset if you owned it. If you are pleased with the asset, you can exercise your right to purchase at a bargain price.

But under a capital lease, you have the risks of ownership. If the asset needs repairs, you have to pay for those repairs.

With an operating lease, you are renting the asset; you don’t own it and don’t have a purchase option for a bargain price. If the item has maintenance problems, it is the lessor’s responsibility to make the repairs.

A capital lease is recorded on the balance sheet as a liability similar to a loan, and the interest portion of the payments is tax-deductible. In most cases, you can also take deductions for the annual depreciation of the leased item, thereby saving money on your taxes.

Payments for an operating lease, on the other hand, can be written off as operating expenses.

Bottom line: Capital leases are more suitable for leasing assets for the long-term, and you expect to exercise the purchase option. Operating leases make more sense for leasing items that are subject to rapidly changing technologies, making them more suitable for short-term commitments.