Did you know that just 2 years after launch, nearly one-third of companies in the private sector have failed?

It’s no surprise then that some people decide to become entrepreneurs by purchasing a business with an already established brand, presence and customer base.

Once you’ve decided that’s the way to go, how do you pull the trigger?

Whether you want to know how to buy your first business (or second or third), here’s what you need to know. We’ll walk you through the steps to go about buying an existing business you can continue to build as well as cover the pros and cons.

1. Know the ‘Whys’ and ‘Whats’ Behind Your Purchase

One of the most common pieces of advice when trying to decide what to do in your career is to chase your passions. While not always feasible, buying into a business that matches your experiences and interests could be a great idea.

For example, if you’ve been working as a sous chef for years but have always had aspirations of running a cafe of your own, buying an existing business could be a great jump-start to the next chapter in your career.

A desire to run your own business combined with industry knowledge could be a great starting point for your entrepreneurial journey. Desire and industry expertise aren’t the only factors that should go into your evaluation, though.

Be sure to also consider the following:

Location

Is your dream business right down the street, an hour away or a 4-hour plane ride from where you call home? Or is it strictly an ecommerce store?

The location of your business doesn’t just impact who and how people will find you. It will matter to you personally in your everyday life.

Size

Give this one careful thought. What are you most comfortable with?

- Do you prefer a small business that’s quaint and likely to demand that you work in the business?

- Or are you seeking something larger that may allow you to focus solely on the big picture but which comes with more people to manage?

Not only will the sale prices greatly differ, but so could the level of stress depending on how you’re wired.

Lifestyle

Once you become a new owner, you’re going to spend a lot of time working to build your business. Get a sense of the types of hours you’re willing to sacrifice to drive a business forward. This can help you decide the kind of existing business you should look to purchase.

2. Find a Business to Buy

Years ago if you wanted to buy a business, you might look through newspaper ads or network with business owners in your community. While that’s still the case, today, the internet makes it easy for anyone to post a business for sale and buyers to find one to invest in.

Websites you can turn to include the following:

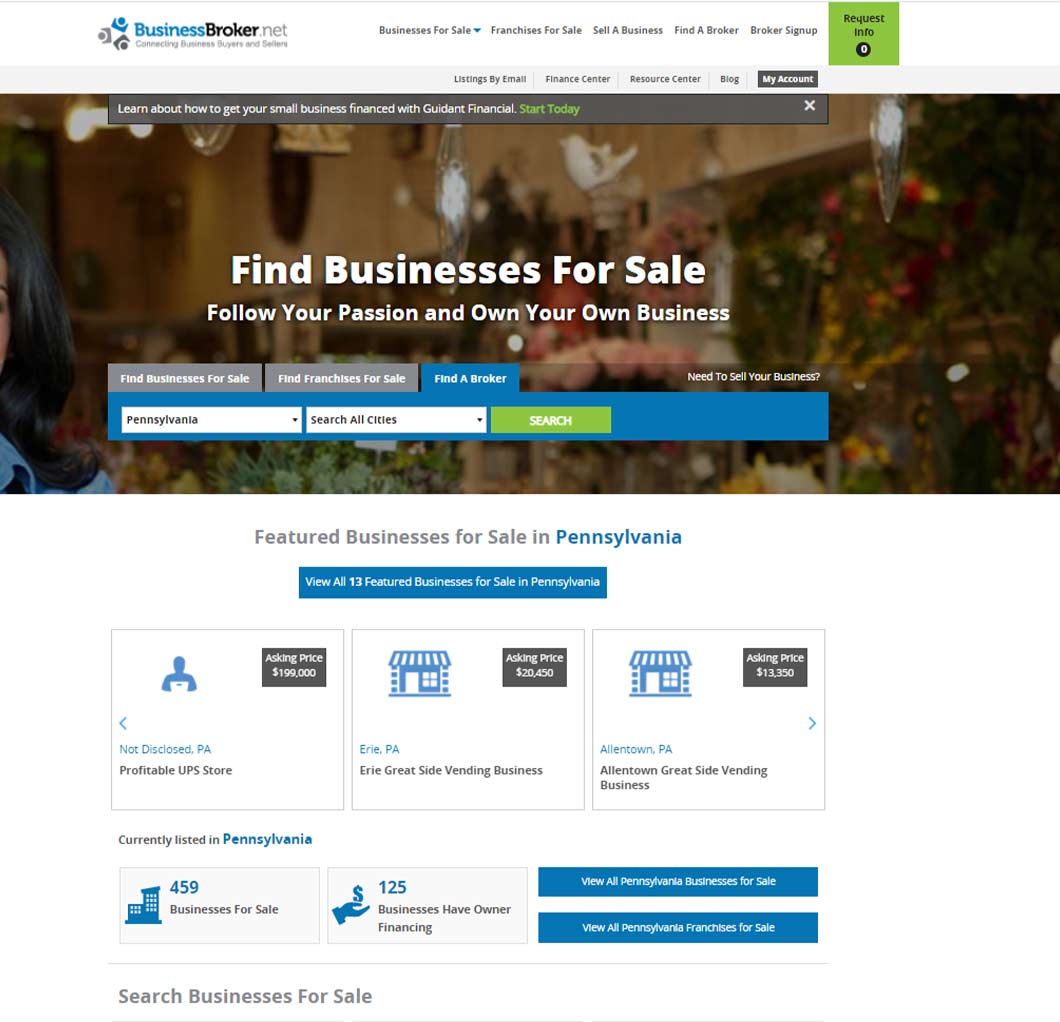

It also may be wise, depending on your background, to work with a business broker. If you’re involved in a local professional organization, see if any of your contacts can refer one. Alternately, you could find one near you (or browse business listings) by visiting a site like BusinessBroker.net.

While a broker most commonly works on behalf of the seller, plenty of brokers are available to work with commercial buyers. They’re able to help you determine the type of business you’d like to acquire, represent you in negotiations and handle any required paperwork.

Keep in mind, when working with a broker, you should always request a written statement that legally indicates they’re representing your side of the transaction in an effort to purchase an existing business.

3. Evaluate If the Business Meets Your Requirements

Knowing why you’d like to buy a business is one thing. Understanding the goals you have around the company once you’ve acquired it is another.

You’ll also need to know if your budget will allow the business purchase and if you’ll have enough funds to successfully run operations once you take over. You’ll need to estimate how much you’d want to change about the business, how it operates, what it provides and the type of employees you’d need to make the business profitable.

The biggest factor from a capital standpoint must be how much of a return you expect to see from your investment. No one wants to buy a business where they won’t benefit, so clearly making sure the numbers add up should be your primary concern once you’ve found a company that scratches your entrepreneurial itch.

Get the help of an accountant to assist with this. An accountant can thoroughly review the business’s financials and give you a proper sense as to whether or not the business will be able to meet or surpass the goals you have in mind.

Have your accountant review documents such as the following:

- Tax returns

- Balance sheets

- Sales records

- Cash-flow statements

- Accounts receivables

- Accounts payables

- Liabilities

- Debt disclosures

- Advertising costs

4. Consider the Time You’ll Need to Put In

Of course, budget isn’t the only resource you must account for. Your time is an asset that can’t be replenished. Where you spend it is where you should be driving the most value.

If you aren’t an expert in the industry you’re looking into but are passionate about it, you’ll need to spend time getting to learn the nuances that surround the market, the motivations of the players and how you can take advantage of any gaps.

It might behoove you to seek out business resources that could provide value to your new venture. Speak with a business advisor, such as a SCORE mentor, for instance. Or take relevant business courses, such as those offered through your local Small Business Development Center.

5. Investigate Why the Business Is for Sale

Oftentimes, a business is for sale for the simplest of reasons. It could be that the owner would like to retire or is simply looking for a new business opportunity themselves.

Unfortunately, there could also be underlying reasons why an owner is looking to sell. During your research phase, be on the lookout for these signs:

- Business debts

- Poor concept

- Inventory issues

- Bad location

- Outdated, costly equipment

- Negative brand reputation

- No market for the product or service

- Competition has far surpassed the business

Another great way to uncover some of the reasons a business may be for sale is by talking with neighboring businesses and residents who’ve likely built a rapport with the seller. Getting an honest opinion from people without any stake in the potential sale can provide a good perspective.

Once you’ve done your homework, building a relationship with the seller is perhaps the best way to understand all of their motivations, reasons or even needs to sell.

6. Gather and Analyze All the Details of the Purchase

Doing your due diligence is crucial when you’re buying an established business. Collect as much information about the business up for sale to decide whether it’s the right purchase for you. While you may be more than perfectly capable of tracking down, arranging and analyzing all the data points, this is a major business and life decision.

In addition to an accountant, consider working with a lawyer to guarantee nothing is lost during this vital process. Another benefit to working with a legal professional is that a seller will likely request you sign a confidentiality agreement or nondisclosure agreement, so you can have your lawyer review that document for you.

Here are several documents and factors you’ll need to consider when you’re considering buying a small business that’s already up and running:

Letter of Intent

Once you’ve agreed on a price point, the seller will likely issue a letter of intent. This indicates that the seller is indeed serious about selling the business and you’re free to proceed with your due diligence.

This letter will include all of the business assets and liabilities to be included in the transaction, the price proposal and the terms and conditions of the sale.

Licenses and Permits

Ensuring a business you’re thinking of purchasing has all the necessary licenses and permits to operate is essential. These licenses and permits allow the state and local governments to properly tax the business as well as make sure the business is legally capable of operating within a specific industry.

Not having proper licenses and permits can result in significant fines and/or legal action taken against the business.

Company Documents

If the business is registered as an LLC, the owner will need to prove that founding papers have been filed with the state. Similarly, a corporation will need to show articles of incorporation.

The business may also hold a certificate of good standing (also known as a certificate of status, a certificate of existence, or a certificate of fact), which would indicate it’s an entity that exists in a specific jurisdiction, has paid its appropriate dues and is authorized to conduct business in the state. A certificate of good standing provides evidence that a company has submitted all required reports and paid all required fees to the state.

Organizational Chart

Because this is a business that has been in operation for some time, the employees who you will be responsible for will presumably already have an operational approach to their work.

Not only do you want to get to know your employees as people, but you’ll also want to know company hierarchy, salary information, benefits, accrued vacation time and more.

Laws and Regulations

Zoning is the legislative process for dividing land into sections for different uses, specifically residential and commercial. These ordinances regulate the use of land and structures built upon it and are established to protect the health, safety and general wellbeing of the people living in or near a particular zone.

For business purposes, office buildings, shopping centers, bars, hotels, vacant land and certain types of warehouses and apartments can be zoned as commercial.

Parking also can affect the type of commercial zoning that is permitted (each municipality will differ, but this has to do with the number of parking spaces available for residents compared to visitors).

Additionally, there can also be rules regarding the proximity of certain types of businesses to others. Bars, for example, aren’t allowed to operate within a certain distance of existing schools or churches. Since zoning laws are typically controlled at the local level, check with your local city planning office to learn more about the zoning laws in your area and to make sure your new business is not at risk of being fined.

You’ll also want to make sure the company is complying with rules set in place by the Environmental Protection Agency and that it hasn’t been willfully or negligently harming the environment.

Contracts

Be sure to ask about specific contracts the business may have with current clients. Regardless of whether these arrangements are beneficial or detrimental to the business, these are details you will absolutely want to know before your negotiations.

Also review contracts and leases specific to the building you’re acquiring, any equipment that will be included in the deal and any vendor agreements that are in place.

Asset Status

Given the amount of upfront capital you’ll be using to purchase the business, you’ll want to make sure that each asset you’re acquiring is as valuable as it can possibly be.

The four largest assets, by cost, that you’ll want to be critical of are these:

- Inventory

- Equipment

- Furniture

- Building

If the assets you’re acquiring don’t match your vision of the business, you could sell these items after your purchase. As you review the quality and condition of these supplies, ask yourself these questions.

- How sellable is this?

- What is this worth on the market?

- How quickly has this sold in the past?

- What’s it’s original selling price vs. the price in its current condition?

- Does it need repair?

- How useful is this for the company?

- How useful could this be to a competitor?

- Will this need upgrades?

Sales Agreement

A sales agreement will establish the final sale price along with everything you have agreed to purchase. Most commonly, this includes all customer data, tangible (inventory, equipment) and intangible (brand reputation, customer loyalty) assets and any intellectual property.

Before you sign the sales agreement, be sure to have your lawyer review it for outstanding details. With a process this involved, you’ll want to make sure that every T has been crossed and every I has been dotted.

7. Determine What the Business Is Worth

In both the letter of intent and the sales agreement, there will be language clearly indicating that both you and the seller have agreed on a fair price for the business. There are a few ways to conduct a business valuation to ensure a reasonable price can be reached for both parties (e.g., profit multiplier method, discounted cash flow method). If real estate is involved, the value of any commercial property must also be determined.

8. Get Funding to Buy the Business

With the final price agreed to, the time to put up your capital has arrived. There are a few ways you could pay the costs involved in buying a small business.

- Personal financing

- Seller financing

- Partnerships

- Business loans

- Angel investing and venture capital

Research each type of business funding carefully, and consider which type of arrangement would be best for you and the future of your business. Getting involved in a partnership, for example, could be advantageous but could also pose certain risks. You’ll want to make sure you get started on the right foot.

9. Finalize the Purchase

You’re almost finished! You’ve agreed on a price and found the best way for you to fund the purchase. In addition the documents already mentioned, here are final details you’ll need to take care of when you’re closing the deal:

- Bill of sale – This document will prove that the business has been sold, officially placing ownership of the company and all agreed-upon assets in your name.

- Purchase price – Once you’ve considered the final price of the company, including any standard, apportioned operating costs, such as inventory, rent, and other utilities, the final note will reflect the adjusted price.

- Vehicles – If you’re acquiring vehicles in your purchase, you’ll need to inform the Department of Motor Vehicles. Any documents that need to be completed must be finished at the time of sale.

- Copyrights, trademarks and patents – As you would for any lease or vehicle, you’ll need to make sure any necessary documentation and paperwork for these assets is completed and in your name by the time of the sale.

- Contractual agreements – Asking for a noncompete agreement is not only a good idea, it’s standard practice. This will protect you and your new business from potentially having to face the seller as a competitor within your industry. Additionally, if the seller has agreed or would like to stay on as an employee or consultant, you will need to file a consultation/employment agreement. Also, be sure any lease agreements are transferred over, or renegotiate terms.

- Tax authority notifications

Just as with many other pieces of this process, you’ll need to inform your local tax and/or financial authority about the sale. These laws prevent business owners from avoiding any taxes assessed to their company after a sale. - Asset acquisition statement

You’ll need to list all of the assets you’ve purchased and the price at which they were sold on IRS Form 8594.

Benefits of Buying an Existing Business

Inherited Profits and Cash Flow

If given the option between building something from nothing or continuing to build on an established business, chances are you’ll take the company that’s already off and running.

Sure, there’s a significant upfront cost to purchasing an existing business, but starting from the ground floor can be just as expensive. Having the luxury of a consistent cash flow isn’t something that should ever be overlooked.

Existing Customer Base and Reputation

Becoming known is perhaps one of the most overlooked factors in starting your own company. Establishing who you are and how you benefit your customer base takes time, effort and resources (both human and financial).

With a business acquisition, you have the ability to bypass the initial brand building period and use your hopefully good reputation to continue building your company.

Employees Who Understand the Business

Even when you’re ready to hit the ground running after you’ve finished purchasing a business, it’s going to take time for you to fully understand and identify with the business. Having experienced employees gives you the breathing room you’ll need to get in sync with the business.

While you’re ultimately responsible for their productivity, they have just as much incentive for passing on their insider knowledge. Use them to your advantage.

Set Procedures, Systems and Policies

Knowing what to do in any scenario is all about practice. By taking over an established business, you’re inheriting all of the hard work and due diligence of the previous owner. While you’ll need to review the established systems and procedures independently, the groundwork has already been laid out for you.

If you’re looking for ways to improve these policies, make your employees aware that you’re open to suggestions on how operations and guidelines can be improved to benefit the business.

Established Intellectual Property

Holding copyrights and patents to specific products and processes can separate your business from the competition. Sometimes getting access to these intellectual properties is worth the cost of buying the business in the first place.

Take inventory of these assets and get the most value as you possibly can.

Downsides to Buying an Existing Business

Higher Upfront Costs

When you purchase an established company, the majority of your costs will be steered directly into buying out the interests of the current owner(s). While you may not have to deal with the costs of establishing a brand or furnishing your company, you’ll have to pay a premium for the hard work and intellectual property the seller has produced.

Aside from the tangible assets you’ll be acquiring, you’re also be receiving the following:

- Proven concept and/or products

- Tried and tested processes and policies

- Established customer base/data list

- Assets, equipment, copyrights and other intellectual properties

Learning Curve

Even if you’re a seasoned expert in your new company’s industry, there will be some growing pains. Naturally, you’ll need time to get up to speed on the overall state of the business’s finances, how your employees have been operating under the previous leadership and what obstacles there may be.

Unknown Risks

Regardless of how long you spend doing your research or asking questions, there will always be some kind of uncertainty in buying an existing business. Whether it’s a physical problem with your office that an inspector missed or an application method that wasn’t so proprietary after all, things are bound to be overlooked or oversold.

While it can be a challenge, do your homework and have an extra set of eyes with you every step of the way. By doubling down on your examination, you’ll limit your chances of being hit by a major oversight.

Knowing the positives and negatives of buying an existing business can help you determine whether purchasing an existing business is the right move for you.

Is Buying a Small Business Right for You?

Buying an existing business can be a long, potentially exhausting process, but one that can lead to rewarding results.

While it can be overwhelming at times, it’s worth the effort when you read positive reviews from your customers, see smiling and dedicated employees in your offices and get to associate your name with a business you’re proud of.