An SBA loan, by definition, is a type of financing offered by lenders and partially guaranteed by the Small Business Administration (SBA). SBA loans can take a while to get, but they’re among the most accessible and affordable forms of financing for small to midsize businesses.

How Do SBA Loans Work?

It’s a common misconception that the SBA directly provides loans and financing. What the SBA provides is a guaranty to preferred lenders (including banks, community development organizations, credit unions and alternative online lenders) who issue loans in accordance with the SBA’s requirements.

In doing so, the SBA reduces the risk for lenders working with small business owners, making it much easier for entrepreneurs to obtain affordable financing.

Related: Getting SBA Loans for Bad Credit: Here Are Tips and Alternatives

What Is an SBA Loan Guaranty?

An SBA loan guaranty serves as federally funded security for small business loans offered by partner lenders. This means if a borrower cannot repay a loan, the SBA will step in and provide the capital to pay the lender a portion of the total loan amount.

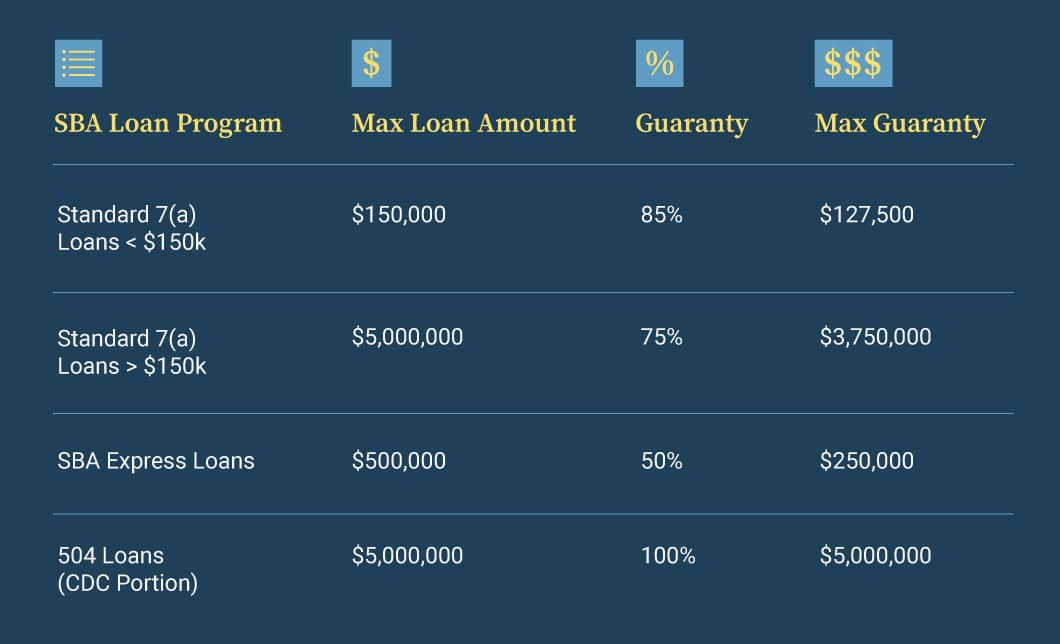

The SBA guarantees up to a certain percentage of each loan. The percentage of the guaranty varies depending on the loan type and amount. For example, the SBA will guarantee 50% of SBA Express loans and 75% or 85% of SBA 7(a) loans, depending on the loan amount.

SBA Loans vs. Traditional Business Loans

Conventional business loans don’t benefit from an SBA guaranty, so they’re usually more difficult to qualify for than SBA loan programs. Additionally, loan amounts are typically lower than what is available through SBA lending (meaning less financing available to bolster your business).

Discover Your Best Business Loan Options

Pros and Cons of SBA Loans

Pros:

- Lower down-payment requirements

- Annual percentage rate (APR) limits

- Generous repayment terms (10-plus years)

- Financing for 75% to 90% of project costs

- Counseling and business education provided by the SBA

Cons:

- Lien on personal assets

- Liens can negatively impact liquidity

- Applicants can only apply through SBA-preferred lenders

If you have personal assets to secure the SBA loan — meaning something such as home equity, personal vehicles or any other asset of value — then you’ll be required to put a lien on these assets to qualify for an SBA loan. You need to provide a legal filing that permits the lender to recoup these assets if you default on the loan.

These liens prevent you from selling the underlying assets or transferring ownership until the loan has been repaid and the liens have been released.

Types of SBA Loans

There are several kinds of SBA business loans you can choose from depending on your needs. You can apply for SBA loan programs through preferred partner lenders. Types of SBA loans include:

- SBA 7(a) loans: Up to $5 million available with up to 25-year terms for real estate or 10 years for working capital or fixed assets

- SBA Express loans: Up to $500,000 in funding with 50% SBA guaranty and 36-hour SBA turnaround time and faster release of funds

- SBA CAPlines: Credit lines, including for working capital, seasonal business needs, building, construction and renovation and contract fulfillment

- CDC/504 loans: Loans generally up to $5 million with 10-, 20- or 25-year terms and use of proceeds for expansion or modernization

- SBA microloans: Up to $50,000 in funding

According to the Federal Reserve Banks’ most recent data, the average loan amount for SBA programs is $107,000.

-

SBA Disaster Assistance

The SBA provides low-interest loans to businesses recovering from a declared disaster. One such offering is the Economic Injury Disaster Loan (EIDL).

Qualifying applicants located in a declared disaster area can access up to $2 million in financial assistance. Loan proceeds can be used for working capital and regular operating expenses, such as rent, utilities, healthcare benefits and fixed debt payments.

The interest rate can’t exceed 4%, and loan terms can extend up to 30 years.

Keep in mind, this EIDL SBA program is not the same as the COVID EIDL, which stopped taking applications as of Jan. 1, 2022.

What Can an SBA Loan Be Used For?

SBA loans support a variety of business needs in virtually any industry. You can use funds to grow your business by expanding to new locations, modernize your company headquarters, upgrade technology and more.

Depending on the SBA loan type, you could use funds for the following:

| Loan Program | Use |

| 7 (a) Loans |

|

| 504 Loans | The purchase or improvement of:

|

| Microloans |

|

Related: SBA Loans – Apply

What Are the Characteristics of Successful SBA Loan Applicants?

SBA loans can’t be issued to prospective borrowers unless all the following minimum requirements are met:

- Business is physically located and operates in the U.S. or its territories

- Owner has invested equity in the business

- Business can’t qualify for funding by other means

- Business is a legal, for-profit enterprise

While the above requirements are fairly straightforward, applicants should be aware that the lending institutions you borrow from may make it more difficult to get approved.

Depending on the lender, you might find that you can’t apply with a FICO credit rating of less than 580. In other cases, the minimum credit score for applicants can be as high as 680.

Applicants should also be aware that even though the SBA guarantees a part of their loan, they will still be subjected to a lender’s underwriting process. In addition to personal credit checks, this will typically entail a formal review of a business plan, appraisal of collateral and background and credit checks for owners in the business.

Small Business Tip:

Want more answers to the questions, “What is an SBA 7(a) loan?” or “How can I apply for an SBA Express loan?” Check out our SBA loan page for more information.

Finding an SBA Loan That Works for You

Not all SBA loans are the same, nor are all SBA lenders. It’s crucial to do your homework before you apply for an SBA loan. Be sure to compare rates, terms and eligibility requirements.

To find an SBA lender that satisfies your company’s needs, use the official SBA Lender Match tool. SBA’s Lender Match system is a free online referral service that can set you up with an SBA-preferred lender whose requirements you’ll meet. You can also use a loan broker or online lending marketplace to assist with your loan search and help you determine what is the best SBA loan program for you.