A neobank is a digital-only banking service that operates completely via a website or mobile app (or both).

In many cases, small business owners have begun opting for this more streamlined, slimmed-down solution to their banking needs. While traditional banks still reign, this new type of financial institution is disrupting the industry.

Here’s everything you need to know about neobanks, including examples of popular ones.

Overview of Neobanking Services

A neobank is a modern banking service offered by emerging financial technology (fintech) companies. Neobanks are not to be confused with online-only banks with no physical branches, such as Ally. Though both are financial institutions that operate online, that’s where the similarities end.

While online-only banks operate under a more traditional framework, neobanks take a more unique and simplified approach to providing financial services to their customers.

In terms of neobanks vs. traditional banks, neobanks have the following features:

- Streamlined products, usually just checking and savings accounts

- More convenient and seamless digital experience

- More simple and straightforward policies

- More targeted financial services

Also referred to as “challenger banks” (for their evident ability to disrupt such a massive industry), neobanks are becoming increasingly popular the world over. According to Statista, 23% of bank customers worldwide held at least 1 neobank account in 2020 — up from just 17% in 2018.

If these trends continue, neobanks could become more and more valuable to individuals and small businesses alike.

How Do Neobanking Services Work?

The answer to the question of how these neo digital banks work depends on who we’re focusing on. For the end-user — be it an individual or small business owner — the process of opening a neobank account is incredibly simple:

- Download the app or log onto the bank’s website

- Sign up for an account, providing some basic identification information

- Deposit or transfer money into your account

From there, users can engage with their account dashboard to complete simple financial tasks and transactions with ease. While often not designed to be comprehensive, neobanks focus on enabling users to get things done quickly so they can get back to running their business.

On the backend, neobanks operate completely online — saving them a ton of money on personnel, equipment and property-related expenses. This allows them to lower or eliminate membership fees and offer more competitive rates.

While many neobanks operate completely independently of their traditional counterparts, some partner with big banks to offer certain financial services to their customers. Similarly, while neobanks aren’t subject to the same regulations banks are, they often partner with big banks to provide FDIC insurance to their customers.

-

How Do Neobanks Make Money?

As for how neobanks actually make money, these are the most common methods:

- Interchange fees, paid by merchants on consumer purchases

- Out-of-network ATM fees, paid by the consumer

- Venture capitalist investments

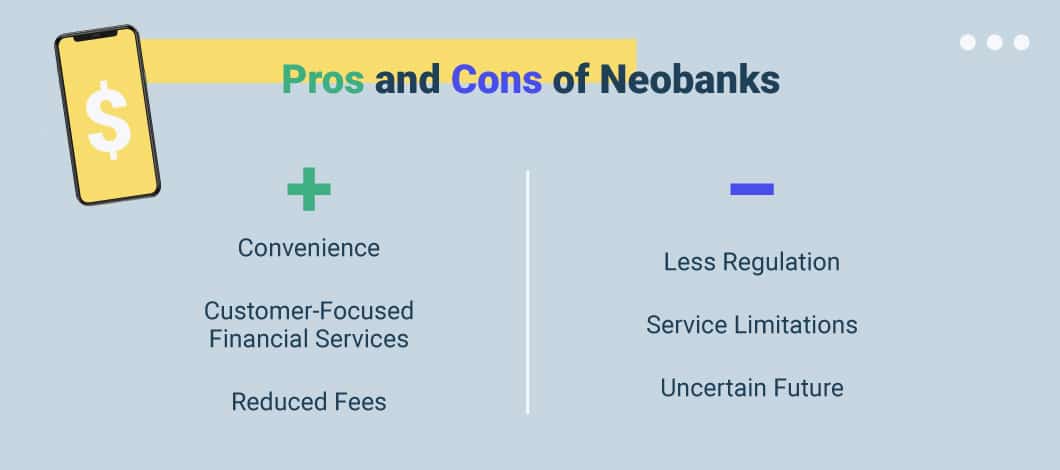

Pros and Cons of Using Neobanks

Let’s now take a look at some of the key benefits and drawbacks of using a neobank vs. traditional bank for business purposes.

Pro: Convenience

The best neobanks operate with a promise of convenience for the end-user.

Where traditional banks provide a plethora of financial services, extraneous online features and various other offers, neobanks focus on core banking functions only. From account registration to account management, neobanks make the process as simple as possible.

The digital nature of neobanks also ensures customers face minimal friction when using their bank of choice. With automation at the helm, owners will always be able to do what they came to do without the need to visit a local branch, wait in a queue or otherwise spend time away from their business.

Pro: Customer-Focused Financial Services

Instead of offering a broad set of financial products like conventional banks do, neobanks are typically focused on the basics (e.g., checking account, savings account, debit cards, transfers). They aim to meet the essential needs of their target customers as opposed to offering something for everyone.

Pro: Reduced Fees

Top neobanks typically offer their services at a minimal cost to the customer — if they require a service fee at all.

In addition, most neobanks offer more transparent terms, allowing customers to easily avoid financial penalties. In fact, brands such as Novo pledge to offer fee-free services for as long as the company stands.

With more transparent and user-friendly terms, neobanks give their customers more control over their overall financial situation.

Con: Less Regulation

Because neobanks are fintechs and not conventional banking institutions, they have less regulatory oversight. Additionally, while many do partner with banking institutions to offer FDIC insurance, the onus is on the customer to ensure this is the case.

Con: Service Limitations

The stripped-down nature of neobanks can be a drawback, in some cases. This is especially true for growing businesses, whose banking-related needs may become more complex over time.

While a neobank allows you to streamline basic processes (e.g., depositing checks, transferring balances, etc.), you’ll likely eventually need a more comprehensive banking solution to keep your business moving. That’s why many small business owners maintain relationships with conventional banks, which are able to provide business loans, a product neobanks do not offer.

The lack of physical branches can also deter entrepreneurs who place value on brick-and-mortar locations and in-person interactions with bank representatives.

The bigger picture here is that neobanks aren’t an all-in-one solution for your small business’s financial needs.

Con: Uncertain Future

Though the neobank industry is certainly picking up steam, there’s no telling what the future will hold.

For one thing, the legality of neobanks is still in question in many ways. Until the legal system comes to a consensus as to how to classify neobanks, there’s always a chance of the entire sector facing massive disruption.

Then, again, there’s the question of whether neobank providers can continue to offer value to individuals and businesses as time goes on. Perhaps it’s not a question of whether or not neobanks will become a mainstay, though, but rather which providers will survive in an already crowded industry.

Need more than basic banking services?

3 Best Neobank Examples for Small Businesses

While most neobanks can provide some level of value to small, growing businesses, only a few deliver services that are somewhat comparable to those offered at conventional banks. Here’s a look at 3 top neobanks out there today.

1. Novo

Novo is a pioneer of the neobank industry, aiming to develop an all-in-1 business banking solution to rival those offered by conventional banks.

Novo partners with both Stripe and Square to facilitate payments via credit or debit card. The service also integrates with Shopify, QuickBooks and other tools to facilitate transactions and keep data secure.

Novo also offers fee-free transactions, ATM reimbursement and transparent terms. One drawback of Novo, though, is the inability to deposit cash or send wires (neither domestic nor international), though ACH transfers are fee-free.

2. Brex

Like Novo, Brex aims to bring a cost-effective, all-in-one banking solution to small businesses. Brex’s main focus is on enabling teams to automate routine financial processes, such as:

- Accepting payments

- Scheduling and paying bills

- Tracking expenses and sales revenues

Brex also provides services to help individuals and businesses build their credit scores and keep their financial histories in good standing.

The Brex team has recently become FDIC insured, while also bringing a chief legal officer onto the executive board. This, along with Brex’s recent $12.3B valuation, make it a top choice for small businesses looking to get their banking done on the cheap.

3. Chime

Chime is another example of a neobank designed for business banking purposes.

In addition to credit and debit card transactions, Chime supports deposits via cash and direct deposit (processed via local third-party partners). Chime’s SpotMe service offers a form of overdraft protection in lieu of penalties.

Chime also offers relatively competitive interest rates of up to 0.50% annual percentage yield. Combined with fee-free services, it all adds up to a cost-friendly neobank option for your growing business.

While Chime is FDIC insured, the service’s security and fraud protection efforts have recently come into question. That said, Chime is a convenient option for small teams looking for a quick-and-easy banking solution.

Is a Neobank Right for Your Small Business?

All things considered, neobanks provide a convenient, user-friendly and cost-effective banking solution to small, growing businesses. But they probably won’t provide everything your growing business may need in terms of a robust financial solution. While a neobank can help you streamline your more basic, core financial processes, such as checking and savings accounts, you might not want to leave your conventional bank just yet.