Looking for the best unsecured business loans out there? We’ll explain what they are, their place in the market, how they work, the possible risks and rewards, what you need to know to qualify and how to get an unsecured loan.

What Is an Unsecured Business Loan?

An unsecured business loan is a commercial loan that—unlike secured business loans—doesn’t require collateral, such as business property, equipment or savings, to back the financing. Instead, an unsecured small business loan is issued on the basis of an applicant’s creditworthiness.

This type of financing is also referred to as a signature loan because your own guarantee, via your signature, is what secures the funding. This is unlike secured loans, which are backed by collateral—physical or liquid assets that will be used to pay off the loan in case of default.

Because an unsecured small business loan is often repaid in a shorter period of time, it’s popular for businesses that aren’t looking to carry debt for the long term.

How Do Unsecured Business Loans Work?

An unsecured business loan functions like many other forms of business funding: You receive cash up front, and it’s repaid over a period of time. With an unsecured business loan, business owners can cover small or immediate expenses without having to disrupt cash flow.

It can be a fast process to get unsecured business funding — sometimes it’s a matter of days to receive approval and the financing. You could even be approved for more funding with an unsecured loan.

The tradeoff is that lenders typically can charge higher interest rates, require personal guarantees and place liens against the business to compensate for the lack of collateral.

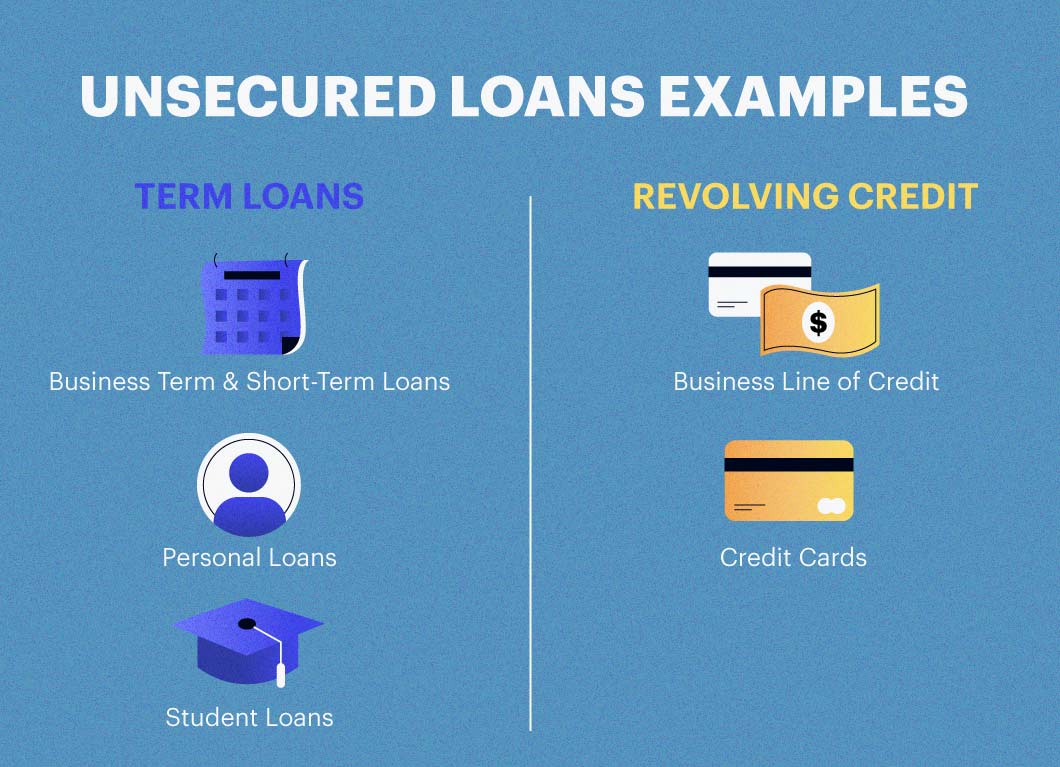

Types of Unsecured Loans and Financing

Let’s break down the different types of unsecured business loans and other finance options.

Term Business Loans

An unsecured business term loan is given to applicants as a lump sum and is repaid over a period of time. This type of large unsecured business loan is best used to pay off significant one-time purchases.

- Average term: 1-5 years

- Payment frequency: Monthly

Here’s what you should know if you want to apply to Fast Capital 360 for unsecured business loans with a long term:

- Interest rates start at 7%

- Funding amounts up to $250,000

- Can receive same-day funding

To qualify with Fast Capital 360, you should meet the following criteria:

- 600+ credit score

- Been in business for at least 1 year

- $200,000 in annual revenue

Short-Term Business Loans

Short-term loans offer a quick solution to temporary cash-flow issues.

- Average term: 3-18 months

- Repayment frequency: Weekly or daily

Here’s what you should know if you want to apply to Fast Capital 360 for an unsecured business short-term loan.

- Interest rates start at 10%

- Funding amounts up to $500,000

- Same-day funding available

To qualify with Fast Capital 360, you should meet the following criteria:

- 540+ credit score

- At least $75,000 in annual revenue

- 1+ years in business

Business Line of Credit

If you’re looking for short- or long-term unsecured business finance solutions, a business line of credit is a more flexible funding option ideal for multiple uses. This option functions more like a credit card than a loan. Rather than receiving a lump sum of money you use to finance all or part of an expense, you have access to a set amount of credit that you borrow as needed. You pay back (and pay interest on) only the money you’ve spent.

Here’s what you should know if you want to apply for an unsecured line of credit through Fast Capital 360.

- Rates start around 8%

- Funding amounts up to $250,000

- Can receive same-day funding

To qualify with Fast Capital 360, you should meet the following criteria:

- 560+ credit score

- Been in business for at least 1 year

- $200,000 in annual revenue

Merchant Cash Advances

While it’s a form of unsecured funding, a merchant cash advance (MCA) is an advance, not a loan. You receive an agreed-upon lump sum in return for a percentage of your business’s future revenue. If you’re facing an unexpected emergency situation and have trouble obtaining quick unsecured loans, an MCA could work for you.

Here’s what you should know if you want to apply to Fast Capital 360 for a merchant cash advance.

- Funding amounts up to $500,000

- Factor rates starting at 1.10

- Same-day funding available

To qualify with Fast Capital 360, you should meet the following criteria:

- 500+ credit score

- At least 4 months in business

- At least $100,000 in annual revenue

Personal Guarantees for Unsecured Funding

In many unsecured loan agreements, a personal guarantee is required. A personal guarantee enables you to act as a co-signer to your own unsecured small business loan. If your business defaults on the loan and is unable to repay the balance, you, personally, are responsible for paying back the financing. Let’s take a look at the agreements a borrower could enter to obtain unsecured financing.

Unlimited Personal Guarantees

An unlimited personal guarantee means you must cover 100% of the loan amount in the event of business failure or payment default.

In these situations, lenders could come after any (or all) of your personal physical or liquid assets. This includes your car, savings and retirement accounts, your spouse’s assets as well as the interest and variable cost of legal fees accrued by the lender to recoup the full cost of the loan.

Related: Secured Business Loans

Limited Personal Guarantees

These types of personal guarantees are commonly used when multiple business partners get an unsecured loan together. Limited personal guarantees set boundaries for each partner’s liability in the event of default.

However, depending on the structure of your limited personal guarantees, it’s possible that you or your partners could be responsible for the full balance of the unsecured loan if another partner is unable to pay.

Blanket Liens

A blanket lien is a legal guarantee that enables a lender to seize any business or personal assets in order to settle a debt. For example, if an unsecured business loan obligation isn’t met, a lender may call upon a lien that allows them to take assets such as company machinery, vehicles or personal savings.

As long as you feel comfortable with the payments your business is being asked to make, personal guarantees and blanket liens won’t be a problem. By doing your research and asking proper questions, an unsecured business loan can be a crucial financial tool for your business.

Advantages and Disadvantages of Unsecured Business Funding

Before entering into an unsecured loan agreement, you should look at both the positives and negatives.

| Unsecured Business Loans: Pros and Cons | |

| ✔ Faster funding | ✖ Higher financing rates |

| ✔ Eliminates the need for collateral | ✖ Personal guarantees |

| ✔ Larger funding amounts available | ✖ Shorter terms |

What Are the Benefits of an Unsecured Business Loan?

Speed of Funding

Typically, getting an unsecured business loan isn’t as involved or time-consuming as types of secured business funding. Because many fast unsecured business loans are offered through alternative funding companies, applications are expedited, only requiring certain pieces of information to get the funds in your account.

Asset Protection

Pursuing unsecured business financing eliminates the need to use any business or personal assets as collateral.

Larger Loans Possible

It’s possible for applicants to get larger loan amounts with an unsecured business loan. This is because secured business loans typically limit your loan amount up to the value of the collateral you’re offering on the financing. It’s more common, however, for secured lenders to approve you for a percentage of the collateral you’re pledging.

What Are the Drawbacks of an Unsecured Business Loan?

Higher Rates

Without collateral to back the financing, unsecured loans pose more of a risk to the lenders who issue them. For borrowers, this can mean higher rates.

Personal Guarantees

Unsecured business lenders require personal guarantees or blanket liens to make sure they get their money back in the event of a business failure or payment default.

Shorter Repayment Windows

Whether you apply for an unsecured loan online or you’re planning to work with a conventional financial institution, lenders view unsecured loans as riskier than their secured counterparts. Because of this, lenders will ask you to pay off the loan in a shorter time frame.

The health of your personal credit and other business factors could improve the length of your repayment window.

How to Get an Unsecured Business Loan

To get an unsecured business loan, lenders evaluate different elements of your company.

Specifically, they’ll review the following factors:

- The overall health of your company (with a focus on revenue)

- Your business and personal credit score

- Consistent cash reserves

- Time in operation

Applying with a Traditional Lender

Traditional lenders such as brick-and-mortar banks or credit unions offer borrowers high funding amounts, longer repayment terms and low interest rates. This can make them appealing financing resources, but those benefits come with stricter requirements for applicants.

Traditional lenders require applicants to have good to excellent credit scores (670 and higher) and a lengthy credit history. Banks and credit unions also prefer to work with applicants who have existing relationships with their institution, and have been in business for at least 2 or 3 years. This can be a challenge if you’re seeking unsecured small business startup loans.

The application process with traditional lenders has multiple steps and it can be several weeks to more than a month before you learn whether your loan request is approved and you receive funding.

Qualifying for an Unsecured Business Loan through a Bank

Individual lenders may have different business loan qualifications, so be sure to do your research before applying for an unsecured small business loan.

However, in general, it’s helpful if you meet the following criteria:

- A credit score of 670 or higher

- Been in business for at least 2 years

Applying with an Alternative Lender

If you work with an alternative or online lender, you’ll complete your entire application on the Internet in a matter of minutes (see Fast Capital 360’s application). This is helpful if you need fast unsecured business loans, and you receive funding on the same day as your application’s approval. Alternative lenders also look at your business’s revenue and overall financial health, making it easier to qualify for unsecured business loans.

However, with the streamlined application process and lower barrier to funding, lenders assume more risk. This means your unsecured small business loan could have shorter repayment terms and higher rates.

Qualifying for an Unsecured Business Loan through an Alternative Lender

If you meet these qualifications, your company might be approved for unsecured business funding:

- A credit score of 500 or higher

- Been in business for at least 6 months

- Your business generates revenue of $10,000 a month or $120,000 annually