Wednesday, Aug. 14, 2019, marked the first time that 10-year U.S. Treasury yields fell below the benchmark set by their 2-year counterparts since 2007. The Dow fell sharply in response, down 800 points by the time the market closed. The S&P 500 Index and the Nasdaq Composite also trended downward, dropping more than 3%.

Although it has recovered slightly since then, the “inverted yield curve” has caused many small business owners to fear a looming recession that could hurt their business. Experts say that might not be the case, however.

What Is a Yield Curve Inversion?

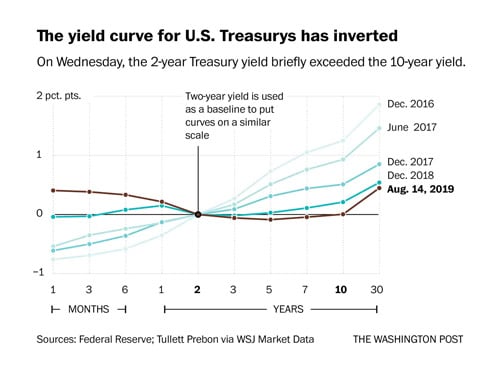

A healthy bond market generally includes higher yields for locking your money away in long-term investments. When looking at a chart or graph of these rates, they will trend upward. When those rates fell below those set for short-term bonds, however, the yield “curve” becomes inverted.

In this case, the 2-year bond rate temporarily rose to 1 basis point (1/100 of 1%) more than the 10-year. It might not seem like a lot, but longer-term bonds usually present a much higher yield.

This chart shows just how much the 10-year rate has declined in the past few years.

An inversion of the curve typically points to expectations of weaker economic growth in the long-term future.

Treasury rates, set by the Federal Reserve, fluctuate to reflect changes in the economy. The Fed will raise bond rates when the economy is performing well as a way to keep the market from “overheating.” On the other hand, the Fed will lower rates in the face of a slowing economy.

Why Did the Yield Curve Invert?

Fears about the trade war between the U.S and China and shrinking economies in Germany and other Eurasian countries have been cited as reasons for the inversion.

But long-term yields have been trending downward for months. In the spring, the 3-month rate had climbed above that of a 10-year bond. When the market closed for trading Wednesday, however, it was 4 times higher than the 10-year benchmark than it was at that point.

Investors have become less bullish on the economy in recent months. They have jumped from short-term investments onto long-term options in fear of an impending decline in the market.

All of these factors cause yields to fall, leaving business owners and investors to guess what will come next.

Is the Inverted Yield Curve a Predictor of a U.S. Recession?

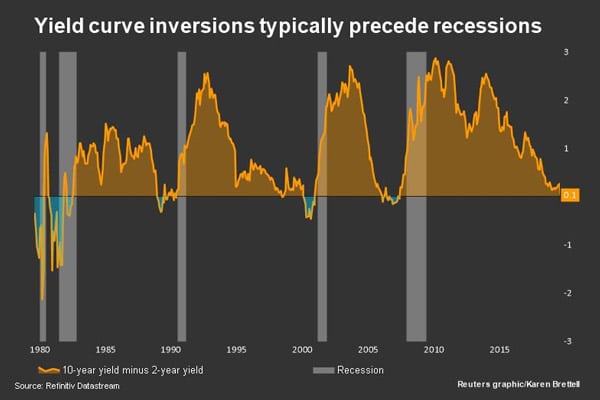

While many consumers and finance pundits have been quick to point out the history of inverted yield curves and recessions, it’s not a surefire predictor.

Yes, it’s true that since 1955 every recession came after an inverted yield curve occurred. But there hasn’t been a recession every time the treasury yield curve inverts.

When the yield curve has predicted them, it has taken months or years for the economy to go into a recession.

What Does it Say About the Economy’s Future?

In the short term, the inverted yield curve gives us a look at what investors and the Fed think about the economy’s future.

Investors jumping to long-term bonds are essentially saying they foresee a possible recession, but believe the economy will bounce back.

They don’t fear inflation, which happens when the economy is doing well. If they did, they wouldn’t risk taking on these lower yields.

Robert Robis, chief fixed income strategist for BCA Research, believes investors expect more to come after the yield-curve inversion.

“At the moment, investors think bonds are the safest way to protect their portfolio,” he said in an interview with MarketWatch. “And some think there’s another shoe to drop and a bigger correction in equities must be waiting around the corner.”

Their actions also point to their belief that the Fed will continue to cut short-term rates. Doing so will be an attempt to bolster the economy, so it’s something to monitor as we see whether this inversion is a sign of recession in 2019 or beyond.

Why We Shouldn’t Fear a Recession

While history strongly indicates the likelihood of a recession after an inverted yield curve, 2019 is a much different landscape.

John Lynch, chief investment strategist for LPL Financial, said he believes the performance of the economy in other areas is a reason not to fear and impending recession.

“We’re not convinced that this yield curve inversion is a sign of imminent recession,” he said in an LPL blog post. “The U.S. labor market is at full employment, healthy wage growth is fueling strong consumer activity and corporate profits are at record levels.”

Indeed, the most recent recessions that occurred after inverted yield curves were spurred by the dot-com and housing bubbles. Today, we don’t have a bubble ready to burst. If trade talks with China cool and global economies don’t tumble, many experts believe the global economic market should correct itself.

Phillip Nelson, the director of asset allocation for investment consultancy NEPC, wrote a blog agreeing with this notion and pointed to the activity of the central banks.

“The central bank’s large balance sheet has driven Treasury term premiums to historic lows, potentially enabling more frequent yield-curve inversions without the associated risk of a recession,” he wrote. “Escalating trade tensions with China and worries of global contagion have dragged down longer-dated Treasury yields, potentially distorting the yield curve.”

There is worry of a self-fulfilling prophecy caused by consumers bringing on a recession. Cuts in consumer spending caused by a fear of an impending recession can slow down the economy. Experts are warning the public not to blow the temporary yield-curve inversion out of proportion.

What’s Next?

For now, things have started reverting back to normal. The daily Treasury yield curve rates for 2- and 10-year bonds have started to return to normal levels.

Some market experts have been reluctant to call last week’s events a “true” inverted yield curve, claiming it needs to invert for weeks or months before beginning to worry. This had been the case when the curve has preceded a true recession.

When it comes to your small business, the anomaly from last week should be considered just that, for now. With the strong performance of the economy before the drop, an economic downturn may be unlikely.