If you’re looking to obtain funding, you may be wondering, “How long does it take to get a business loan?” The answer can vary from minutes to months.

Learn what factors can influence your approval time and what you can do to speed up the process.

First, we’ll look at how much variation there is in the time involved to get a loan approved and what factors underlie this variation. Then we’ll identify what you can do to speed up the process and what variables help determine the success of your application. Finally, we’ll walk you through the steps to applying for a business loan.

How Long Does a Business Loan Take to Get Approved?

Depending on a number of variables, the loan application process can take anywhere from a few minutes to several months. To illustrate the possible variations within this range, let’s start with the example of a Small Business Administration (SBA) loan.

The SBA offers a variety of loan programs in partnership with participating financial institutions. Some institutions are preferred lenders, which gives them authority to approve loan applications without direct review from the SBA, speeding up the application process. How long an SBA loan application will take depends partly on what type of loan you’re applying for and whether you’re working with a preferred lender.

SBA Express Loans may be processed by the SBA within as little as 36 hours, while Export Express Loans can be processed within 24 hours. However, this is just the SBA’s end of the loan-processing process, and it doesn’t include the time it takes for your lender to handle their end or the time it takes for you to complete your paperwork. In total, SBA 7(a) loans tend to take 60-90 days to process.

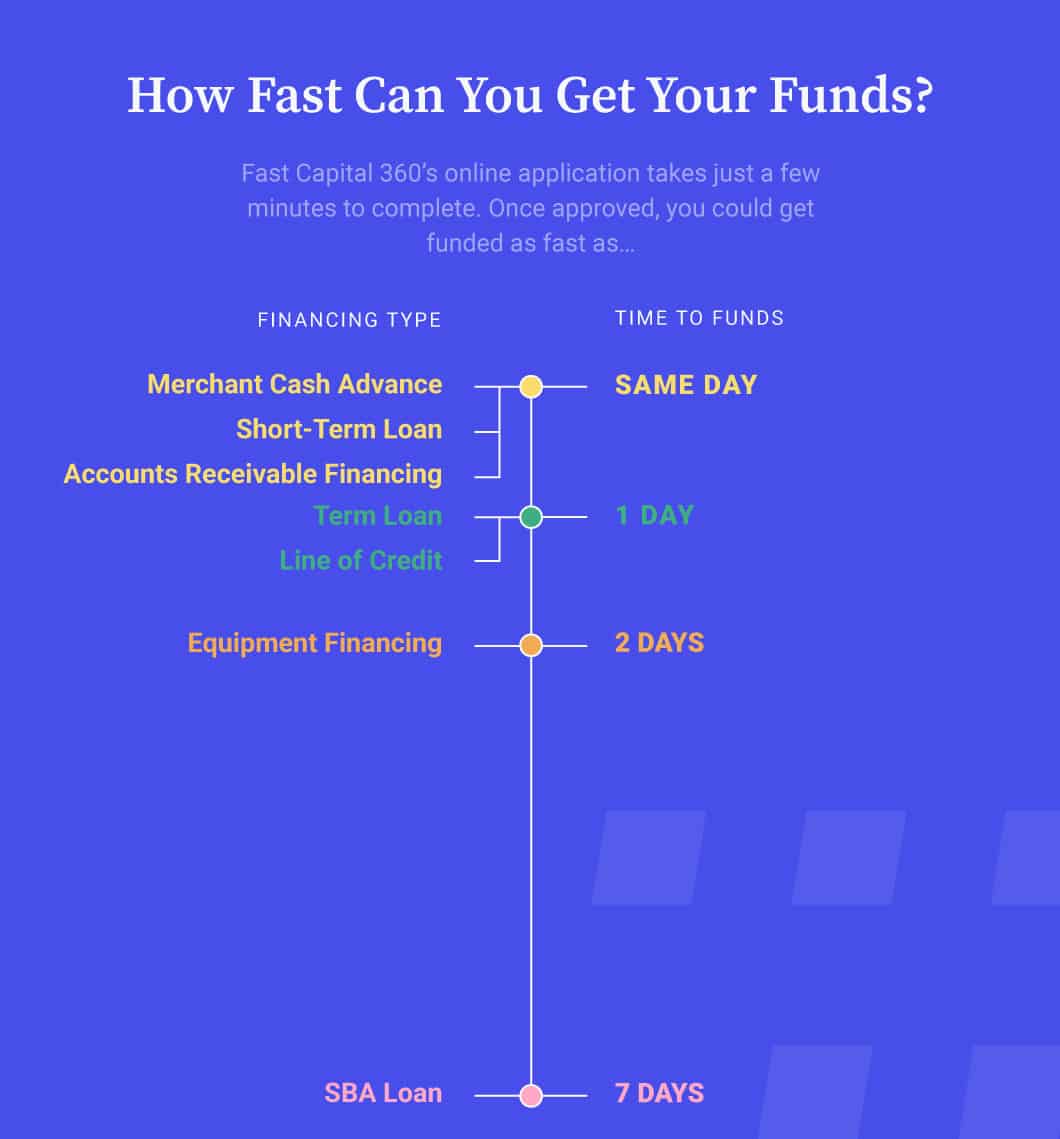

Now let’s contrast this lengthy scenario with the rapid approval processes for certain types of non-SBA loans available from some online lenders.

Let’s say you’re using unpaid invoices as collateral to apply for accounts receivable financing using an online lending platform. Because you’re providing collateral, qualification requirements are minimal, simplifying the application process. You can be approved as quickly as it takes you to provide verification of your accounts receivable and as fast as your lender can run a credit check. Often, you’ll be approved the same day. With some online lenders and loan types, this can be shortened to less than an hour.

What Are Some Factors That Influence Loan Approval Time?

So, which variables account for such a wide range in the loan approval timeline? There are a number of factors which can be identified, including:

- Which lender you apply with

- What type of loan you apply for

- What qualifications your lender requests

- How efficiently you submit your documentation

- When you submit your application

Let’s look at how each of these factors can weigh in on the amount of time it takes for your loan application to get processed.

Which Lender You Apply With

One of the biggest factors influencing your loan processing speed is which lender you apply with. With conventional lenders such as banks and credit unions, you have to apply on-site, which may require setting an appointment. You’ll then need to go through the institution’s underwriting process, which includes formal procedures to ensure compliance with federal regulations. If you get approved, you’ll have to be physically present to sign papers, which may require another appointment. All this lengthens the approval process.

In contrast, an online lender may deal with you entirely over the internet or over the phone, and regulatory requirements may be loosened, depending on the specifics of your application. Your approval process may be handled automatically by technology, and funds may be transferred electronically. This can speed up the approval process significantly.

What Type of Loan You Apply For

The type of loan you seek is another major factor influencing your approval time. Loans that involve large amounts, extensive paperwork, rigorous qualifications and proof of collateral or guarantees take longer. Loans involving smaller amounts, streamlined paperwork, minimal qualifications or simplified collateral verification take less time. This is one reason SBA loans can take longer to process than some other types of financing.

What Qualifications Your Lender Requests

Another factor that has an impact is what qualifications your lender requests, which can be tied to how well you qualify as a borrower. Most application processes include some type of prequalifying process where you submit basic information such as your monthly revenue and your lender checks on key criteria such as your credit score.

If your lender’s preliminary assessment is that you look like a good credit risk, you may not have to submit as much paperwork. However, if your lender needs documentation of your creditworthiness or if they want collateral or a guarantee, this can lengthen your application process.

How Efficiently You Submit Your Documentation

How efficiently you process your paperwork on your end also affects the length of your application process. If you come to your lender with all the documentation you need already assembled, it speeds up the process for both you and your lender.

If you have to go searching for documents, or if you make a mistake on your application form, it can slow things down. How quickly you return emails and phone calls from your lender likewise affects your processing time.

When You Submit Your Application

The timing of your application also can play a role. For example, if you submit your application on a Friday afternoon, you may have to wait until the next week for processing to begin. Holidays and tax season can cause similar delays.

What Can You Do to Speed Up the Loan Approval Process?

In light of the factors which influence loan processing time, you can take a number of steps to expedite your application:

- Work with lenders known for prompt turnaround

- Consider the type of loan you’re applying for and whether speed is enough of a priority to seek a different type of financing (in some cases you may decide other considerations such as loan amount or qualifying criteria are more important)

- Study your lender’s application requirements before initiating your submission

- Verify that you meet your lender’s qualifications

- Assemble all known required documentation before starting your application

- Submit your application on a weekday, preferably not a Friday

- Return all email and phone calls from your lender promptly

- Authorize electronic deposit of funds

These steps will help accelerate things on your end of the process. Of course, some factors on your lender’s end will be beyond your control. But at least you’ll have done what you can to speed things up.

What Does It Take to Get a Business Loan Approved?

Loan approval criteria vary by loan product and lender. For application processes with minimal requirements, you usually will need to meet basic criteria. This may include meeting a minimum number of months in business, a minimum monthly revenue and a minimum credit score.

Some applications will require additional criteria such as bank statements, tax statements, collateral or guarantees. Studying your lender’s requirements before you apply will help you assemble what you need and speed up your application.

What Are the Loan Application Process Steps?

Applying for a loan generally involves 5 steps:

- Reviewing your own eligibility for the type of loan you’re considering by checking key criteria such as your revenue and credit score

- Researching loan providers to find the right provider and understand their application process

- Assembling whatever paperwork your provider requires

- Submitting your loan application

- Signing your loan closing agreement

Your lender will provide more detailed instructions on how to complete these steps.

Speed up Your Loan Application by Using Technology

Loan speed processing can vary from minutes to months. It depends on variables such as the lender you work with and the type of loan you apply for. Researching lender requirements and assembling your paperwork ahead of time can speed up the application process.

Another way to speed up your application is by working with a lender who uses technology to accelerate your loan processing. Fast Capital 360 uses digital technology to match your prequalifying criteria with a network of lenders who meet your needs. Take a few minutes to fill out our prequalifying form and instantly see your loan options.