For small growing companies, business credit cards offer a convenient way to streamline routine purchases and improve buying power — and can help stave off financial ruin should disaster strike.

They also provide numerous opportunities for a business to earn various rewards with every purchase they make. While some business credit cards offer freebies, service discounts, and other such rewards, others simply reward their customers with actual cash.

So, how cash-back business cards work and how you should determine which cashback reward structure is right for your business. Let’s look at the most valuable cash-back business credit cards available to small businesses today.

How Cash-Back Business Credit Cards Work

Cash-back business credit cards offer cash rewards based on a company’s card usage and purchasing habits.

Typically, a company can earn anywhere from 1%-3% back on specific purchases — and can sometimes get as much as 5% back with certain cards. As we’ll discuss, many credit card companies offer higher rebate amounts for certain purchases (e.g., food, gas, travel), while offering a smaller amount back on all other business purchases.

Different cards also offer different ways for companies to redeem the cash rewards they’ve earned, including:

- Some accounts accumulate points on business purchases, which can then be exchanged for cash rewards (and potentially other products or services)

- Some accumulate an actual dollar amount within the account with every purchase made. From there, the business can use the money to pay off their credit account, or can choose to have a check cut for the amount earned.

- Certain credit cards automatically apply cash-back rewards to the account in question on specific dates (often lining up with the company’s billing cycle)

Most cash-back business credit cards also offer cash rebates to companies that spend a certain amount within the card’s introductory period.

Regardless of how your cash-back business card of choice works, using it will almost always put some extra cash in your coffers.

How to Get the Most Out of Business Credit Card Cash-Back Rewards

Of course, you need to be strategic in how you use your cash-back business credit card to get the most value out of it.

To begin with, avoid choosing a card solely because it offers a juicy cash-back rewards scheme. Pay attention to the card’s policies regarding annual fees, annual percentage rate (APR), usage limits and other associated costs and limitations. Needless to say, you don’t want to end up spending more in fees than you end up getting back in rewards.

(You also need to know with certainty that you’ll be able to keep up with your card payments over time. This applies to all business credit card initiatives, but is worth reiterating here.)

Once you’ve hammered out these overarching details, you’ll then want to focus specifically on the card’s cash-back reward policies.

Worth Noting

There are a few things to consider at this point:

First, consider how the card’s cash-back reward structure aligns with how you intend to use it. For example, if you’ll be using it while traveling for business, you want to be sure the card you choose offers higher-percentage rebates on hotel rooms, travel expenses and restaurants. Those looking to use the card for routine business purchases might look for one that balances rebate amounts across different sectors.

You also want to think about which redemption structure works best for your business. In some cases, you might be happy to have your cash-back rewards automatically applied to your credit account. In others, you might want a little more control over how and when you redeem your cash rebates.

Similarly, take note of any stipulations placed on the cash-back offer, such as annual rebate limits or ineligible purchases. Depending on the situation, this may limit the amount of cash you receive back over time — and can limit the ways in which you’re actually able to use the card in the first place.

Finally, look to see what other additional services or offers each credit card company provides on top of your cash-back rewards. From tangible perks and rewards to personalized financial services (and more), many card providers offer unique value of some form that you can likely take advantage of.

Finding the cash-back business credit card that’s right for your company requires taking a holistic approach to each of your options, then digging into the nitty-gritty details of each in turn. The goal isn’t just to find the card that earns your company the most cash back — but the one that truly brings the most value to your business.

5 Cash-Back Business Credit Cards to Consider

With the above in mind, let’s take a look at the 5 best cash-back business credit cards available today.

1. American Express Blue Business Cash

The American Express Blue Business Cash credit card is an excellent choice for growing companies looking for an agile cash-back payment option.

Blue Business Cash members receive 2% back on all business purchases made within a calendar year, up to $50,000. Once this limit is reached, members will still receive 1% cash-back on all eligible purchases. New members are eligible to receive $250 cash back after making $3,000 worth of purchases within their first six months. When a cash-back reward is earned, it will automatically be credited to the member’s future account statement.

American Express offers Blue Business Cash with no annual fee, along with a 12-month 0% annual percentage rate (APR) period to new members. After this introductory period, members will receive anywhere from 13.24%-19.24% APR depending on credit history.

Blue Business Cash members also can take advantage of American Express’ Expanded Buying Power service as needed. This service allows members to buy above their credit limit for specific purchases and during specific situations without penalty.

For growing businesses with plenty of routine expenses and dynamic financial circumstances, this American Express card might be your best option.

2. Chase Ink Business Card

Chase Ink’s cash-back rewards structure makes it the perfect business credit card for routine and ongoing office expenses.

As far as cash back, Visa Ink offers:

- 5% back on office supplies, along with internet & cable services, up to $25,000 annually

- 2% back on purchases made in restaurants and gas stations, again up to $25,000

- 1% back on all other purchases, with no annual limit

Chase Ink also offers no annual membership fees, along with the same 12-month, 0% APR period (and the same 13.24-19.24% APR afterward).

New members can also earn $750 back after making at least $7,500 in business purchases within their first three months.

Once rewards are earned, Chase Ink members can choose to have the cash deposited into their checking or savings account, or to be applied as a credit to their account. Rewards can also be redeemed via gift card, or through certain travel-related purchases.

Ink members have access to Chase’s digital business services, which allows them to manage and maintain their company’s financial situation. They’ll also receive a number of perks while traveling, such as collision insurance and roadside assistance.

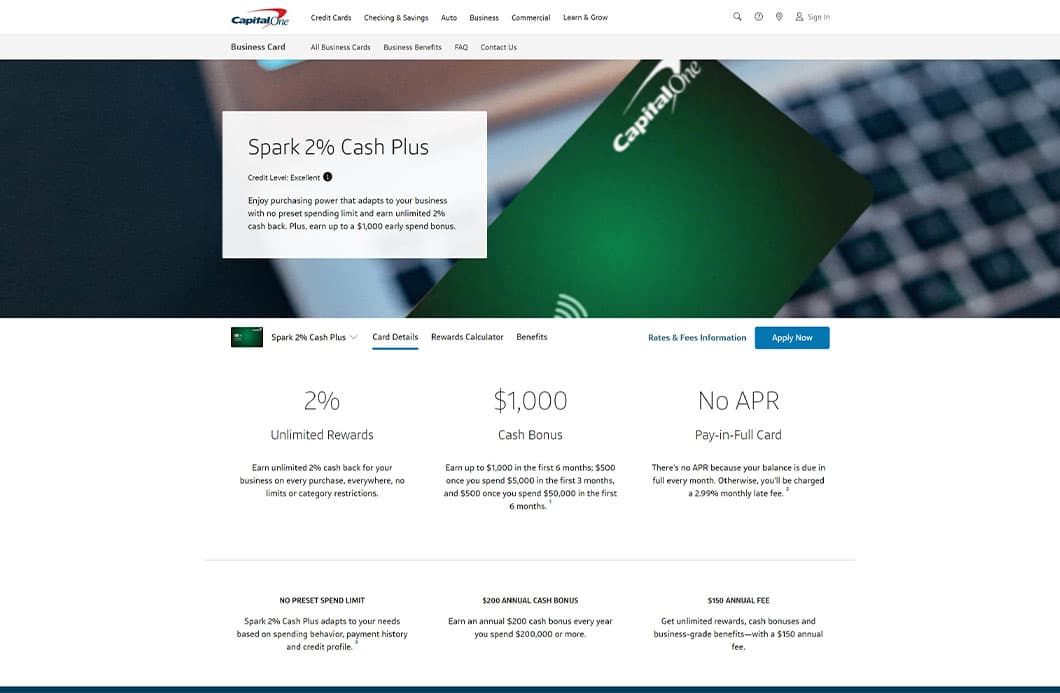

3. Capital One Spark Business

The Capital One Spark Business credit card is perhaps the most unique card on our list, for a few reasons.

Firstly, the provider offers a dynamic spending limit to cardholders. While not unlimited, the provider uses a number of factors to determine the member’s spending limit at any given moment — allowing for maximum buying power for the member.

The Spark Business card is also a pay-in-full card, meaning members must zero-out their balance every month, or pay a 2.99% monthly late fee on their outstanding balance. This is in lieu of a monthly APR charge on open balances. (Due to this pay-in-full policy, the Spark Business card is only available to companies with excellent credit ratings.)

Spark Business members pay a $150 annual fee. In exchange, they receive a number of business-grade benefits on top of the expected cash-back rewards.

On that note, Spark Business offers 2% cash back on all business purchases — regardless of annual spending levels. Those who spend more than $200,000 in a given year will be eligible for an extra $200 rebate.

New cardholders are also eligible for two $500 rebates: One after spending $5,000 in three months, and the next after spending $50,000 in six months.

All this, along with Capital One’s account management and security features, make the Spark Business card a key choice for growing companies looking to make regular, heavy use of their business credit card.

4. Bank of America Business Advantage Customized Cash Rewards

Bank of America’s Business Advantage Customized Cash Rewards card is a flexible option for companies in various industries with just as varied spending habits.

The Business Advantage card offers 3 reward tiers:

- 3% cash back on purchases within a category of the member’s choice

- 2% cash back on dining purchases

- 1% cash back on all other eligible business purchases

After a total of $150,000 in purchases (at any tier), members will receive 1% back on business purchases of any kind. New customers also will receive $300 back after spending $3,000 within 90 days. Cardholders that have a Bank of America business checking account can earn up to 75% more cash back per-purchase, potentially earning as much as 5.25% back on top-tier purchases.

The Business Advantage card is offered at 0% APR for nine billing cycles, after which the APR becomes 12.24-22.24% based on the member’s credit history. There is no annual fee attached to membership.

Members have three options for redeeming their cash-back rewards:

- Direct deposit into a checking or savings account (Bank of America only)

- As a credit to their business credit card account

- Via mailed check

The customizable nature of Bank of America’s Business Advantage card, along with its customer-friendly rewards structure, makes it a prime choice for businesses of all shapes and sizes.

5. US Bank Business Triple Cash Rewards World Elite

The last entry in our list of cash-back business credit cards provides three ways for cardholders to collect monetary rewards.

First, US Bank’s Business Triple Cash Rewards World Elite card offers 3% cash-back on unlimited eligible purchases at gas stations, restaurants, and office supply stores. This 3% rebate also applies to purchases from cellphone service providers, as well.

(All other purchases are eligible for a 1% rebate.)

New members can earn $500 cash back after making at least $4,500 in purchases over their first 150 days. All cardholders — new and existing — can receive $100 back on recurring software subscriptions, such as QuickBooks or FreshBooks.

As with most others on our list, US Bank requires no annual fee, and offers 0% introductory APR through the first 15 billing cycles. Once this period is up, the card’s APR can range from 13.99%-22.99%.

As for additional features and services, US Bank offers:

- Expense management through Visa’s Spend Clarity dashboard

- Round-the-clock security measures, such as fraud monitoring and liability

- 24/7 customer service and support

These user-friendly features, coupled with the offer of limitless cash-back rewards, are just enough for US Bank’s World Elite card to secure the final spot in our list of top available cash-back business credit cards in 2021 and beyond.