Getting a business loan or other financing, and securing that funding at the best rates, isn’t as difficult as one might think. It all starts with learning about the right option for your small business.

5 Steps to Getting a Business Loan

Conducting research and employing due diligence before filing a small business loan application is crucial and will help you determine which financing options work for you — now and in the future as you pay down the loan.

Want to know how to apply for a small business loan? Follow these 5 steps to getting a small business loan:

- Why do you need to obtain a business loan?

- Know whether you qualify for financing

- Choose a form of business financing

- Gather your documents and other relevant information

- Apply for the loan or financing

Step 1: Why Do You Need a Business Loan?

Why do you need outside funding? Do you require a loan to start your small business or cover daily expenses? Do you need capital to expand your company?

Here are why small firms applied for funding in 2020, according to the Federal Reserve Banks’ State of Small Business Credit Survey:

- Meet operating expenses: 58%

- Expand business, pursue new opportunities or acquire new assets: 38%

- Refinance or pay down debt: 32%

- Make repairs or replace capital assets: 22%

Identifying why you need a business loan will help you determine which financing options best suit your needs and the steps you’ll take to apply for a business loan. The following funding options can serve various business needs; for example:

- Work with individual investors or investment partners and groups to obtain startup capital

- Manage a cash-flow gap (e.g., waiting for customers to pay their invoices or experiencing a seasonal slow-down) to cover operating costs

- Cover emergency repairs

- Equipment purchases

- Take advantage of a limited-time offer (e.g. discount price on inventory)

- Expand your business’s product or service offerings

- Purchase another business

- Add a new retail location, warehouse or office space

How Much Funding Do You Need?

Many business owners interested in applying for funding often ask, “How much financing can I get?” The better question is, “How much do I need to borrow?”

If you have a vague idea of how much your company requires to cover its short-term expenses or projects, you might end up borrowing (and paying interest on) more funding than you need.

Conversely, some business owners are too conservative when asking for a loan. Don’t underestimate the amount of capital you need: That can jeopardize the financial sustainability of your company.

Also, look at your business’s financials to determine how much you can comfortably allocate toward loan repayments.

Know what you’re asking for — and what you need — before you take steps to apply for a business loan.

Step 2: Know Whether You Qualify for Financing

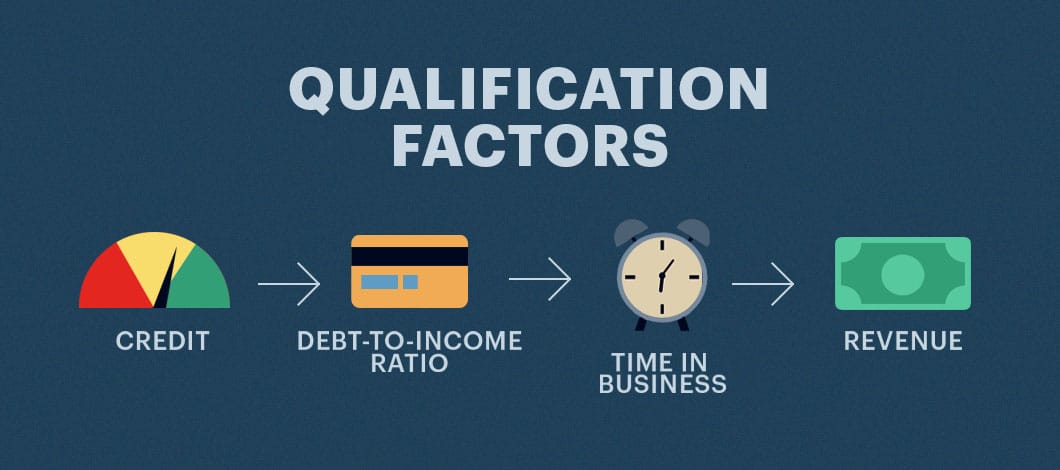

Not all small businesses are equal in the eyes of lenders. Indeed, some metrics and scores separate highly qualified businesses from those that are riskier for financing providers. The key to getting approved for an affordable business loan is lenders putting your business in the first category.

Credit Score and History

Like a personal credit score, your business credit score is a number that reflects the total picture of your business’s financial health and how well you manage its debt obligations. Credit-reporting agencies use different scales to score businesses. For example, Dun & Bradstreet (D&B), Experian and Equifax rank businesses on a scale from 0-100, while FICO uses a 300-850 scale for business credit rankings. Note that you’ll likely need at least 80 or 90 out of 100 to be determined a “low risk” borrower. According to Experian, a good FICO credit score is in the range of 670-739, while a fair score is between 580 and 669.

Because it can take some time for a small business to establish a strong credit rating, many lenders consider other qualifications — some review personal credit scores.

What credit score do you need to get a small business loan? It depends on the lender and the type of financing. Many conventional institutions like banks and credit unions will want to see a minimum credit score of 670, but other alternative lenders could accept candidates with fair or poor credit scores.

In addition to your credit score, lenders will also review your credit history. For example, do you pay debts on time? How much financing has your business received in the past? What are your current debt obligations?

Debt-to-Income Ratio

Another important metric creditors use to determine creditworthiness is your debt-to-income (DTI) ratio, which helps lenders measure your business’s overall financial health and ability to repay additional debts.

If your debt-to-income ratio is too high (under 35% is preferred, but ratios as high as 50% can still be OK for businesses in certain industries), most creditors could see you as a poor candidate for getting a business loan.

Time in Business

How long you’ve been in business will impact if you can apply for a business loan. In general, online and alternative lenders want to see that your business has been operating for at least a year. Banks and credit unions usually won’t approve financing for a business that’s been around for fewer than 2 or 3 years.

Revenue

Your business’s revenue is considered when you apply for a business loan. Requirements vary according to the lender and type of financing you want. Depending on the financing product, some lenders will approve businesses with less than $100,000 in annual revenue.. For other financing options, lenders won’t approve businesses making less than $250,000 in annual revenue.

Step 3: Choose a Form of Business Financing

A long-term bank loan isn’t your only financing option. Here are 4 of the most popular financing alternatives for small businesses:

SBA Loans

Many financial institutions will not offer loans to small businesses because they are deemed too risky (e.g., insufficient revenue, time in business, bad credit or no credit). However, SBA loans are secured loans backed by the Small Business Administration (SBA), making them less risky investments for lenders.

These low-interest loans are provided by commercial banks, financing companies and nonprofit lenders. The federal agency guarantees a portion of the small business loan on your behalf. Interest rates and loan fees are capped, making SBA loans some of the most cost-effective ways to fund a small business.

Getting a long-term SBA small business loan can be competitive, so be ready to meet the requirements.

-

Do you qualify?*

- In business 2 or more years

- Annual revenue of $50,000 or higher

- Credit score of 650 or better

*Fast Capital 360 requirements for borrowers

Business Line of Credit

Business lines of credit are a convenient take-what-you-need option for financing. Acting as a reserve source of cash to be used whenever needed, a line of credit can also supplement a conventional loan.

Business lines of credit offer the following advantages:

- Flexible cash-flow management

- Lower interest rates and higher limits than many credit cards

-

Do you qualify?*

- In business 1 year or more

- Annual revenue of $200,000 or more

- Credit score of 560 or higher

*Fast Capital 360 requirements for borrowers

Equipment Financing

If your business operates in an industry that’s reliant on equipment, such as the medical or construction industries, you may be eligible for equipment financing. Banks and other creditors can loan you up to 100% of the value of the equipment, which you then repay with interest.

One of the main benefits of equipment financing is lower interest rates. Since the equipment generally secures the loan, interest rates don’t skyrocket because you don’t have collateral on hand.

-

Do you qualify?*

- In business 2 years or more

- Annual revenue of $160,000 or more

- Credit score of 620 or higher

*Fast Capital 360 requirements for borrowers

Picking the Right Lender

Some new entrepreneurs assume they have to get a small business loan from a large national bank. However, you’re more likely to get approved if you solicit a smaller, regional bank.

When considering how to get a small business loan, evaluate other lender options, namely credit unions, not-for-profit financiers and alternative lenders, including online marketplace operators such as Fast Capital 360.

Make sure you review your funding options and research where to get a small business loan, including:

- Big banks (e.g., Wells Fargo, JPMorgan Chase, etc.)

- Regional banks (small local chains)

- Nonprofit lenders

- Alternative lenders and online lending marketplaces (e.g., Fast Capital 360)

- Microlenders

- Credit unions

Loan approval rates have improved in 2021 as the economy recovers from the pandemic-caused downturn. As of July 2021, institutions had the following approval rates:

- Big banks: 13.8%

- Small business banks: 19.1%

- Institutional banks: 23.9%

- Alternative Lenders: 24.7%

Step 4: Gather Your Documents and Other Relevant Information

Make sure your company’s financial records are organized and accessible before applying for a business loan or other form of financing.

Required documents include the following:

- Government identification

- Business license and permits

You also will need to provide proof that you’re the lawful owner of your company, such as the following:

- Articles of incorporation (if applicable)

- Owner’s tax return, including the Schedule C form

- “Doing business as” documents with owner’s name attached

- Stock ownership documents (if applicable)

- Internal Revenue Service (IRS) form K-1

- Company stock certificates (if applicable)

Step 5: Apply for the Loan or Financing

When you’ve narrowed down the type of loan or financing option that’s right for you, you’re ready to apply for a business loan. You’ll need to begin the application. Generally, a loan officer will be your first point of contact and go-to for all things related to your loan.

Once your small business loan application is complete, you should prepare to meet face-to-face with your financial institution’s loan officer.

You’ll pitch your case for why your business can be trusted with the money by explaining your intent. So be prepared: Come with a rehearsed pitch and an organized business plan.

Give yourself 10-15 minutes to go over your planned capital expenses and a roadmap to profitability. Your presentation should start with an executive summary that quickly states the main talking points and your company’s competitive advantage.

However, if you’re looking to an online lender, you might speak to an advisor over the phone or through email to complete the entire process.

Get Your Business Loan Faster

How long it takes to learn whether you’re approved for financing depends on the lender.

It can take several weeks and more than a month to get approval for a small business loan from a bank, especially a large one. However, smaller, regional banks tend to take significantly less time to process a small business loan application.

The approval process is typically much faster if you apply for a business loan online, with some lenders approving loan applications within hours of receiving them.

Steps to Apply for a Business Loan Online

Online lenders make the loan application process quick and easy. In general, alternative lenders’ requirements aren’t as rigid as banks’ and credit unions’. For example, if you’ve been in business for only a year and don’t have a long credit history, you could still apply with an online lender. In contrast, a big bank usually won’t approve a business that doesn’t hasn’t been operating for long or that doesn’t have a significant credit history.

You’ll take the following steps if you want to apply for a business loan online.

1. Choose an Online Business Loan Type

There are several options available to you if you’re interested in applying for a business loan online, including the options outlined above as well as the following:

Short-Term Loans

Short-term loans are a great choice if you know you will experience a quick return on your investment. For example, good use of a short-term loan would be to buy inventory in advance of your busy season.

Short-term loans typically reach maturity in 18 months or fewer. You can still borrow medium to large amounts (up to $500,000) but be aware that the shorter repayment terms can often mean higher payments.

-

Do you qualify?*

- In business for 1 year or more

- Annual revenue of $75,000 or more

- Credit score of 540 or higher

*Fast Capital 360 requirements for borrowers

Merchant Cash Advances

Another option when it comes to online borrowing is taking out a merchant cash advance.

This type of financing involves a lump sum cash infusion issued in return for a portion of the company’s future sales.

Most online merchant cash advances require a minimum credit score of 500. Typically, online lenders issue merchant cash advances in the range of $3,000-$500,000, depending on the total and consistency of your cash flow.

-

Do you qualify?*

- In business for 4 months or more

- Annual revenue of $100,000 or more

- Credit score of 500 of higher

*Fast Capital 360 requirements for borrowers

Invoice Financing

A form of accounts receivable financing, invoice financing, involves pledging unpaid invoices as collateral in exchange for cash.

Companies that need fast cash for short-term expenses often turn to invoice financing if they have high-value outstanding invoices.

Most creditors offer between 75%-90% of the invoice face value. The cash is then advanced to the borrower, and the remaining balance is remitted after the invoice is paid in full, minus fees.

Those looking to get a small business loan with bad credit can take advantage of invoice financing because the creditworthiness of your customers is weighted more heavily than your company’s financial health.

-

Do you qualify?*

- In business 1 year or more

- Annual revenue of $150,000 or more

- Credit score of 600 or higher

*Fast Capital 360 requirements for borrowers

2. What You’ll Need to Apply

Most online lenders don’t have brick-and-mortar locations, so you’ll complete the application exclusively on the lender’s website. If you’ve gathered all of the necessary documents, the application process could take mere minutes. Typically, online lenders require applicants to contribute the following information:

- Income and annual revenue (often in the form of a bank statement)

Lenders could want to see 4-12 months of bank statements, depending on your business’s industry and the type of financing you’re trying to obtain. - Social Security number

- Business name and legal name

Your business’s DBA (doing business as) name could be different from the legal name on the formation documents you filed when you started your business. For example, a sole proprietorship would legally have your own name as the business’s name, and a partnership would have your name and your partner’s name. Your potential lender will want to see both names on your application.

- Business tax identification number

- Personal contact information

3. Complete the Online Application Process

Upload your information to your lender’s website. Depending on the online lender, your qualifications and the type of loan you’ve applied for, financing can be approved within hours and funding could be transferred to your business bank account in as few as 24 hours.

The Pros and Cons of Online Business Loans

Pros

✔ Applying for business financing online is far more convenient and expedient than the conventional application process.

✔ At a brick-and-mortar bank, it might take upwards of a month for your application to be reviewed, but online lenders can process a loan application in hours.

✔ Alternative lenders are more likely to approve an application, according to Statista.

✔ For businesses going through a cash crunch, online financing provides accelerated access to cash. Some online lenders can provide business financing the same day you apply.

✔ Between SBA loans, merchant cash advances, short-term loans and more, there are various online business funding options to suit a company’s unique needs and challenges.

Cons

✗ Expedited funding isn’t cheap. If you need cash within a few days, financing from an online lender may translate to higher annual percentage rates (APRs).

✗ You may be facing shorter repayment terms.

✗ Some online lenders tack on hidden fees or terms.

How to Apply for a Business Loan: Frequently Asked Questions

How do I apply for a business loan with bad credit?

If you’re wondering how to apply for a small business loan with bad credit — it’s possible. However, keep in mind the terms likely won’t be as favorable. You might not qualify for as much funding or face higher interest rates. Some financing options available to borrowers with less-than-stellar credit include short-term loans, an MCA as well as invoice financing.

If your personal credit score is fair (between 580 and 669) to very poor (580 or lower), start building positive credit as quickly as possible to bolster your chances of getting the loan approved. These simple steps include the following:

- Paying bills or other debts on time

- Maintaining a diverse credit portfolio

- Make sure your company is in the black (i.e., not operating at a loss) at the time of application

Read more about tips and financing alternatives for businesses with poor credit scores.

How to obtain a business loan with no money down?

Providing a down payment for business financing reduces the risk for lenders and can help you obtain a lower interest rate. However, if you can’t afford to put any money down, you’re not without options. Many lenders will accept collateral in place of a down payment. Like a down payment, collateral mitigates risk as a lender can liquidate assets and recoup losses in the event of loan default. Other lenders may extend financing to qualifying business owners without a down payment, though the terms are typically less favorable. Often, no-money-down business loans are smaller, have shorter repayment terms, higher interest rates and require a personal guarantee — a legal promise to repay credit.

How to obtain a business loan with no collateral?

If you’re curious about how to get an unsecured business loan — financing that isn’t secured by a high-value item like property or a vehicle — you can check out the following business loans or financing options:

- Term loans

- Business lines of credit

- Invoice financing

- Merchant cash advances

Conventional lenders may offer unsecured loans to highly qualified borrowers, but you’re most likely to acquire unsecured financing through an alternative lender. Because of their higher risk profile, lenders typically ask for personal guarantees, charge higher interest and issue shorter terms.

Read more about how to obtain a business loan with no collateral.

How to apply for a business loan after filing for bankruptcy?

If you’re asking, “What do you need to get a business loan after filing for bankruptcy?” getting a co-signer is the most immediate option. A co-signer, someone with a higher credit score and stronger credit history, reduces risk for your lenders and can improve your chances of getting approved for a business loan. Note that if you default on the loan, your co-signer’s and your credit rating will be affected.

Even if you obtain a co-signer, you’ll need to rebuild your credit score. You can take the following steps for this process:

- Prepare a business plan to demonstrate you can successfully operate a commercial venture.

- Write an explanation of your bankruptcy. This will help lenders evaluate your future financial risk, especially if extenuating circumstances are behind your bankruptcy filing (e.g., high medical bills)

- Make bill and debt payments on time.

- Get a secured credit card.

Read more about steps to get a business loan after filing for bankruptcy.

Are online business loans safe?

Online business loan applications are managed and reviewed electronically using secure web portals that protect your data through encryption, keeping it confidential and safe from security threats.

For instance, Secure Sockets Layer (SSL) encryption is a standard technology that makes the link between the web server and your browser highly threat-resistant. It ensures that all data and messaging between the lender and borrower is kept private.

Seek online lenders with a TRUSTe Certified Privacy certificate. These finance firms have taken steps to ensure that the highest data privacy standards are upheld and all collected data is kept confidential and secure.

Keep in mind it’s crucial to exercise due diligence and thoroughly research any lender or platform you use to apply for an online business loan.