So you’ve been approved for a Paycheck Protection Program (PPP) loan, or you plan to apply for one.

You may be wondering how to get the loan forgiven?

To qualify for complete or partial PPP loan forgiveness, you need to prove that you spent loan proceeds on the right things.

Here’s what you need to know.

What Is the Paycheck Protection Program (PPP)?

The Paycheck Protection Program (PPP) provides 8 weeks of cash-flow assistance to qualifying small businesses.

The loan amount is based on your average monthly payroll cost for 2019.

You can receive 2.5 times that amount, up to $10 million.

What Can PPP Loan Proceeds Be Used For?

According to the U.S. Department of the Treasury, funds from the PPP can be used for:

- Payroll costs, including benefits

- Interest on mortgage obligations, incurred before February 15, 2020

- Rent, under lease agreement before February 15, 2020

- Utilities, for which service began before February 15, 2020

Payroll costs include:

- Salary, wages, commissions or tips (capped at $100,000 on an annualized basis per employee)

- Employee benefits including costs for vacation, parental, family, medical or sick leave; allowances for separation or dismissal; payments required for the provision of group health care benefits including insurance premiums; and payment of any retirement benefit

- State and local taxes assessed on compensation

- For a sole proprietor or independent contractor: wages, commissions, income or net earnings from self-employment, capped at $100,000 on an annualized basis for each employee.

What Expenses Are Eligible for PPP Loan Forgiveness?

All business owners who use PPP loan proceeds to pay for qualifying expenses are eligible for loan forgiveness.

To qualify:

- Funds must be spent within 8 weeks of loan disbursement. Only qualifying expenses incurred and paid for within this 8-week window are eligible for loan forgiveness.

- Employee and compensation levels must be maintained. Reductions in either category may impact forgivable loan allowances.

- No more than 25% of your loan is used to cover non-payroll expenses, including mortgage interest, rent or utility costs.

To Qualify for Loan Forgiveness, How Many Employees Must You Maintain on Your Payroll?

The amount of loan forgiveness is lowered if you reduce the number of full-time equivalent employees on your payroll within the 8 weeks following loan disbursement.

To determine if you’ve met this condition, tally the number of full-time equivalent employees on your payroll 8 weeks after loan disbursement. Then, compare it to the number of employees you had through February 15, 2019 to June 30, 2019 OR January 1, 2020 to February 29, 2020.

If the number of employees is equal to or greater than your pre-PPP full-time equivalent staff level, you’re in the clear. If it’s fallen, your forgivable loan amount would be reduced proportionately.

You will not be penalized for any reduction in the number of full-time equivalent employees as long as you eliminate the reductions by June 30, 2020.

Will Reductions in Employee Compensation Impact Loan Forgiveness?

It can. If you reduce total employee salary or wages by more than 25% during the 8 weeks following the PPP loan disbursement, your loan forgiveness amount will be reduced by the difference in pay.

As with staffing levels, you will not be penalized for any reduction in salary or wages as long as you reinstate reduced compensation levels before June 30, 2020.

What Other Factors Can Reduce Loan Forgiveness Amounts?

If you received an advance through the Economic Injury Disaster Loan program, this amount will be deducted from your forgivable allowance.

How Do You Request PPP Loan Forgiveness?

Loan forgiveness does not happen automatically. You will need to submit a request to your PPP loan provider.

Be sure you’re clear as to where, when and how to apply for loan forgiveness as each lender has their requirements.

What Documentation Is Required to Apply for Loan Forgiveness?

There is no standardized PPP loan forgiveness process. As such, lenders may have unique requirements.

At a minimum, prepare documentation of:

- Staffing levels and pay rates for the periods before and after PPP loan disbursement. Your lender may request to see:

- IRS Form 940, 941 or 944 payroll tax reports

- Payroll reports from your payroll provider

- Income, payroll, unemployment insurance filings from your state

- Retirement and health insurance contributions

- Mortgage interest, rent or lease and utility payments in the 8 weeks following disbursement of the loan

- Any advance received under the CARES Act Economic Injury Disaster Loan Emergency Grant program

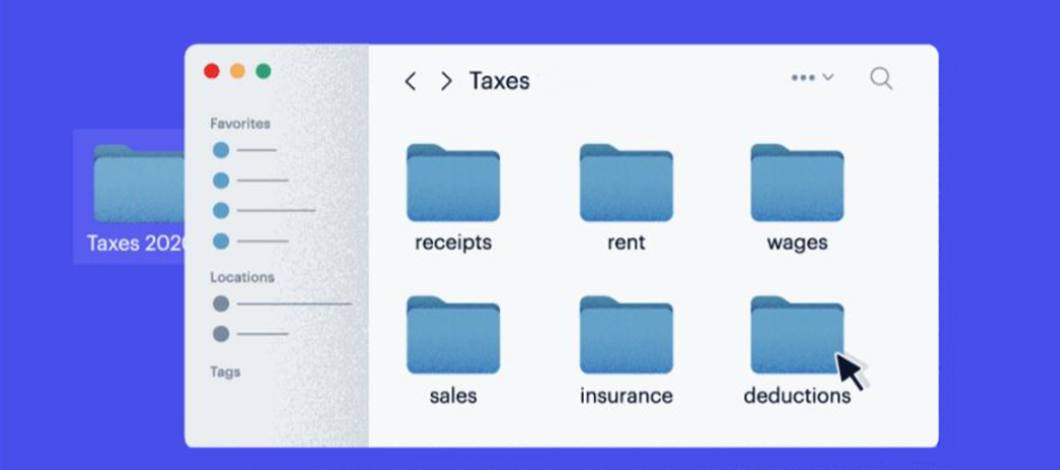

Excellent recordkeeping is essential to qualifying for PPP loan forgiveness. Be sure to track and categorize every expense.

What Happens If You’re Not Approved for Forgiveness?

If you do not meet the conditions of PPP loan forgiveness, your balance will accrue interest at a fixed rate of 1%.

The repayment term for PPP loans is 2 years, though you have the option to pay off your balance early with no prepayment penalty.

All loan payments are deferred for 6 months, though interest will accrue over this period.

Disclaimer: The information presented above is a general guide. Defer to the lender servicing your loan for PPP loan forgiveness specifics.