Any type of business financing comes with rates and fees that add to the total cost of your borrowed or advanced funding. While borrowers often pay interest rates on loans — expressed as a percentage of the funded amount — some short-term business financing products use factor rates instead.

Let’s explore what a factor rate is, how to calculate a factor rate and how it can impact your business financing.

What Is a Factor Rate?

A factor rate is expressed as a decimal figure — often between 1.1 and 1.9, with the average factoring rate ranging from 1.5 to 1.9. It is commonly applied to short-term business financing products. These typically include accounts receivable financing and merchant cash advances, which are one of the most approved forms of business financing with 84% of applications approved, according to the Federal Reserve Banks’ Small Business Credit Survey.

To determine factor rates, lenders review your creditworthiness as a borrower and time in business, among other elements. The factor loan rate is then multiplied by the total amount financed to find the complete cost of borrowing. Like an interest rate, the lower your factor rate, the more affordable the financing.

When it comes to a factor rate vs. interest rate, a factor rate is calculated once — at the start of the lending period — and doesn’t adjust during the life of a loan.

Related: So, How Much Is a Small Business Loan? (Rates, Fees and Other Costs)

How to Calculate Factor Rate Costs

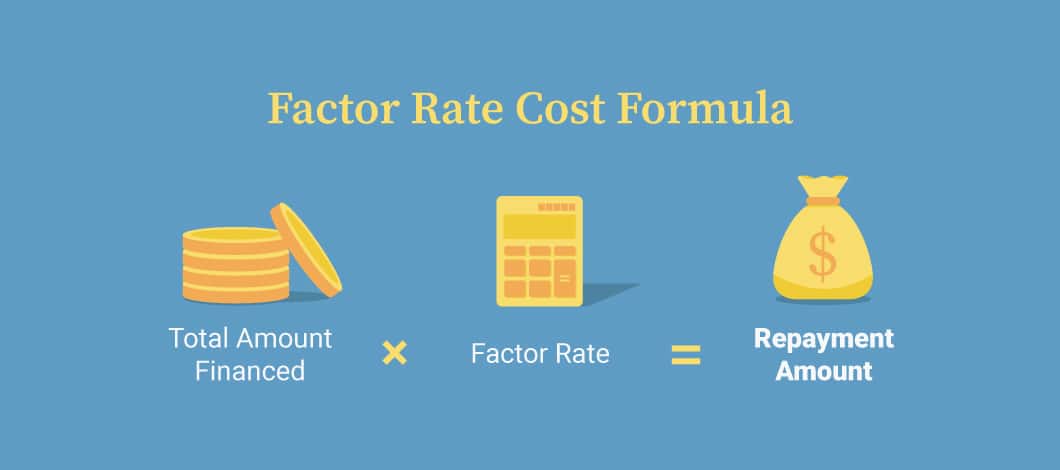

If you’re wondering how to calculate a factor rate, here’s the loan factor formula:

As an example, let’s say you’re applying for merchant cash advance financing in the amount of $20,000. The lender quotes you a merchant cash advance factor rate of 1.2.

Simply multiply your total amount of financing, in this case, $20,000, by your factor rate of 1.2.

$20,000 X 1.2 = $24,000

The amount that exceeds your advance amount is your cost to borrow the funds. In this case, to get a $20,000 advance, you’ll pay $4,000.

In other words, you’ll repay $24,000 — your advance amount plus your merchant cash advance factor fee amount.

You also can calculate the factor rate from your total repayment amount. To do this, take your total repayment amount and divide it by the financed amount.

For instance, using our example, we’d divide $24,000 by $20,000. This would give us a factor rate of 1.2.

Note: Funding fees are common of factor rate financing and separate from the factor fee.

Using a Factor Rate Calculator for Payment Installments

Of course, you could also search for interest rate and factor calculators, to determine your cost of financing.

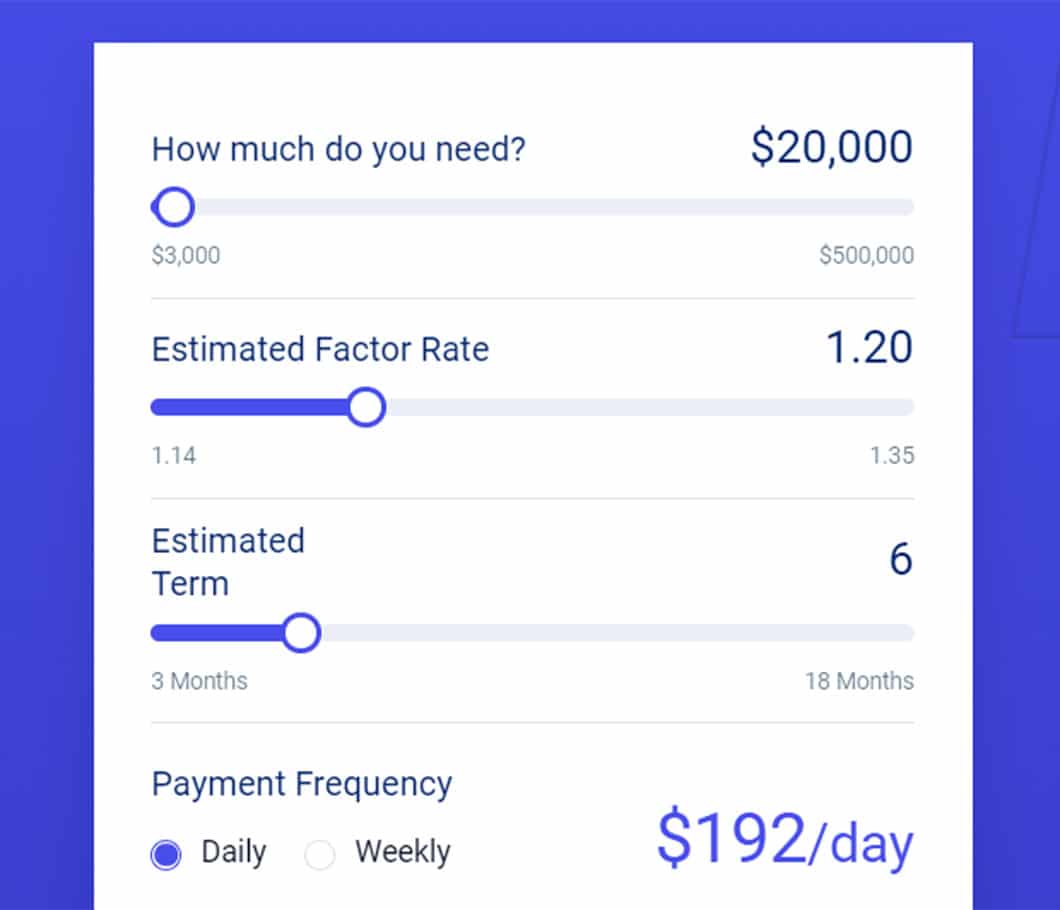

Online financing calculators can help you determine your factor rate payment, whether you have a daily or weekly remittance schedule.

You could use a factor rate calculator to estimate your payment schedule. Gather the following information to input into a calculator:

- Financing amount

- Factor rate

- Repayment term

- Payment frequency

Use an online merchant cash advance calculator to see how much our previous example would cost on a daily or weekly basis. Specifically, we’ll use the factor payment example, financing $20,000 at a 1.2 MCA factor rate over a term of 6 months. This would equate to payments of approximately $190 a day. Alternatively, the same factor rate financing set up to be paid weekly would cost an estimated $960 per week.

What’s Different Between a Factor Rate vs. an Interest Rate?

One of the biggest differences between a factor rate vs. an interest rate is the way your payments are calculated and applied.

With most loans, when the lender charges interest you can repay early and save money. This isn’t the case with factor rates. A factor rate is calculated only once, at the beginning of the lending period. You’re responsible for the total amount financed and fees calculated by your factor rate no matter what. Paying off your funding early won’t lower your total repayment.

In contrast, for interest rate loans, the interest amount applied to your balance adjusts throughout the life of a loan. Interest amounts can change based on the payment schedule and the frequency (or lateness) of the payments. For instance, if you pay off your interest rate loan early, you’ll save in interest over the life of the loan.

Interest Rate vs. Annual Percentage Rate

Keep in mind, an interest rate isn’t the same as an annual percentage rate (APR). Interest rate refers to the cost of borrowing your loan’s principal. Your installment payment is based on your interest rate.

An APR, on the other hand, affects your total loan repayment and takes your interest rate into account as well as other lender costs, such as origination fees. Your APR will tell you the total annual cost for taking out a business loan.

Converting a Factor Rate to an Annualized Interest Rate

Factor rate financing doesn’t typically extend to a year, so calculating an annual fee isn’t comparing apples to apples. However, if you’d like to see what your factor rate would equate to in terms of annual interest, here are the steps you’ll need to take.

Using our example above, with a $20,000 merchant cash advance at a 1.2 factor rate, you’d pay a total of $24,000, or $4,000 in financing.

Take the financing cost ($4,000) and divide it by the original advance amount ($20,000): in other words, $4,000 ÷ $20,000, which equals 20%.

$4,000 ÷ $20,000 = 20%

We’d then take that percentage rate (20%) and multiply it by the total number of days in a year, 365. This would give us 73.

.20 X 365 = 73

Finally, take that number and divide it into the total repayment period.

Let’s say our merchant cash advance is due in 6 months. We’ll assume 30 days a month, or 180 days. In other words, 73 divided by 180 would give us an estimated annual interest rate of 40.6%.

73 ÷ 180 = 40.6

What Impacts Your Factor Rate?

Your factor rate can vary depending on your business’s health and credit history.

After all, business financing can be complex, and lenders must be certain their risk is as low as possible. To do this, they’ll make a strong effort to evaluate your business model and look for a solid history of strong cash flow and payment of any obligations and debts.

When you present your application, you’ll probably be asked for additional documentation to help the lender see how well your business is doing. Depending on the lender’s expectations, you could be offered a higher or lower rate.

Lenders look at a number of elements that can impact your factor rate, such as:

- Bank statements: Your business bank statements are one way you can demonstrate cash flow to your lender so they can evaluate creditworthiness and see how strong your business is. Usually, they’ll ask for at least 4 months of the most recent data, but they might need more.

- Credit-card processing statements: This is another way to show your business is selling products or services and taking in income.

- Length of time in business: Generally, the older your business, the more established and credit-worthy it is to lenders. Brand-new businesses might not be eligible for a cash advance or short-term loan right away.

- Business tax returns: Consistent, stable income reports on your business taxes are another form of cash flow proof that a bank or an alternative lender may ask for when you apply.

Keep in mind, determining the factor rate depends on the lender. Banks and alternative lenders have their own approaches to evaluating applications. Once you learn what your factor rate is, you’ll be able to compare the full borrowing cost with other offers you receive.

Why Consider Factor Rate Financing?

Funding products with factor rate terms often appeal to business owners with low credit scores who are looking for fast access to cash. Many times, online lenders are able to fund you the same day you apply.

In most of these cases, there are no restrictions on how you can use your funds.

You might consider factor rate financing to get money for the following:

- Payroll

- Rent

- Utilities

- Taxes

- Emergencies

- Repairs

- Equipment purchases

- Working capital

Finding the Right Factor Rate Financing

For your business, the right factor rate financing likely depends on a variety of details. Repayment options, borrowing terms and impact on personal credit may be aspects of business borrowing that you’re thinking about as you weigh your options.

Calculating your cost of borrowing tells you upfront how good of a deal you’re getting on your loan, allows you to make easier comparisons and helps with planning. As you consider your business borrowing options, you may find multiple offers and be in a position to compare different factor rates.

Whatever you do, it’s crucial to do your own research into business lending. Find the information, advice and practical help you need to make borrowing part of your business success story. Don’t hesitate to ask questions and get specific pricing, special offers and terms when you shop around for factor rate quotes.