The effort to efficiently manage a company’s working capital highlights the importance of the cash conversion cycle (CCC).

It’s crucial for managers to understand how to measure the components of a cash conversion cycle and how to use them to improve the company’s working capital position.

What Is the Cash Conversion Cycle?

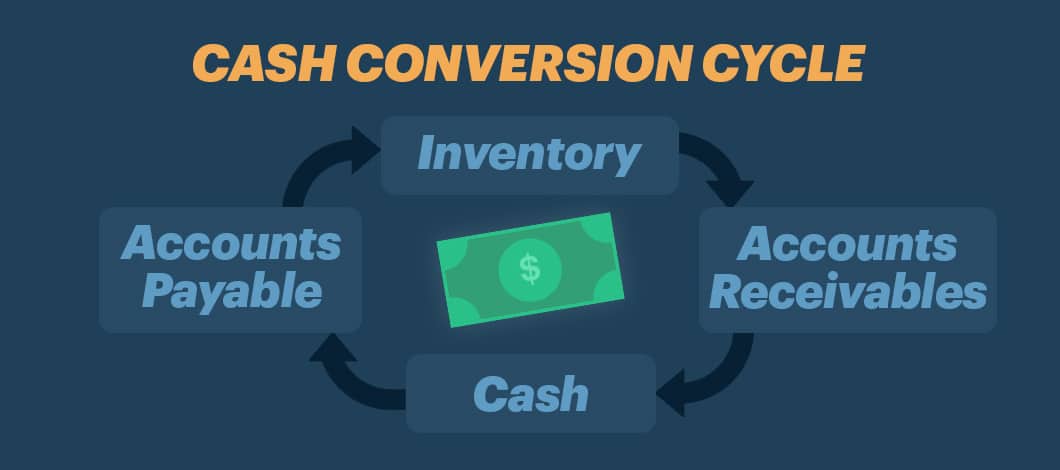

The cash conversion cycle is the number of days it takes to convert your inventory into cash.

In the first stage, the cash conversion cycle begins when you purchase inventory from your suppliers. The inventory is stored until you sell it to your customers on credit terms in the second phase. In the meantime, you pay your suppliers and other accounts payable. In the final phase, you collect your receivables and put cash back into the business.

Key CCC Things to Know

- Cash conversion cycles vary by industry. The number of days in the cash cycle in one business may be unacceptable in another. It depends on the product mix of a company’s inventory, the terms normally given to customers and the payment terms offered by suppliers.

- Cash conversion cycles are only relevant to companies that maintain inventory or offer credit terms to their customers. A software company, for example, doesn’t have a physical inventory. Its cash cycle is simply selling and collecting its receivables. Another example is a clothing retailer that has an inventory but doesn’t sell on credit terms to its customers.

- Some businesses can have a negative cash conversion cycle. Take Amazon and eBay as examples. These companies receive payments from buyers for goods that actually belong to third parties who use eBay and Amazon as platforms to sell their products. However, eBay and Amazon don’t actually hold any inventory themselves and don’t pay these sellers immediately. Instead, they hold on to the money for a few months, thereby creating a negative cash conversion cycle.

What Does the Cash Conversion Cycle Measure?

The cash conversion cycle analyzes 3 components of a company’s current assets and current liabilities: inventory, accounts receivable and accounts payable to suppliers

The cash conversion cycle measures the number of days sales that a company has in inventory. The next component is the number of days that it takes a company to collect its accounts receivable. The final component is the average number of days that a business takes to pay its suppliers.

The cash conversion cycle formula is:

CCC = Days of inventory outstanding (DIO) + Days sales outstanding (DSO) – Days payable outstanding (DPO)

How to Calculate the Cash Conversion Cycle

Let’s use the calculations of the 3 components of the cash conversion cycle for Company ABC as an example.

Days of Inventory Outstanding

Suppose Company ABC had $30,000 in inventory at the beginning of the year and had $40,000 remaining at the end of the year. During the year, the company had cost of goods sold of $250,000.

DIO = ((Beginning inventory + Ending inventory) / 2) / cost of goods sold x Number of days

DIO = (($30,000 + $40,000 / 2) / $250,000 x 365 = 51.1 days

Days Sales Outstanding

Company ABC had $20,000 in accounts receivable at the beginning of the year and $30,000 at the end. The company made $500,000 in credit sales for the year.

DSO = ((Beginning receivables + Ending receivables) / 2 ) / Credit sales x Number of days

DSO = (($20,000 + $30,000) / 2) / $500,000 x 365 = 18.25 days

Days payables outstanding

ABC owed $25,000 in payables at the start of the year and $15,000 at the end.

DPO = ((Beginning payables + Ending payables) / 2) / Cost of goods sold x Number of days

DPO = (($25,000 + $15,000) / 2) / $250,000 x 365 = 29.2 days

The CCC for Company ABC is

CCC = DIO + DSO – DPO

CCC = 51.1 + 18.25 – 29.2 = 40.15 days

How to Interpret a Cash Conversion Cycle Analysis

Let’s look at the analysis for Company ABC’s cash conversion cycle. In total, it takes Company ABC about 40 days to convert its purchases of inventory into sales and back to cash. Is this good or bad? Let’s analyze each component.

DIO

The DIO is about 51 days. This means the company is turning its inventory over roughly 7 times a year (365 days divided by 51 days). However, management may feel that it should be turning over its inventory every 30 days. If so, this means the inventory probably contains a number of slow-moving items as well as other products that are obsolete. Managers will need to analyze each item in inventory and weed out the slow-movers to get the level down and increase turnover.

DSO

The DSO of about 18 days looks good. If the company is selling its products on 30-day terms, a DSO of 18 days means its customers are, on average, paying before due dates. The company may be offering a discount, such as 2/10/30, to encourage its customers to pay early and many are taking advantage of this offer.

(Some vendors give their customers a discount off the full invoice amount if they pay early. The expression 2/10/30 means the customer can take a 2% discount off the full value of the invoice if they pay within 10 days of the date of the invoice. Otherwise, the customer would pay the full amount at the 30 day due date.)

Unless a company has a poor credit history, most suppliers give their customers terms of 30, 60 or 90 days to pay their invoices. Suppliers don’t charge interest for these terms, so it makes sense for a customer to take full advantage of the terms offered.

DPO

Company ABC has a DPO of 29 days. This would indicate the company is probably receiving 30-day terms from its suppliers and is paying its invoices on time before the due dates. The company is taking full advantage of the terms from its suppliers. There isn’t much room for improvement in this component.

How to Improve the Cash Conversion Cycle

The cash conversion cycle is one of several metrics that business owners can use to manage their working capital. A trend of a steadily increasing cash conversion cycle would be a warning sign that something isn’t performing efficiently and needs attention.

A company can improve its cash conversion cycle by increasing its inventory turnover. However, a company can’t reduce its inventory level too much because it soon will begin losing sales by being out of stock for certain items ordered by customers.

In the same sense, a company must be aggressive in collecting its accounts receivable, but not so aggressive as to offend customers. Tracking the DSO will help managers strike the right balance.

Financing May Be a Solution

One way a company can speed up the cash flow from its receivables is to take advantage of invoice financing offered by online lenders. With invoice financing, a business can present an invoice to the lender and get a receipt of the funds immediately.

Managers should also take advantage of the payment terms offered by suppliers. Say the calculation of the DPO shows the company is paying its bills too early, like 15 days before due dates when suppliers are offering 30 days. This can create a drag on the company’s liquidity and reduce the cash needed to buy inventory and make additional sales.