A good score from the FICO Small Business Scoring Service (SBSS) can impact both your chances of getting a loan or business line of credit and your ability to obtain a low interest rate.

It can make the difference between finding the financing you need and struggling to get by. We’ll explain how your SBSS score is calculated, how lenders and the Small Business Administration (SBA) use this score and how to maximize your chances of obtaining financing.

What Is a FICO SBSS Score?

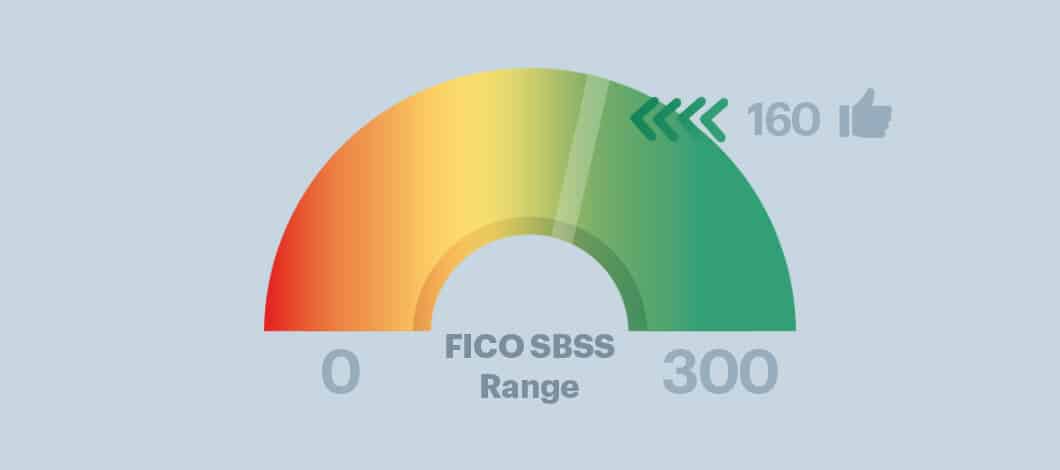

A FICO SBSS score, which ranges from 0-300, is a measure of a company’s creditworthiness and credit risk. As with personal credit, the higher your score, the better.

SBSS credit scores are used by the SBA, banks, credit unions and other lenders to evaluate applications for loans and lines of credit up to $1 million. This business credit score was created by FICO (Fair Isaac Corp.), an analytics company known for its consumer FICO credit score system.

FICO’s SBSS is one of the most important scoring systems for business owners because it tracks very closely with one’s personal FICO score, which is reviewed by most lenders. The SBSS also pulls data about your business from these credit-reporting firms:

- Experian

- Equifax

- Dun & Bradstreet

These companies offer their own business scoring systems, too. For example, Equifax’s scoring system and Experian’s Intelliscore business credit system are used by lenders, while Dun & Bradstreet’s ratings, such as Paydex scores, mainly are used by vendors and suppliers.

Each of these systems uses its own scoring scale, which differs from the SBSS scale.

How Is Your FICO SBSS Score Calculated?

There are 2 main categories of information that go into calculating your FICO score:

- Data about your company’s principal(s), including personal financial data

- Data about your company’s commercial finances, such as financial statements, bank records, records of payments to suppliers and vendors, audited accounts and loan applications

A number of financing advisory sites state a small business owner’s personal credit history can contribute as much as 50%-90% to the total SBSS score. This means your SBSS score is heavily influenced by the same factors that affect your personal FICO score, such as:

- History of paying bills on time

- Ratio of outstanding credit card balances to account limits (credit utilization rate)

- How long you’ve had your accounts

- Types of accounts

- How frequently you’ve applied for credit

Your SBSS score also is affected by factors related to your business finances, such as:

- Cash flow

- Business assets

- Number of workers

- Time in business

- Industry risks

- Public records with negative information, such as bankruptcy filings, liens and judgments

These business factors combine with your personal credit information to determine your FICO SBSS score. Additionally, lenders can place more weight on some factors versus others, such as your personal credit score and business credit profile.

How to Check My SBSS Score

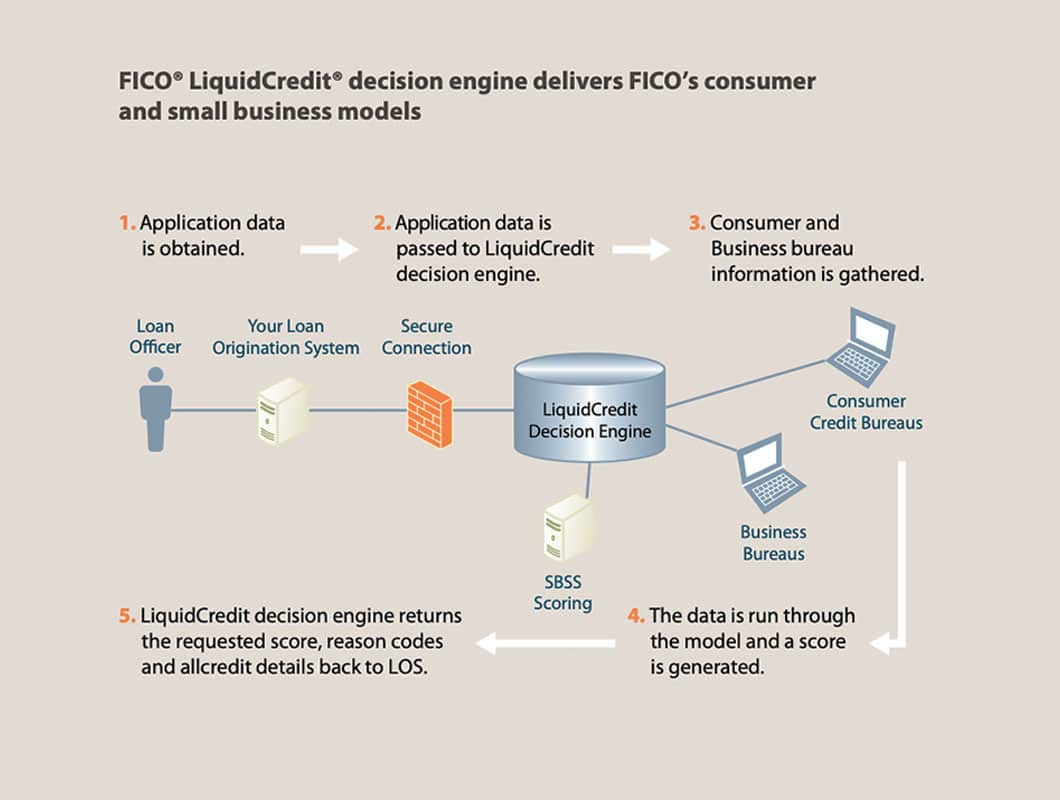

According to FICO, SBSS scores are delivered through FICO’s LiquidCredit Service. However, checking your business’s SBSS isn’t like checking your personal credit score, and your SBSS score can actually vary by lender. Why?

Here’s how the process works and why business owners don’t have easy access to checking their own business FICO score: When you submit your loan application to a lender, the lender sends a request to FICO for your score. As mentioned, the lender can choose to put more weight on certain factors (e.g., personal or business credit history) when pulling your score.

Keep in mind, a business FICO SBSS score is created based on a combination of the lender’s weighting preferences, personal credit, business credit and business financial data, which can come from one or more business credit agencies, depending on the availability of information. These factors can cause your score to change from lender to lender.

That said, you can check your business credit reports from these agencies: Experian, Dun & Bradstreet and Equifax.

What Is a Good SBSS Score?

Overall, a good SBSS credit score is said to be in the mid-to-high 200s. Different lenders and loan types have varying minimum requirements, however.

At a minimum, the SBA requires borrowers to have a FICO SBSS credit score of 140, though a score of 160 may be required in some instances. Incidentally, a score of 140 is the highest score you can achieve with no business credit history and being in business for a limited time, though you’d need excellent personal credit to score that rating.

In contrast, conventional lenders, such as banks and credit unions may require a minimum score of 160-180.

Online lenders also may review your score, but may set a lower minimum threshold than the SBA and place more consideration on other factors, such as cash flow, time in business, industry and revenue.

Related: Bad Credit Business Loans: These Are Your 5 Best Options

Why Is Your Business FICO Score Important?

Your business FICO score is important because it can determine your eligibility for credit and your ability to obtain low-interest loans and credit lines. In fact, more than 7,500 banks and other lenders use the SBSS score when evaluating a borrower’s creditworthiness. Additionally, the SBA uses the SBSS score to prescreen applicant eligibility for 7(a) loans.

-

Why Your Credit Score Matters for an SBA Loan

Since 2014, the SBA has been using business credit scoring when evaluating all 7(a) loans up to $350,000, excluding the SBA Express and Export Express financing programs.

Specifically, the SBA uses the FICO SBSS to save time during the application process. The service considers more than 100 consumer and business analytical model combinations and draws from various data sources. As such, this automated system is able to efficiently assist with the prescreening of loans, automatically ruling out businesses that don’t meet a minimum threshold.

Your SBSS score can directly affect your ability to secure financing from the SBA as well as other lenders.

No matter what type of financing you’re seeking for your business, maximizing your SBSS score is in your best interests.

How to Improve Your FICO SBSS Score

Because your FICO SBSS score may be evaluated differently depending on the specific financial provider, it’s important to do your best to try to maximize your score.

There are several strategies you can use to increase your SBSS score:

- Paying bills on time

- Maintaining a low credit utilization rate, with less than 30% considered the maximum by many financial advisers (10%-20% or lower is even better)

- Keeping accounts open as long as possible

- Diversifying your credit portfolio by taking out and repaying small loans on time, such as secure loans or credit-builder loans

- Applying for credit infrequently

- Following sound cybersecurity practices to avoid identity theft

- Monitoring your credit report to detect suspicious activity and dispute inaccurate items

You also can build your business credit by taking steps such as these:

- Keep your business and personal credit accounts separate

- Pay suppliers and vendors on time

- Follow good accounting practices to avoid cash-flow crunches

- Apply for secured business credit cards or loans

What Does a FICO SBSS Business Credit Score Mean for You?

Your FICO SBSS score can be a window or a hurdle in your pursuit of financing. Look to improve your FICO SBSS score by taking steps to improve your personal credit rating, such as keeping low balances and paying bills on time, as well as by working to build your business credit history.